Uniswap v4 and Onchain Investment Banking

Onchain issuers are flocking to launchpads.

Startups typically go public in 7-10 years.

Most memecoins are available for trading immediately upon launch.

All it takes is an image, a ticker, some project information and the memecoin is live.

Moments later, Telegram bots identify and promote the memecoin to their users which start buying it.

We covered this in our dedicated post about Bots:

All of this is possible because of launchpads.

Investment Banking 2.0

Launchpads are basically software-based abstractions of investment bank issuance services.

They provide:

The smart contracts required to launch your ERC20 token (listing)

The mechanics of providing liquidity (pricing) usually via some form of bonding curve or purchasing rules

Discoverability (investor relations)

As argued, in last week’s post, we don't necessarily need more memecoin launches.

Irresponsible purchasing of newly issued tokens often leads to investor loss.

However, launchpads are setting an example for how programmatic, trustless issuance will work for assets more broadly.

There are many benefits to using a launchpad as opposed to hand rolling your own token smart contracts and liquidity strategy:

Launchpad code (usually) gets audited and is tested by multiple projects. Code reuse improves security

Launchpad tokens are naturally more decentralized since they default to having more transparency about the issuance mechanism and its fairness

There are too many liquidity management options to choose from (off chain market making, onchain ALM, bonding curves, dutch auctions, liquidity mining, TWAMM, etc.). Launchpads help you pick and parametrize a transparent launch mechanism that has been stress tested by several other projects

Liquidity from day one. Launchpads encourage projects to support trading for their tokens as soon as they are created. Low liquidity of tokens is a major issue for most projects, even ones that have been successful in the past

More serious launchpads like Juicebox also offer several DAO & treasury management facilities that help projects focus on developing product rather than operational smart contracts

One area where memecoins are doing better is conducting more successful launches for the community.

Issuer services are becoming the default

The IPO market is highly intermediated.

Investment bankers, legal, marketing consultants and other service providers handle the various aspects of launches and ongoing management of public companies post-launch.

Onchain issuers are now going through the same transition.

The average issuer, can already:

Use Galxe and to reward and incentivize community members

Use Sablier to reward contributors

Use Jokerace to host ecosystem competitions and generate attention

Use Aera to implement arbitrary treasury management services

Use Merkl to create liquidity mining programs

Use Gitcoin to run matching programs

Launching and issuing using a third-party launchpad is a natural next step.

The best place to build a launchpad

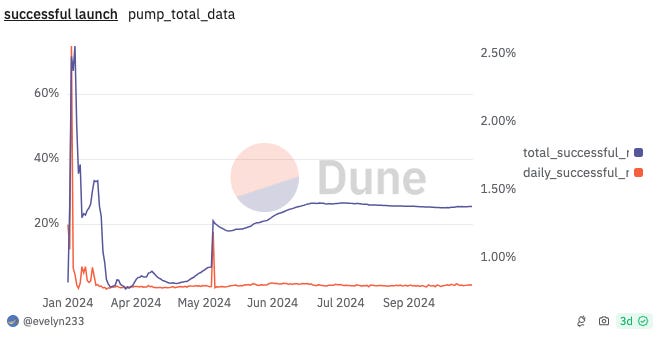

Pump.fun has a unique concept called “graduation”.

When you launch on their platform, trading happens according to their bonding curve and their own exchange.

You have to reach a $69,000 market cap on their platform to move on to a DEX (Raydium).

At that point they close the bonding curve and move you to your own pool on Raydium.

Only 1.4% of tokens on pump.fun actually graduate.

This is why building a launchpad as a Uniswap v4 hook is a clear improvement.

v4 offers enough flexibility to build the bonding curve directly and be able to transition to a normal post-launch trading curve later.

One such example is Doppler, a dutch-auction liquidity bootstrapping hook built by Whetstone Research.

Not only can Uniswap v4 support the launch process, it can also adapt to the unique needs of each issuer post-launch.

Here are some examples.

RWAs

RWAs like BUIDL and USDY restrict transfers.

Regular AMMs and their order flow stack do not support these types of tokens and would not have meaningful price discovery.

Instead, they can use a v4 KYC hook that restricts swapping to whitelisted individuals and trade efficiently as part of the v4 Singleton.

Issuers with Protocol Owned Liquidity

Large protocols that decide to incentivize or allocate their treasuries to provide liquidity often have the power of “kingmaking” a given pool.

Instead of having to pick which pool to support, they can now develop their own tailored hook.

For example, AAVE could develop a dedicated v4 hook to implement the safety module and make that the most liquid pool for AAVE/ETH.

The rise of B2B hooks

While issuers may initially choose to build custom hooks, there will be a broader marketplace of B2B hooks tailored for specific use cases.

Issuers will tailor how liquidity is generated in safe, tested and economically sound ways.

Launchpads are just the beginning.

To close, I have to highlight an excerpt from Arthur Hayes describing the right way to launch last week in PvP:

It’s a good reason to get excited about Uniswap v4.