Reinventing Nouns

How an old Magic the Gathering strategy could revitalize Nouns.

This post is taking part in the Nouns x Kiwi writing contest. Auditless is a protocol strategy organization, not a marketing agency. Therefore this post is very transparent about current challenges facing Nouns. However, it also represents a genuine attempt at solving for a path forward and I hope Nouners who read this post will enjoy that.

After all, the glasses are not rose-tinted ⌐◨-◨.

Nouns is one of the most successful and mainstream-penetrating brands in crypto.

But the Nouns treasury (once colossal, reaching 30k ETH at its peak!) is now trending towards 0.

What’s crazy is that this downtrend represents a step in an ongoing journey to make “Nounish DAOs” viable.

One mechanism change impacted everything.

But before we can explain that we have to recap the basic game theory behind Nouns.

How Nouns works

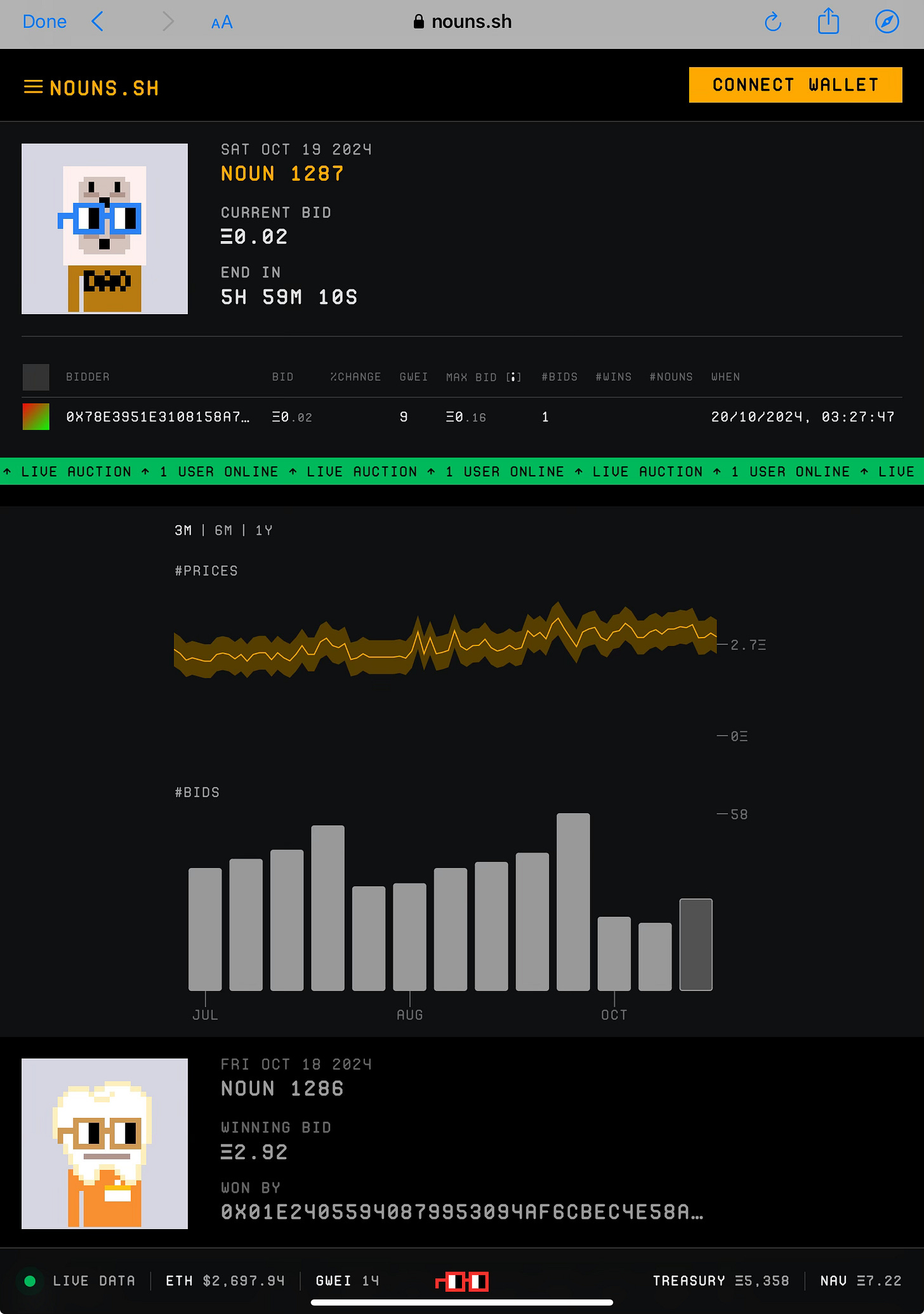

Every day there is an open auction selling 1 randomly generated Noun in exchange for ETH.

This is how it looks like on nouns.sh:

The ETH flows directly into the Nouns treasury.

Each Noun represents 1 vote in the DAO.

Nouners can make and vote on proposals to spend the treasury.

This design achieves a couple of things:

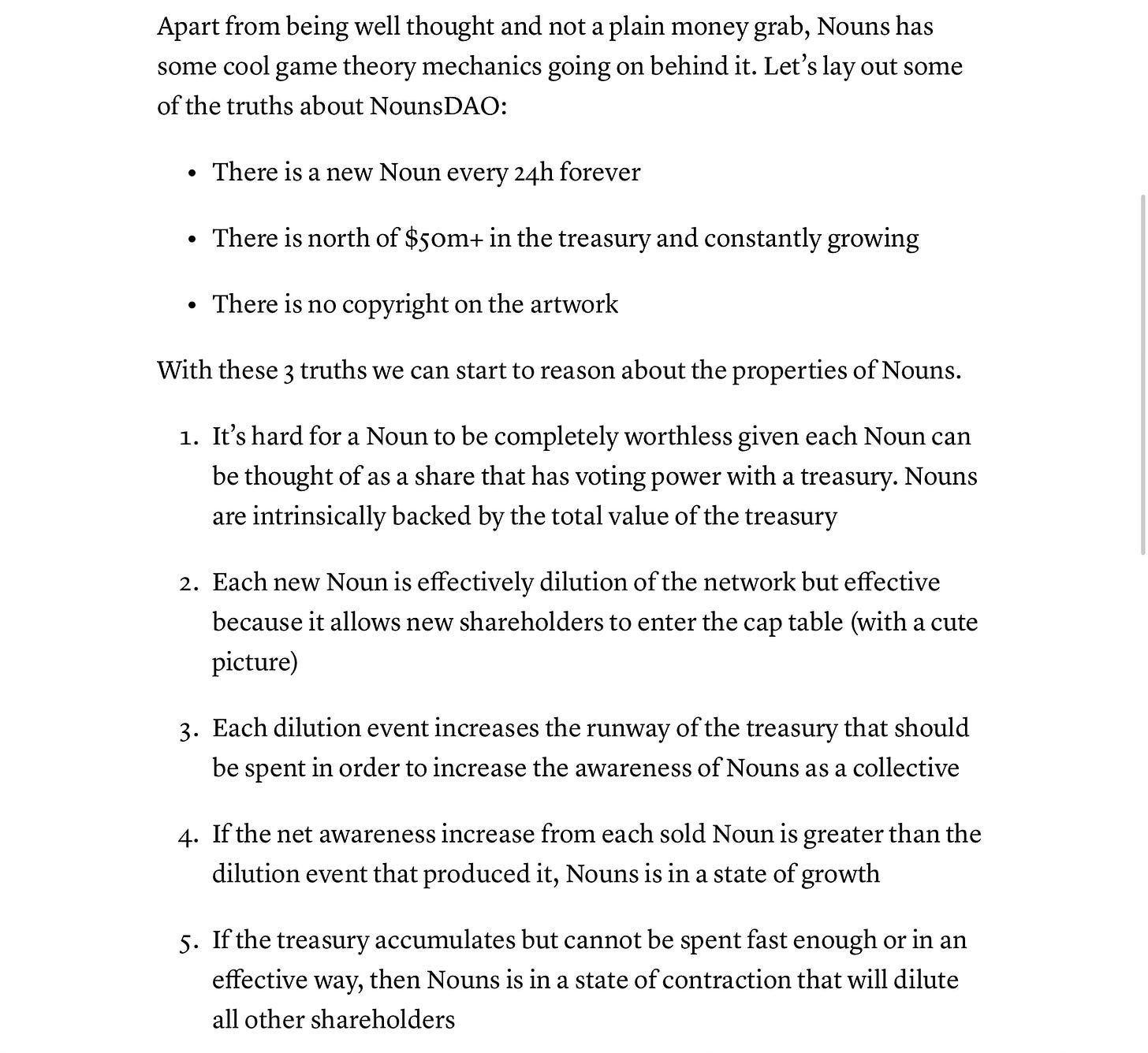

Built-in dilution curve. Traditionally companies have to decide when to dilute their “shares” by having discrete liquidity events. Nouns dilutes exactly by 1 Noun every day (technically every 10th Noun goes to the Founders). Note the frequency of the auction (daily) is not too important in this context, see this analysis by Llama.

Hostile takeovers are slow. It’s hard to acquire Nouns en masse at close to auction prices. One has to either wait and win several auctions in a row. Or one has to find a sufficient amount of sellers at depth which is difficult considering Nouns has been a broadly diversified principled community.

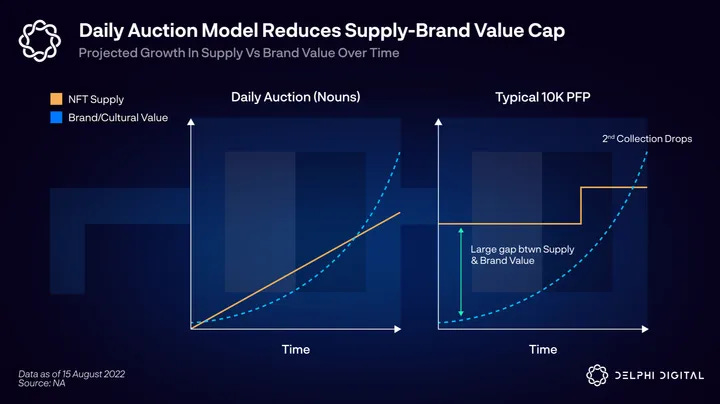

Nouns are more accessible compared to finite supply NFT projects. The below chart from Delphi Digital explains this well.

Kerman Kohli wrote about some other basic implications of the Nouns protocol:

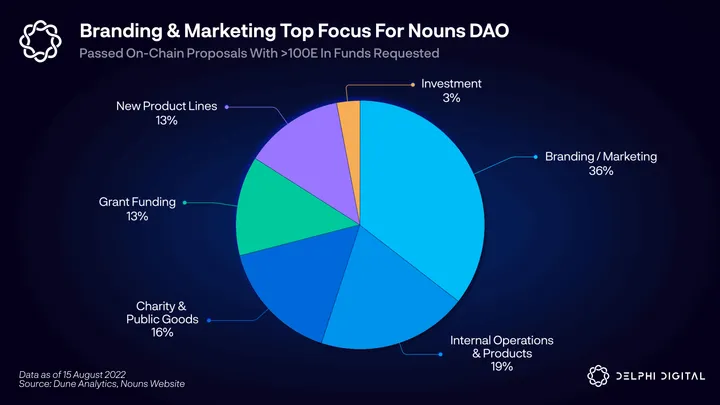

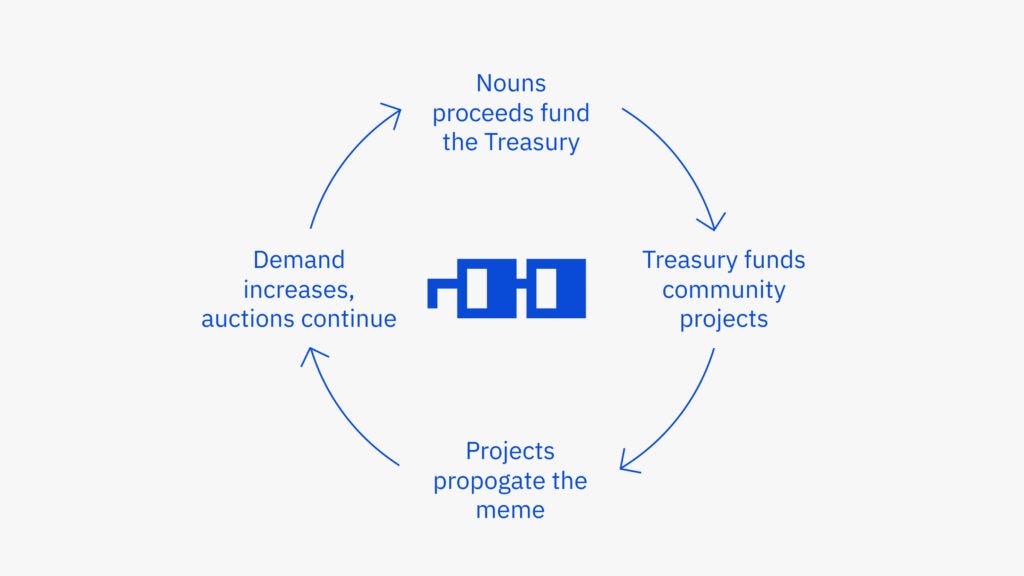

The initial members of Nouns focused on “proliferating the Nouns meme” funding a vast array of projects ranging from pure branding, content creation and social impact/public goods projects.

Some were experimental and some were very successful.

Whales kept buying Nouns at record high prices and the treasury grew.

This created a honey pot.

What if Nouns got 51% attacked?

If a group of market participants organized together, they could collude to steal all of the treasury.

The Nouns Arb Game

Taking a page from Bitcoin and Ethereum, Nouns implemented the ability to fork:

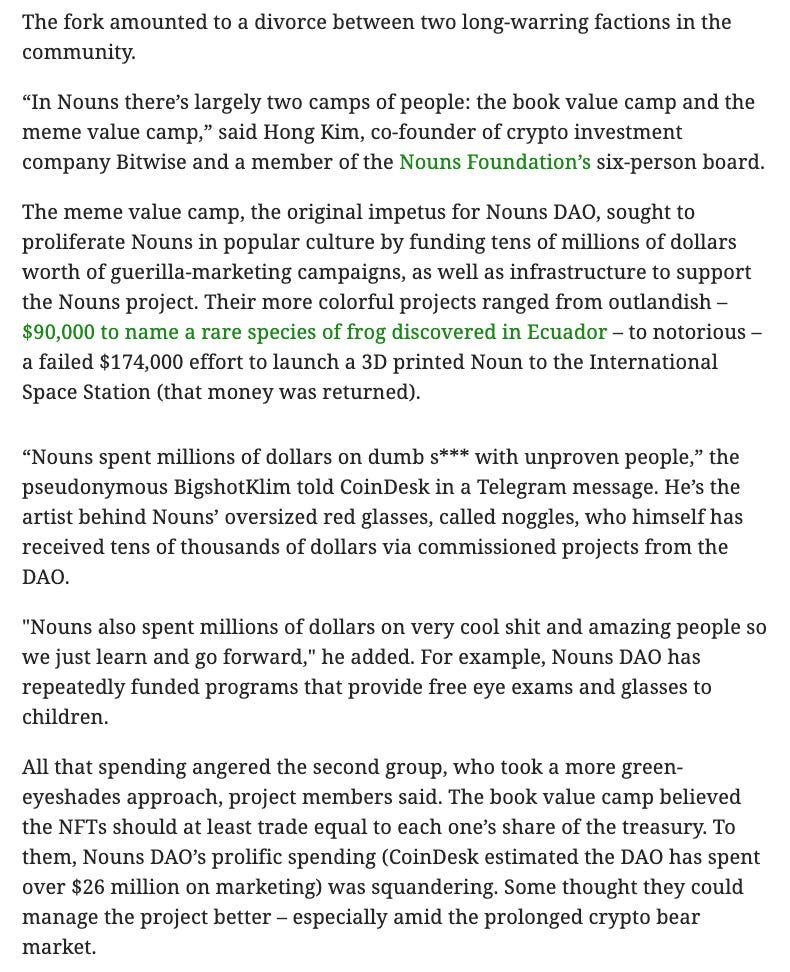

This resulted in a highly controversial fork between two warring factions: the “meme value camp” (the proliferators) and the “book value camp” (Nouners focused on driving treasury value per Noun):

Unfortunately, the fork mechanism is less idealistic than envisioned, since it all supports the ability to fully exit by withdrawing one's pro rata share of the funds.

This was exploited by arbitrageurs who had won auctions at prices below the book value of Nouns.

They could cash out immediately following the fork effectively helping drain half the treasury.

Unfortunately that wasn't the end.

The fork permanently altered the Nouns “metagame” and apparently most auctions are still won by arbitrageurs who are quietly accumulating numbers to keep mounting forks to extract book value.

Now the big question: is the Nouns Arb Game a natural end state for Nouns or can the DAO enter a new modality.

If the treasury is being spent at too slow of a pace, arbitrageurs have an incentive to buy and coordinate.

A path forward

The initial experiment in Nouns proliferation hoped for the following (from the Variant blog):

However, while the brand expansion projects were incredibly successful, this did not resulting in ongoing increased organic demand for Nouns. Arbitrageurs still kept winning auctions.

Imagine you had a public company that decided to spend all of its treasury on investor relations.

They would throw the best parties, market in places investors are and do cool things that investors would appreciate like sponsor golf tournaments.

While investors would enjoy these campaigns, this wouldn't necessarily make the stock more appealing. Purchasing in expectation of future demand is speculation.

Equally, I don't think focusing entirely on book value makes sense either. There are plenty of yield farms and investment DAOs that are suitable for this purpose.

Nouns has intangible assets that shouldn't be neglected: a passionate community, substantial brand awareness, a track record of positive social impact and big dreams.

I think ultimately there is a false dichotomy that Nouns has to be focused on book value or proliferation at the expense of another.

Instead, I think there’s a strategy that straddles both.

In Magic, there is a very unique strategy of winning games that is only viable very decade or so.

It involves “poisoning” your opponent by placing a poison counter on them and then proliferating the poison counter 9 times until they have 10 poison counters and lose the game.

A “poison pill” in the DAO context is an unforkable asset. Purchasing a crypto punk has been suggested in the past as one example but would not be considered “Nounish”.

I think the key to the future of Nouns is to build poison pills that can be proliferated.

Instead of Nouns doing finite campaigns for point-in-time brand awareness, it’s time for the DAO to channel brand awareness and build ownership in media assets.

Buying attention is temporary.

Building ownership in media = buying an attention or proliferation engine.

Nouns is in a unique position where they can build an audience of millions that has strong awareness and affinity for Nouns and is well-monetized at the same time.