Valuing Alpha: The Game Theory of Bittensor

How a novel AMM is able to fund breakthrough DeAI research.

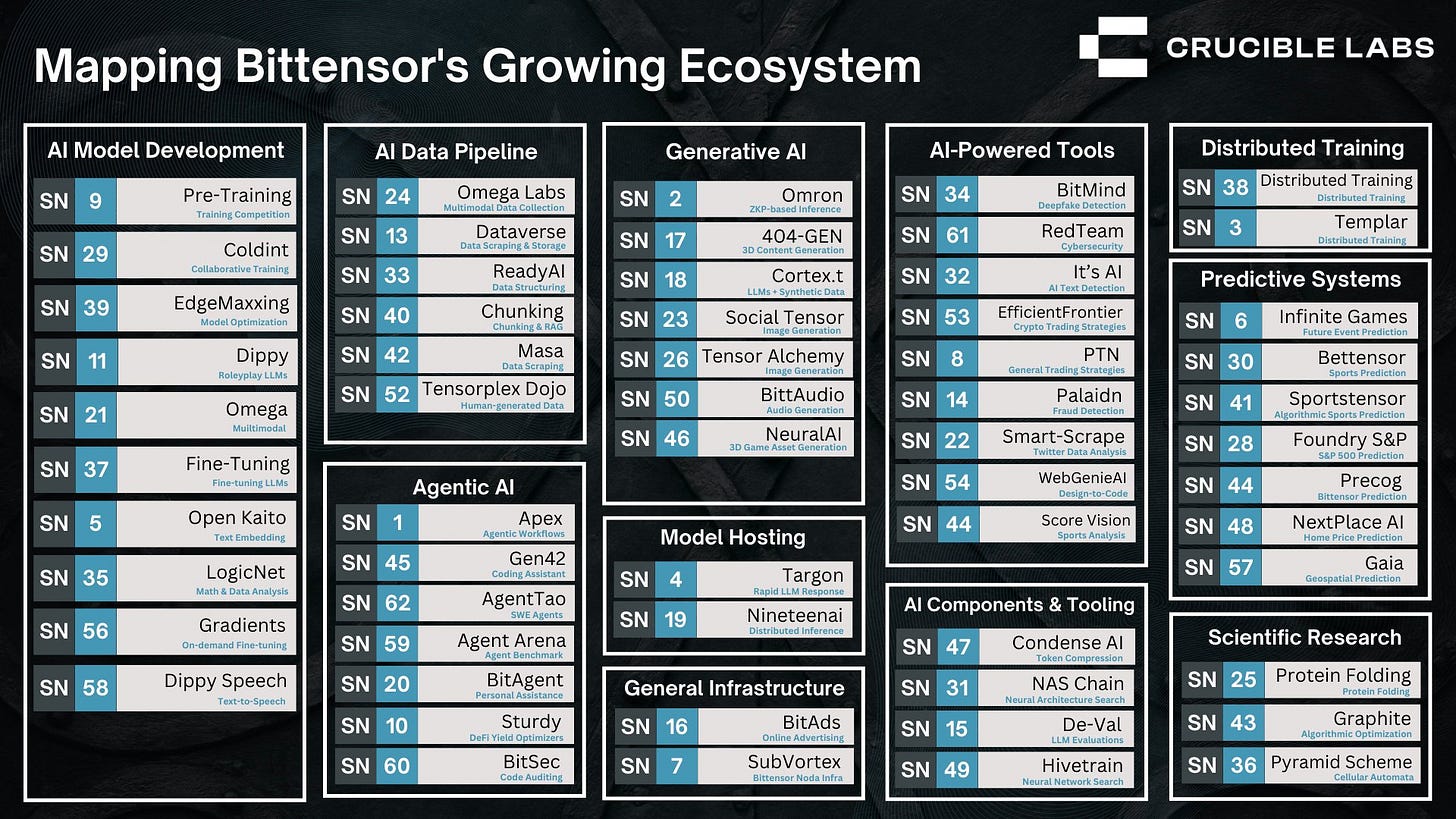

The Bittensor ecosystem is known for its subnets which include leading DeAI teams like Chutes, Celium and Templar.

These subnets join Bittensor to receive three primary benefits:

An out-of-the-box incentive model for miners and validators;

Intra-subnet collaboration;

An emissions system that effectively provides research teams with non-dilutive funding.

It’s the latter system that is most interesting and most novel about Bittensor.

The emissions drive why subnets join (and stay) in Bittensor. This article will explain how they work and how to think about valuing TAO and Alpha tokens.

THE ORIGINS OF DTAO

The current “DTAO” emissions system wasn’t originally part of the network.

Bittensor was initially funded on the ideal of a transactional intra-subnet economy where each subnet could invoke another for different services.

Collaboration does exist among subnets (and some subnets are owned by the same entity, Rayon Labs being the biggest multi-subnet team).

In practice, subnets weren't really competing with each other for direct product revenue, they were competing against the best alternatives in the market – other AI (or DeAI) companies.

And of course these most competitive alternatives usually weren't other Bittensor subnets.

Instead, subnets were competing against each other for emissions.

And it was time to change Bittensor to make that competition as efficient as possible.

Now each Subnet has an “Alpha” token which can be received by staking Tao. The Alpha tokens are priced by an AMM that allows users to stake Tao to “purchase” Alpha tokens (and vice versa).

In short: Bittensor pivoted to a cryptoeconomic holding company built entirely on incentives.

Bittensor now acts as a way to aggregate market expectations around the future revenue potential and execution capability of decentralized AI teams.

The most important part is that each subnet also receives emissions which are proportional to the current price of Alpha tokens in its AMM.

And here are some fun facts:

The only thing driving the value of $TAO is the ability to create subnets and participate in their pricing;

There is nothing formally in the protocol that drives the value of Alpha tokens;

TAO is isolated from the failure of a single subnet but needs multiple subnets to be valuable.

Before we explain why, we have to understand how this mechanism works.

TOKENS WITH A BUILT-IN MARKET MAKER

The core idea is that instead of allowing each subnet to launch their own token independently, tokens Alpha1, Alpha2, etc. are created for each subnet with the tokenomics being completely controlled by Bittensor.

What’s especially novel is that Bittensor opts to provide market making services for these tokens by reserving a subnet pool for each subnet.

This pool is a constant product AMM with some TAO reserves and some AlphaN reserves (for each N).

Anyone can use the pool to swap between TAO and AlphaN. Since nobody own or LPs in the pool (it's enshrined), there are no fees.

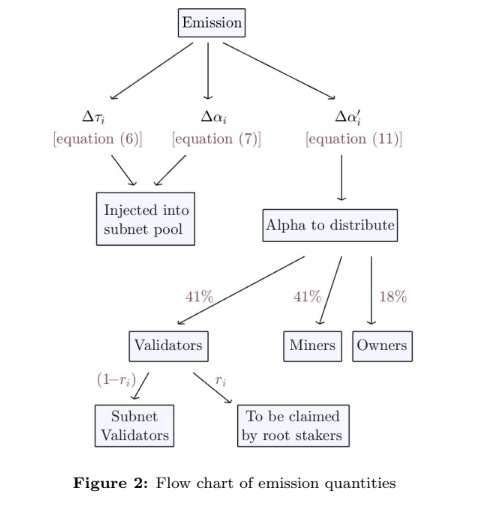

For the pool to grow it receives a proportional amount of TAO and AlphaN tokens every block. Every pool will receive the same amount of AlphaN tokens but a different amount of TAO depending on the current price of AlphaN vs. TAO.

Moreover, the subnet’s participants (owners, validators and miners) also receive rewards proportional to the TAO price of the subnet’s Alpha token.

So emissions are both used to reward subnet participants and to keep growing the active liquidity for the subnet. The emissions are subject to a halving process so the terminal supply of each subnet's Alpha token is finite.

For reference, here are the distributions:

Note: the first two top-level terms represent injections into the AMM pool and the third branch of the tree represents how emissions flow into subnet participants.

VALUING ALPHA

In addition to governing emissions, each Alpha token can be used for consensus in establishing which miners should receive rewards.

But since miners only receive emissions in the form of the corresponding Alpha token, the value of determining consensus is somewhat recursive.

People mistakenly believe that Bittensor is a funding mechanism for AI research. While funding AI research is an outcome, the raw research (models, papers, APIs) produced by subnets are mostly public and quickly commoditized.

Their direct economic value rapidly tends to zero. What remains valuable long-term is:

Execution and operational ability of subnet teams to translate public research into marketable, monetizable products;

Unique subnet tokenomics, e.g., structured buybacks, burn mechanisms, or fee distributions, which create tangible financial utility and scarcity for subnet tokens;

Network effects that entrench a subnet’s service in practical workflows or commercial ecosystems (integrations, partnerships);

Narrative premium, i.e., the perception and speculative attractiveness of the subnet’s future adoption and use.

But since Alpha tokens don't (by default) have a claim on subnet owners' revenue, value only comes from three places:

Additional mechanisms

Soft commitments by subnet owners to drive further value to Alpha

Incentives of subnet owners to drive further value to Alpha

1/ Additional mechanisms

While none of this is enshrined in the system, subnet owners can always add additional utility for Alpha token holders such as additional staking opportunities, governance rights, a claim on certain assets, etc.

2/ Soft commitments

Subnet owners can commit to activities that would drive up the Alpha token price, for example, using parts of their treasury (e.g., revenue) to buyback Alpha tokens. This has already been happening.

3/ Incentives of subnet owners

Buybacks can even be profitable in some cases. The smaller the subnet, the more price impact to Alpha can be delivered by buying back Alpha tokens. That price impact can translate in larger emissions for the subnet owners and can actually be a form of reliable staking yield.

I do think one of the most useful measures the Bittensor ecosystem could start tracking is the Buyback yield as a way to better interpret subnet owner actions. Halvings will have a drastic negative impact on this yield and will make buybacks less profitable over time.

The combination of 1+2+3 creates a clear guideline how to think about subnet valuation. There are more quantitative methods, but I don't think they meaningfully affect long-term valuations.

If you see a subnet merely buying back their own tokens because they get positive ROI through emissions, be vary of how little hard claim Alpha token holders have over future value.

If you see additional utility for your Alpha tokens or “irrational” buybacks which show that subnet owners believe in a higher than current price, that could be a sign that Alpha tokens could be undervalued.

VALUING TAO

So what is the value and meaning of TAO in the new DTAO system?

TAO needs to be spent to register subnets and will only become more important as the 128 subnet cap takes place. But lets set that aside since there are plenty of unprofitable subnets right now.

It’s tempting to think of it as an index token but it isn't.

It’s really more of an optionality token.

TAO is the gateway to acquiring Alpha tokens.

In some ways, TAO held today is a call option that can be pointed at the emissions of any Alpha tokens that seem undervalued. It provides permanent exposure to subnet arbitrage.

It’s valuable as scarce access to dynamic subnet returns.

I'd love to see more deep dives that seek to value TAO using this method (and also consider the recursive impacts of TAO price on Alpha token prices).

In conclusion, I don't see Bittensor as merely incentive infrastructure to help build a miner-validator network.

I see Bittensor as an always-on activist investor and market maker which uses market forces to provide subnets with capital.

The end result? They don't need to talk to a VC.