Starknet Is All In: BTCFi

Thoughts on the launch and the new interop landscape.

Check Part 5 of this series on Starknet becoming a Bitcoin L2.

In the previous article we talked about how enabling Bitcoin DeFi is the first step towards Starknet becoming a Bitcoin L2.

Well, that moment is finally here.

Starknet’s BTCFi campaign is live and it looks to be one of the biggest incentive campaigns for Bitcoin as a DeFi collateral asset.

Here’s everything that is happening:

Starknet will launch a unique BTC staking primitive. Staked BTC will be tokenized and generate STRK rewards.

Re7 is launching an institutional Bitcoin Yield Fund allocating directly into Starknet's BTC staking and DeFi strategies. Re7 will combine onchain allocations with off chain options/volatility trading.

A 1-click yield aggregator will be launched and integrated into various wallets. It will be managed by Re7 to allocate BTC into productive strategies: staking, lending, LPing.

100M in STRK incentives will be allocated across various partner protocols targeted at long-term TVL retention.

WHY STARKNET

The Bitcoin restaking category has fallen out of fashion recently (alongside other restaking opportunities):

The alternatives aren't that exciting either, “actively managed/curated” BTC vaults net no more than 3% in additional yield.

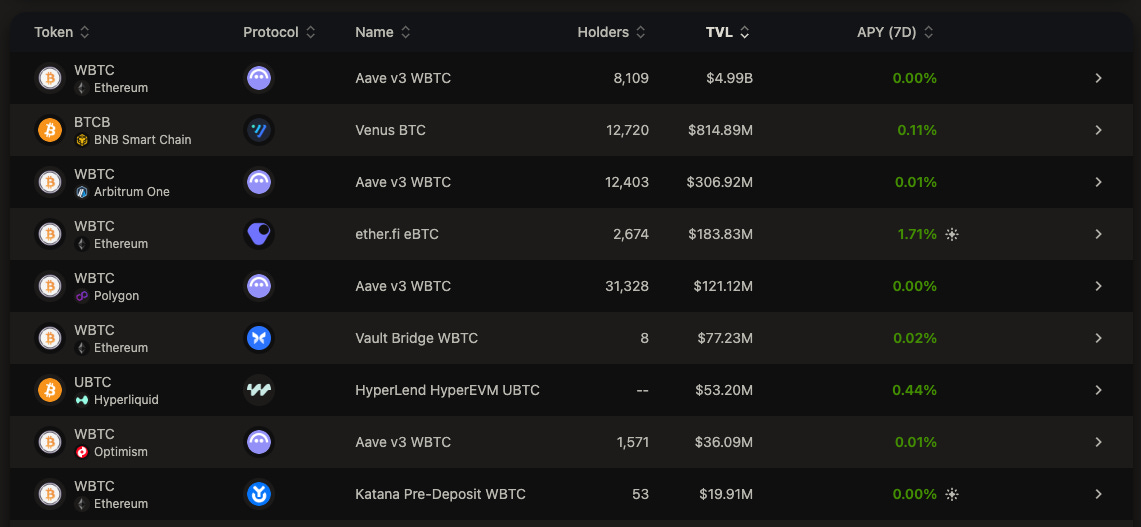

Most BTC on EVM chains currently lives in low-risk lending protocols, here are the top venues by yield:

Bitcoin depositors need a combination of higher yields and better trust properties to move their holdings. Bitcoin principal already carries risk so the last thing people need is giving up their hedge asset to chase 1-3% in net APY.

Starknet is well positioned to address both issues.

It will become a trustless bridge between Ethereum and Bitcoin allowing Bitcoin to be used as a collateral asset without any custodians. In previous articles we discussed various paths for Starknet to establish a trustless bridge with Bitcoin. Starknet is also committed to more decentralization than other L2s, already running multiple sequencers since the Grinta upgrade.

Starknet is building a Bitcoin DeFi ecosystem from the ground up. When Starknet becomes a Bitcoin rollup, its entire suite of protocols and applications will become the native Bitcoin DeFi layer allowing more complex primitives like perpetuals to unlock higher BTC yields.

LIQUIDITY AND THE NEW INTEROP LANDSCAPE

In Lets Dissect the Base ⇄ Solana Bridge, we saw an emerging shift in the interop vision:

The Superchain narrative gets a bit more confusing now as Base are effectively minting new types of cross-chain tokens that are not on the surface

SuperchainERC20compatible. They also didn’t advertise the bridge as a public good for the Superchain.If this is true then Base is potentially saying no to using the Superchain as a liquidity bridge long-term and instead relying on it as a low-cost messaging layer only.

We seem to be moving further away from isolated interop hubs (Superchain, Orbit, AggLayer) to a world with good baseline interoperability (provided by a combination of bridging platforms with various trust and liquidity properties) further enhanced with tighter liquidity/issuance links between chains.

The new world order has three elements:

The institutional stablecoin cluster. The set of chains linked via CCTP which includes major USDC DeFi chains, Arc as well as individual chains like Tempo and the Robinhood Chain.

The “culture” cluster. This is led by Solana and Base and is connected by the Base/Solana bridge. A notable characteristic of the EVM chains on this list is that they have become fairly asset agnostic in the spirit of maximizing overall issuance rather than doubling down on ETH. Unichain, Monad, Abstract would all end up here too.

The Bitcoin cluster which includes Bitcoin L1 (neglected by pretty much every other liquid EVM chain) and Starknet! This cluster is also philosophically the most focused on building an unstoppable financial system (validity proven blocks, validator decentralization, privacy, etc.).

One way to think about this is that it’s becoming less important which chains can cheaply pass messages between each other and more important which assets have high non-native liquidity on other chains (liquidity moats > transaction costs).

PRODUCT MARKET FIT?

I believe this will be a moment where Starknet as a chain finally settles on its “niche”: the best possible tradeoff between optimal security and performance AND the most sophisticated developer experience for smart contracts – both things that are relevant in taking Bitcoin to take the next step as a functional asset while preserving its security properties.

It’s far easier to become a dominant chain for one important collateral asset than many at once and now Starknet is making a concentrated bet on Bitcoin finance. This is an important domino in growing DeFi with crypto-native assets.

The war chest here is likely bigger than any other L2 with competing priorities could allocate to BTCFi and it may give Starknet an important head start. While institutional entrants seem to be giving up on ETH as a native asset, BTC is the domino that can't fall:

The ironic thing is that financial institutions seem to be piling into BTC and ETH while building away from the assets’ native networks.

Disclaimer: This research is supported by a grant from StarkWare. The views expressed are solely those of the author and do not represent the views of StarkWare or their employers, clients or affiliates. This report does not constitute financial advice. Peteris and Auditless are $STRK airdrop recipients.