Lets Dissect the Base ⇄ Solana Bridge

Base just opened the tap. Is liquidity going to flow their way?

Yes, Base is launching a network token and that would be fun to speculate on but we can't speculate on just vibes.

Instead I’ll write about the Solana-Base bridge which aims to be the “one bridge to rule them all”?

The joke is that this is a vampire attack on Solana liquidity.

Announcing a bridge and an airdrop (sorry, read: token) at the same exact time is certainly suggestive timing, but I don't think this is a one off vampire attack.

I think Base is taking steps to own cross chain issuance.

A NEW TYPE OF BRIDGE

Remember this?

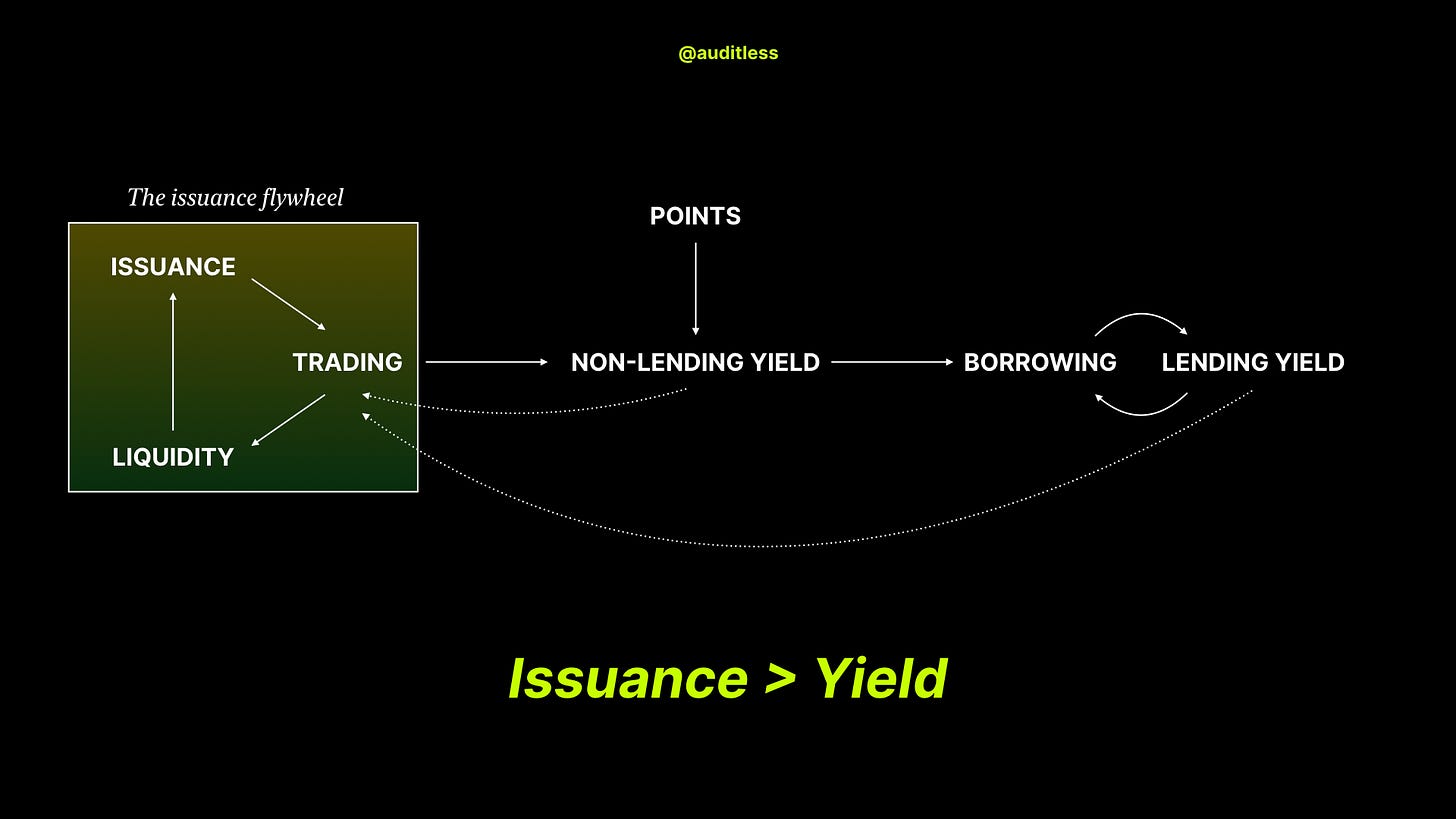

Cross-chain liquidity fragmentation is a pressing problem precisely because there is no unifying standard and issuance is the most crucial component of sustainable rollup growth.

There are several ways to make tokens travel across chains:

L1→rollup bridges are the simplest and closest to a pure “wrapper” of the underlying token. When you send your L1 token to the rollup bridge, everything is preserved (name, symbol and decimals). The wrapped tokens preserve no real functionality from the underlying token.

Liquidity bridges have canonical wrapped versions of each token and use a registry to determine how they should be named, what decimals to use and so on. These wrapped tokens also have no functionality.

Layer0’s OFT standard allows projects to “build their own omnichain tokens” with custom functionality. This means that not only can tokens be minted by burning the same token on another chain, but the cross-chain compatible token could support native minting too (e.g., vault deposits, lending deposits, rewards).

Interop clusters like the Superchain provide another path as a shared liquidity bridge across a set of rollups. However, I'm not exactly sure whether the SuperchainERC20 will look more like an OFT or a wrapped L1 token.

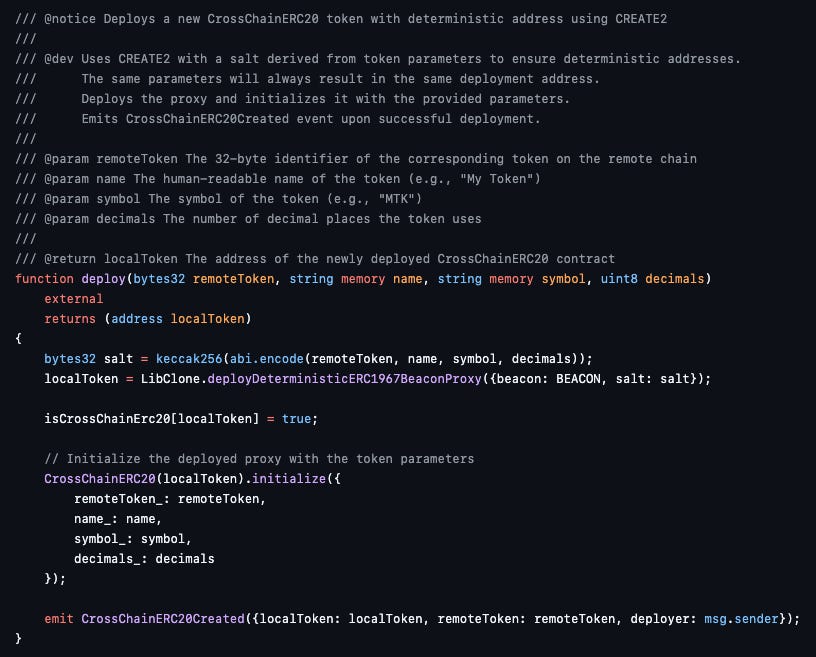

On a cursory look it seems like the Base Bridge supports deployment of multiple Base local tokens for each Solana token but not vice versa.

If true (and I'm very happy to be proven wrong if someone wants to dig deeper into the contracts), this means that the bridge allows liquidity fragmentation for Solana tokens on Base but consolidates liquidity for each Base token on Solana.

One way to think about this is that Base may see their bridge as inherently asymmetric or existing to reinforce their position as a liquidity hub chain.

There is a benefit that you don't need trusted registry management for the tokens but is it worth the risks of liquidity fragmentation?

WHAT HAPPENS NOW?

The bridge is a pure liquidity play.

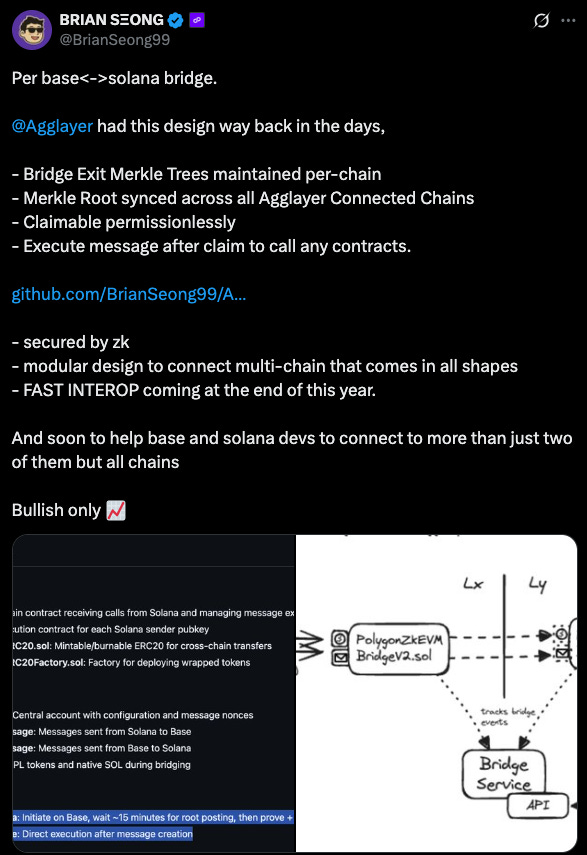

It’s currently a Stage 0 bridge (secured entirely by operators, validators + a guardian) so there isn't anything fancy or interesting technology wise here as Polygon are happy to point out:

Now that the flood gates are open, the competition shifts to who can get their natively issued tokens on other chains the fastest.

The choice of chains matters here too. We may be seeing a bifurcation of the creator/memecoin economy and the institutional stablecoin economy and Base are seem to be focusing on the former for now.

Of course, both economies converge at payments but the angles of approach are very different.

WHAT DOES IT MEAN FOR OPTIMISM?

The Superchain narrative gets a bit more confusing now as Base are effectively minting new types of cross-chain tokens that are not on the surface SuperchainERC20 compatible. They also didn't advertise the bridge as a public good for the Superchain.

If this is true then Base is potentially saying no to using the Superchain as a liquidity bridge long-term and instead relying on it as a low-cost messaging layer only.

Base’s position was also a little different focusing on creator coins and consumer apps while providing easy fiat onramps. Now Base is borrowing language from Unichain and talking about becoming a liquidity hub for crypto.

While far from a red flag, people that think Base will ultimately exit the Superchain will probably see this as another signal in that direction.

If an exit eventually is possible, you would indeed avoid tying up liquidity in SuperchainERC20 tokens which you have less control over.