Insider Trading and Polymarket

How much should we trust prediction market prices?

Our previous prediction market article introduced the architecture of Polymarket. Now that TVL has doubled (elections aside), it’s time to figure out what information we can extract from the many markets on Polymarket.

To make it concrete, there’s a live market that predicts that Google will have the model with the best Arena benchmark score (with 72% confidence) and it makes me wonder: who drives these markets and what information are they actually trading on (if any)?

POLYMARKET IS ACCURATE, LIQUIDITY PERMITTING

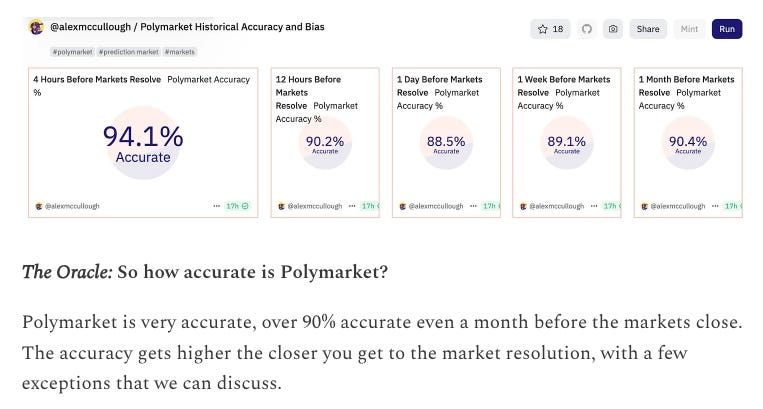

The first thing to note is that Polymarket does eventually converge to an accurate prediction. The >50% outcome is correct 94% of the time 4 hours before market resolution.

Perhaps even more impressively, accuracy only drops down to 90% a month before resolution.

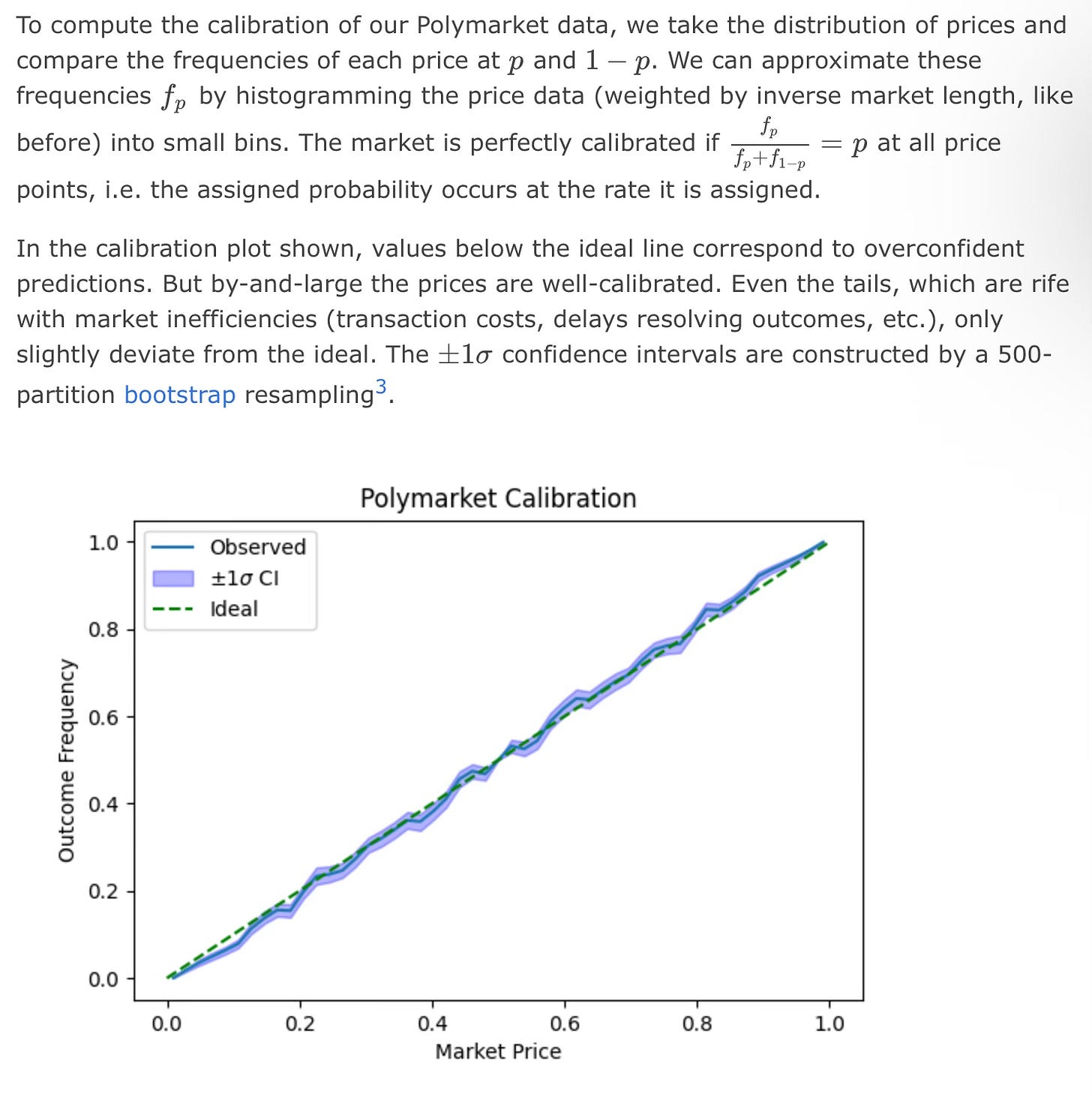

Even the specific probabilities are quite well calibrated, we have two independent sources to validate that:

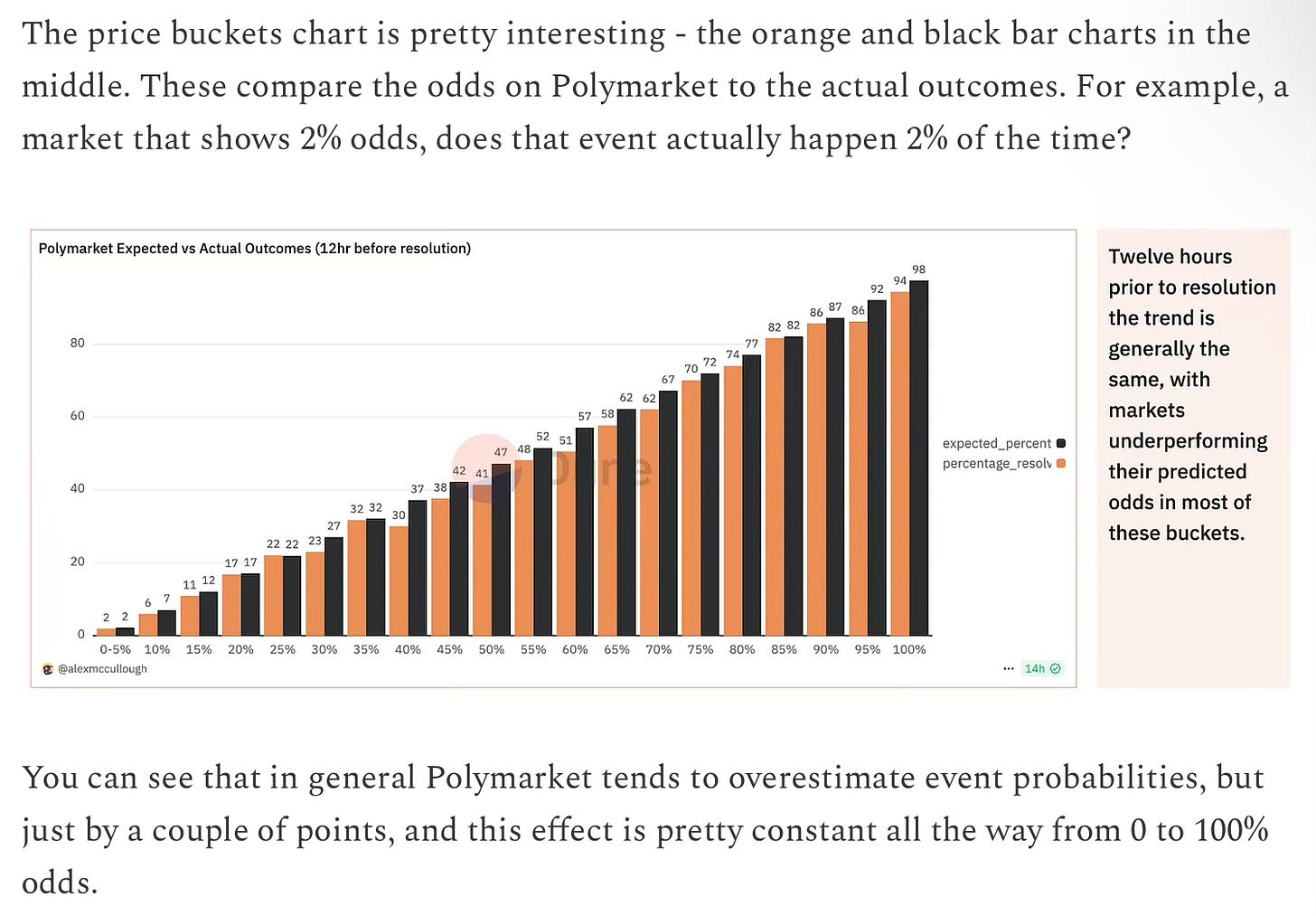

Here’s the more scientific version:

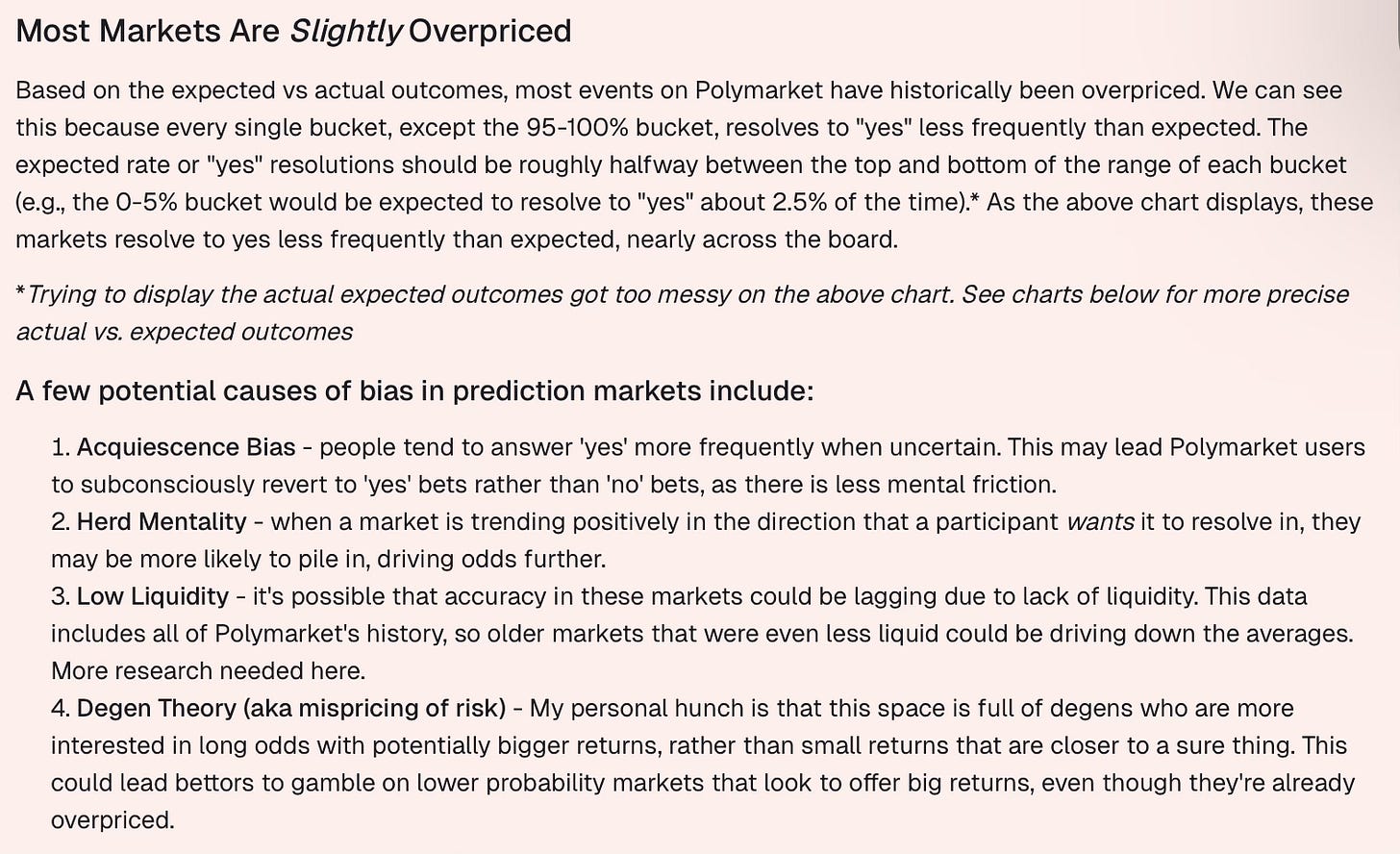

The only subtle deviation is a slight overpricing of markets explained pretty well in the original Dune dashboard.

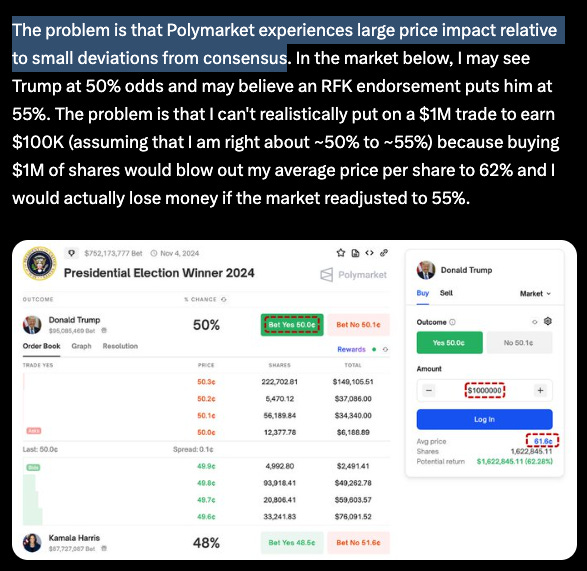

The other limitation is liquidity. Smaller markets are necessarily less accurate.

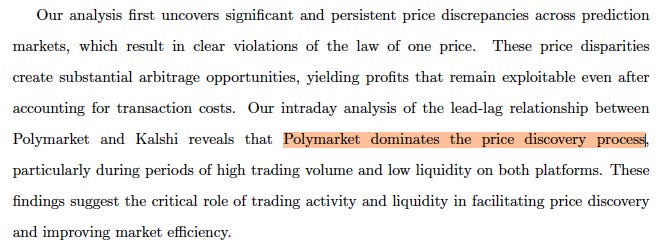

It’s therefore unsurprising that Polymarket dominates price discovery for other prediction markets as well.

THE 4 CHARACTERS OF POLYMARKET

The next question is how the accuracy is achieved. There are broadly four types of actors that drive market pricing in Polymarket.

Arbitrageurs

Just like in regular markets, arbitrageurs exploit low-latency and low-risk opportunities created by price discrepancies (e.g., Polymarket vs. Kalshi) or market irrationality (e.g., MECE outcomes don't add up to 100%).

Insiders

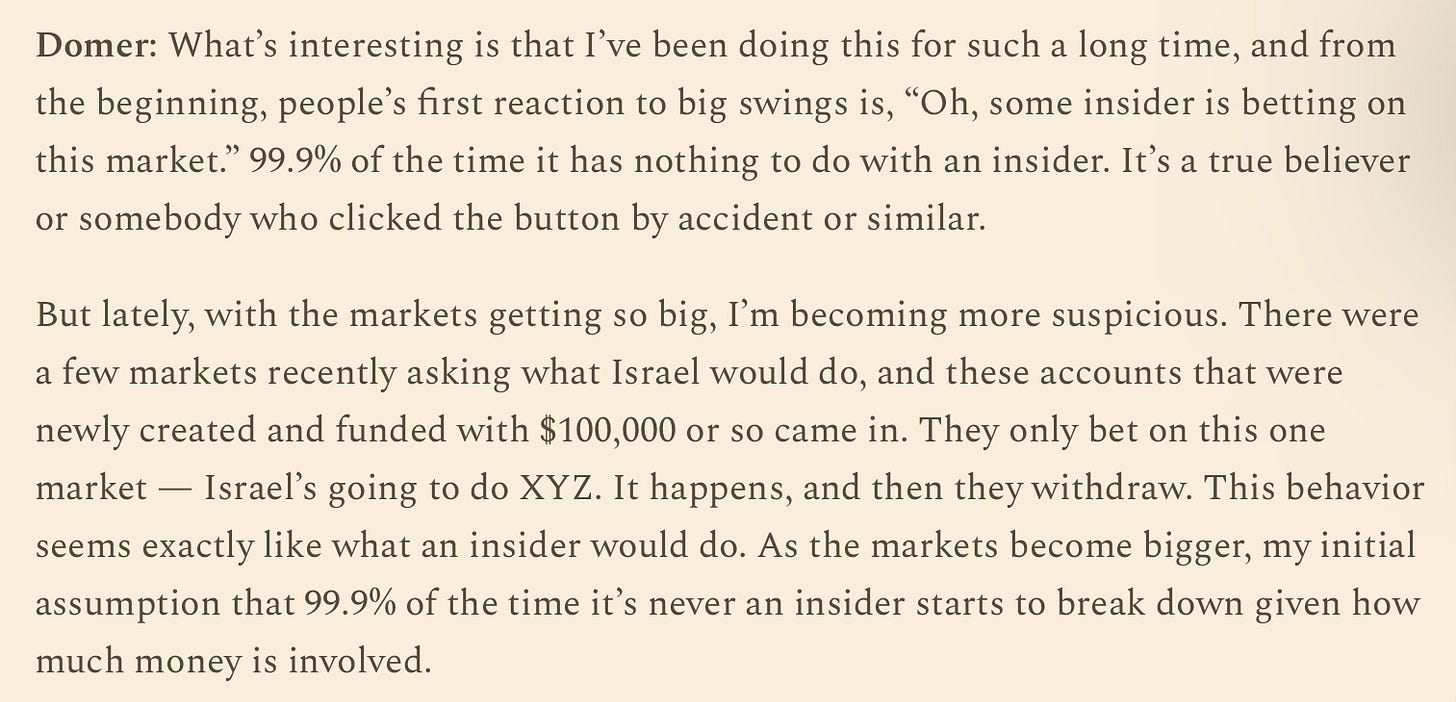

Insider trading is much harder to pin down and technically illegal according to the Terms of Service of all prediction market platforms. However, there are some indications that insider trading may be occurring in higher liquidity markets:

Superforecasters

Some people do dedicate serious time to research and trade based on events and are profitable doing so. Their profits don't always come from deep contemplation but rather from responsiveness and more rapid re-calibration:

Low-information traders

The remaining set of traders on Polymarket are analogous to casual sports betters. They are simply overconfident traders that use the platform as a form of entertainment and are under-equipped to bet profitably.

In fact up to 89% of Polymarket participants carry losses, so this is also the largest segment.

There is one more segment of users which could become more important in the future and that is hedgers. Individuals or institutions that would use prediction markets as a form of a put option to compensate for certain risks they are exposed to.

The interplay of these groups is what drives pricing on Polymarket. The low-information traders provide the profit incentive and the arbitrageurs, insiders and superforecasters reap it.

So where does the data leave us with the Google prediction?

It suggests that the market price is probably right and Google is most likely to have the best model by EOY.

It’s unclear how much of this is driven by a cabal of Googlers running a prediction market side-hustle or full-time superforecasters that are better at interpreting AI news than I am.

Nevertheless, I’ll check back in by end of year to see how this one resolves.

In the meantime, I may place a bet.