MetaDAO: Can Futarchy Protect Investments?

Trying to make the game fair.

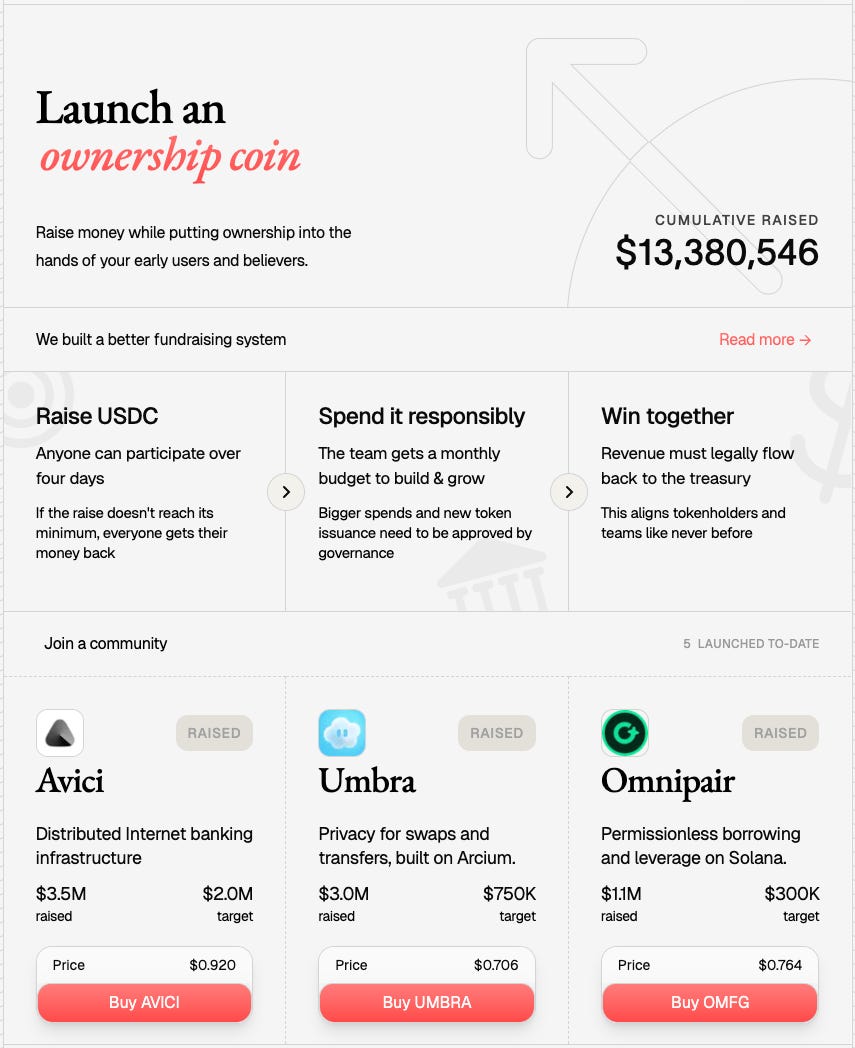

MetaDAO has already helped projects raise >$13M through an “unruggable” futarchy based mechanism.

I've been interested in practical applications of Futarchy ever since Butter’s early experiment of funding lending incentives with the Uniswap Foundation. If only for the simple reason that markets work and finding more mechanisms to apply markets to seems useful.

With both prediction markets and launchpads maturing, we now have some of the ingredients to point Futarchy at funding entire projects.

That’s what MetaDAO is doing.

METADAO IS A LAUNCHPAD WITH BETTER GOVERNANCE

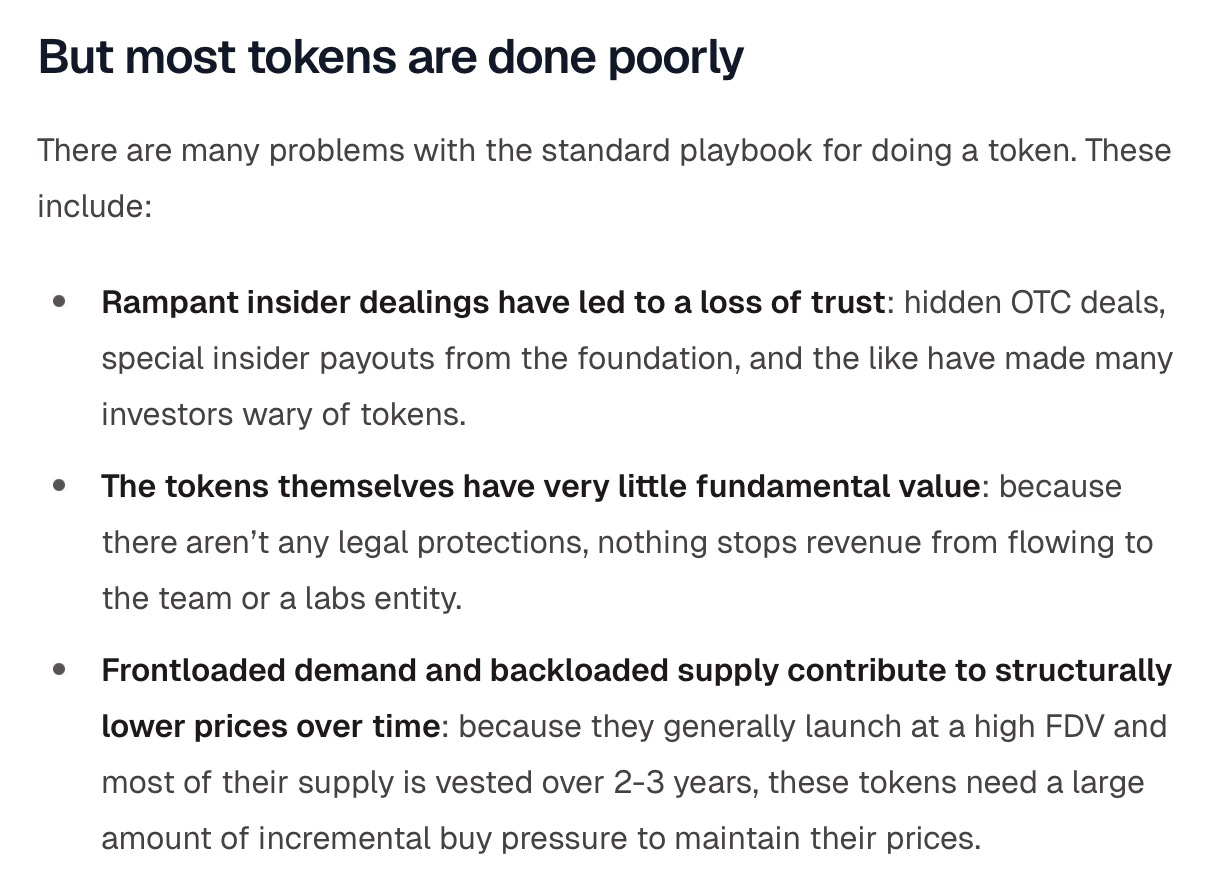

While token launches are simpler than IPOs, 2017 ICOs had to go through a convoluted process to sell tokens. Each launch was unique and each team had to individually navigate ever-changing regulations post-launch. At times this prevented teams from working on their own projects, not out of a lack of motivation, but simply due to regulatory uncertainty (or hostility).

Launchpads radically simplified the launch process by providing issuance primitives (built-in market making), smart contracts and a distribution platform to reach users. This helped projects go from non-existent to a real market cap faster than ever. Unfortunately, this worked better for memecoins than for real utility projects. Launchpads still had hostile parametrisations which could be abused to rug users and there was no enforcement that teams would actively try and create value in the long-term. It wasn't the right model for serious projects.

Bittensor improved on memecoin launchpads and created an issuance incentive for team leaders to continue working on their projects.

Unfortunately, as we pointed out in our article, this mechanism is also not bulletproof and without legal enforcement these incentives could prove insufficient:

Buybacks can even be profitable in some cases. The smaller the subnet, the more price impact to Alpha can be delivered by buying back Alpha tokens. That price impact can translate in larger emissions for the subnet owners and can actually be a form of reliable staking yield.

I do think one of the most useful measures the Bittensor ecosystem could start tracking is the Buyback yield as a way to better interpret subnet owner actions. Halvings will have a drastic negative impact on this yield and will make buybacks less profitable over time.

The combination of 1+2+3 creates a clear guideline how to think about subnet valuation. There are more quantitative methods, but I don’t think they meaningfully affect long-term valuations.

If you see a subnet merely buying back their own tokens because they get positive ROI through emissions, be vary of how little hard claim Alpha token holders have over future value.

MetaDAO has a good summary of these issues (and others) in their Docs:

MetaDAO (Founded by Proph3t and Kollan House) aims to create a fast and reliable path to fund a long-term project:

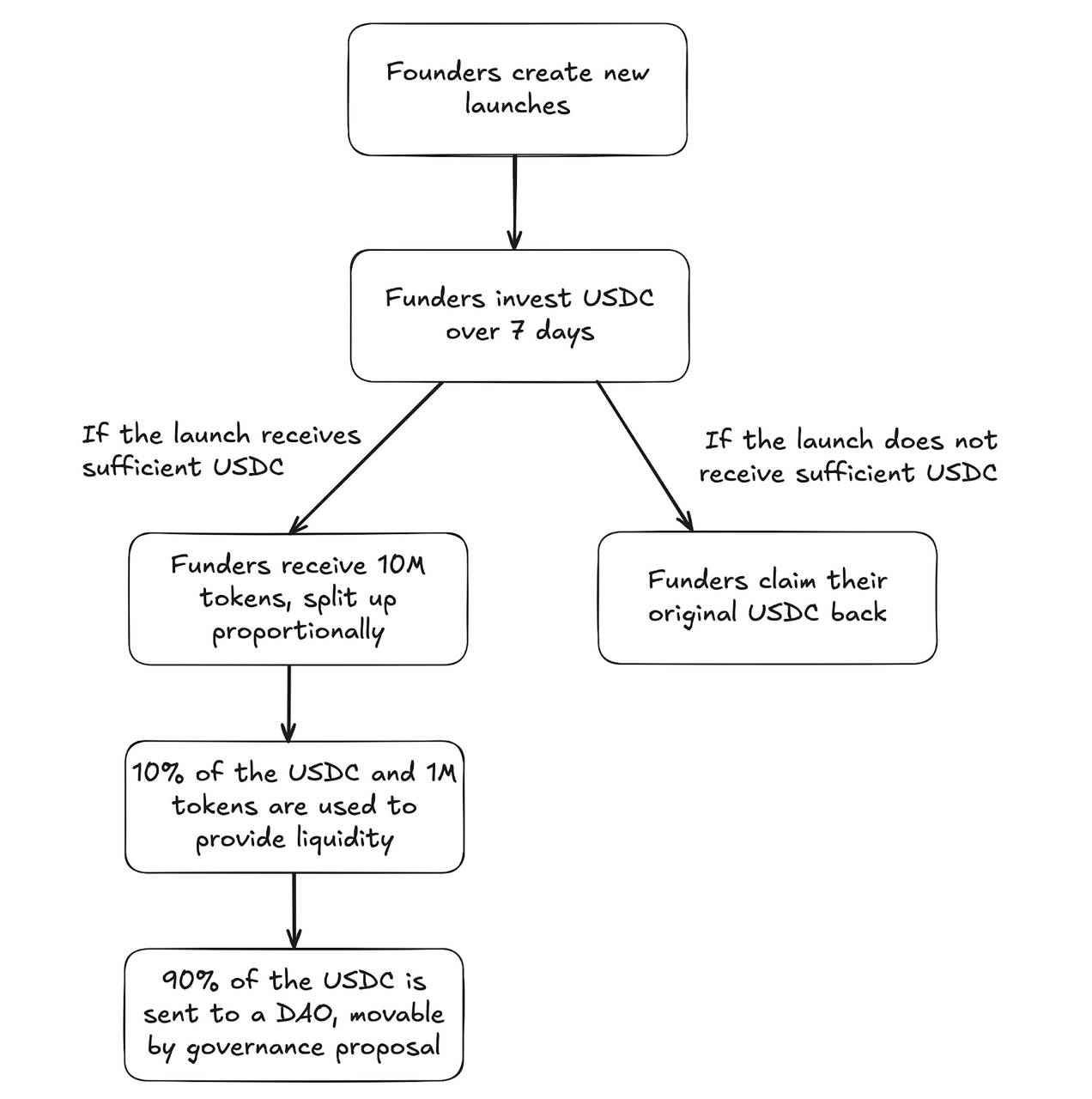

Funders invest USDC during the launch;

If a sufficient amount of USDC is met (Kickstarter model), the token is launched and funders receive a supply 10M proportionately divided;

The treasury can only be spent via a futarchy vote;

Team can include a performance package that is vested and related to token price increases only (no upfront granting of tokens);

The voting itself happens by creating 2 different markets: one for the token price if the proposal passes and one on the price if the proposal fails. At any point you can get “bought out” by the other side if the proposal didn't go your way.

METADAO ADDS REAL DOWNSIDE PROTECTION

MetaDAO isn't really appealing for scammers. First of all, there’s no team allocation on day 1 and the treasury (outside a monthly allowance) can only be spent via governance proposals. The best one could do is take some of the monthly allowance and stop working on the project but without regular progress updates the token holders will quickly reclaim back the remaining treasury.

Consider this market where the Founder of Omnipair proposed to increase the monthly allowance to hire additional team members and cover infrastructure costs:

There are several concessions here:

The spending is clearly attributed;

The $50k is not a guaranteed amount but a budget depending on the actual spend;

$50k is a SMALL incremental amount (compare this with $15-75M grants we’ve seen).

The Founder commits to do a monthly accountability update;

The short-term plan for spending is provided.

As an angel investor who’s had their money partially refunded on a couple of investments that didn't work out, I understand that a partial loss when the Founders don't see the project succeeding is better than running the company into the ground.

In MetaDAO’s case the mechanics are even better, any investor losing faith can use the futarchy market to exit the project.

FUTARCHY DOESN'T GUARANTEE SUCCESS

As we know from Nouns, decentralized decision making alone doesn't guarantee success. In fact it may inhibit it in many ways: slowing it down through requiring excessive transparency, leaking competitive strategies to the market, requiring a short-term focus, etc.

Futarchy isn't perfect either.

There’s a risk that the futarchy market doesn't find a path that will increase the token valuation the most if the crowd experiences availability bias and doesn't appropriately account for the opportunity cost of any single proposal.

Requiring token owners to assess and quantitatively compare two distinct outcomes may also be asking too much (compared to the simple yes/no model in existing governance which already leads to apathy).

I do think there’s a pretty wide design space to overcome both issues in the future. For one, I could imagine the community may start maintaining spreadsheet models with various assumptions as a way to build consensus in a more sophisticated way. The model could even create prediction markets to fill in various probabilities.

Ultimately, the most exciting thing here is that MetaDAO is a launchpad for projects that are here to stay and create value in the long run. We need more experiments that serve projects doing things the “hard way”.