Starknet's Inevitable Path to Bitcoin & Technical Options

For Starknet, All Roads Lead to Bitcoin.

Check Part 4 of this series on Starknet becoming a Bitcoin L2.

Bitcoin is the most decentralized cryptocurrency, but trustless rollups are not yet possible on the network.

While Starknet has committed to becoming a Bitcoin rollup (in addition to settling on Ethereum), it has several possible paths to do so.

The choice of which paths to pursue depends on future network upgrades and research, unfolding into a series of parallel (and overlapping) universes for Bitcoin scaling.

In this post, we’ll describe those universes and their implications for what could become the most important Bitcoin rollup.

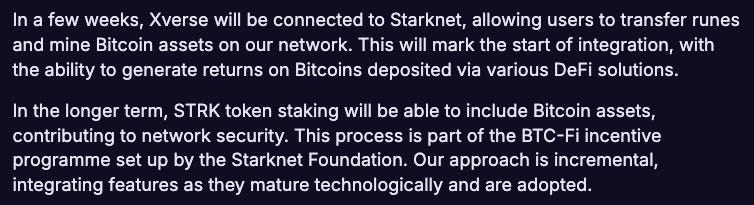

BTCFI

Our starting universe is BTCfi (short for Bitcoin Finance) which features the proliferation of Bitcoin as a collateral asset in Ethereum DeFi.

Of all networks, Ethereum has already proven that there is significant demand for using Bitcoin in a DeFi context:

Bitcoin is still seen by many as a long-term inflation hedge, the principal component of risky-on yield and simply the most “Lindy” crypto asset.

Without native staking options, holders have traditionally turned to the Ethereum ecosystem to access additional yield, rewards or participate in Bitcoin money markets.

Starknet is also continuing to engage this community as future Bitcoin rollup users recently partnering with Lombard to offer Bitcoin staking on Starknet.

Expect the Starknet Foundation’s BTCfi season initiative to take this much further.

However, the adoption of BTCfi is still limited by compromises in trust. Holders of the most decentralized collateral asset in crypto are not always happy to take custody or bridge risk for a couple extra percentage points in yield and this caution is often rewarded (as those who stayed away from Blockfi will know).

FEDERATED BRIDGE

The next step towards building a Bitcoin economy on Starknet is to allow minting of the asset under the network’s trust assumptions using a Federated Bridge.

Aside from trust assumptions, the benefit of Federated bridging is that the minted assets could readily participate and enhance integrations with existing BTCfi protocols.

Liquidity fragmentation across various forms of Bitcoin wrappers would have to be carefully managed but with the growth of intent systems there will be paths to pay solvers for the convenience of using the right collateral for each protocol or swap.

This won't be the only way to bridge Bitcoin in the meantime with the recent Garden partnership opening a pathway to atomic swaps.

Interestingly, many BTCfi related partnerships may become less useful once Starknet trustlessly settles to both Ethereum and Bitcoin and becomes a programmable bridge between the two networks itself, however, these partnerships helps establish an early strategic advantage by using Starknet’s existing stature as an active Ethereum rollup to build up a liquidity and community network effect while other aspiring Bitcoin rollups don't have the same privilege.

BITVM

BitVM, Bitcoin’s universal optimistic proving engine is currently the most popular implementation option for other Bitcoin rollups. We've specifically covered how BitVM would power Citrea and Alpen in prior posts.

It’s a strong candidate option for Starknet also, enabling a hybrid ZK/optimistic proof system with a 1-of-n honesty assumption (read: one well behaving verifier is enough to make the BitVM bridge secure).

Embracing the BitVM path could mean that no relevant soft forks or network upgrades were approved and would mean that the different Bitcoin rollups would likely all converge to some form of optimistic proving setup but there may be significant performance differences from the efficiency of proving and proof size which Starknet should already be in a very good position to optimize.

It could also be an intermediary option, allowing Starknet to achieve Bitcoin rollup status on a similar timeline as other Bitcoin rollups if the soft fork plans suffer from delays or indecision.

COLLIDERVM

ColliderVM is a home grown invention invented by the StarkWare team as an evolution of ColliderScript:

It uses hash puzzles, with parameters carefully tuned for current compute complexity to create puzzles that are solvable but cannot be cheated; this is analogous to how Bitcoin mining is viable, but double spending is not.

The problem with ColliderVM is the cost.

As such, it likely represents a stepping stone in research as opposed to a more viable solution like BitVM but it could well lead to a better global optimum.

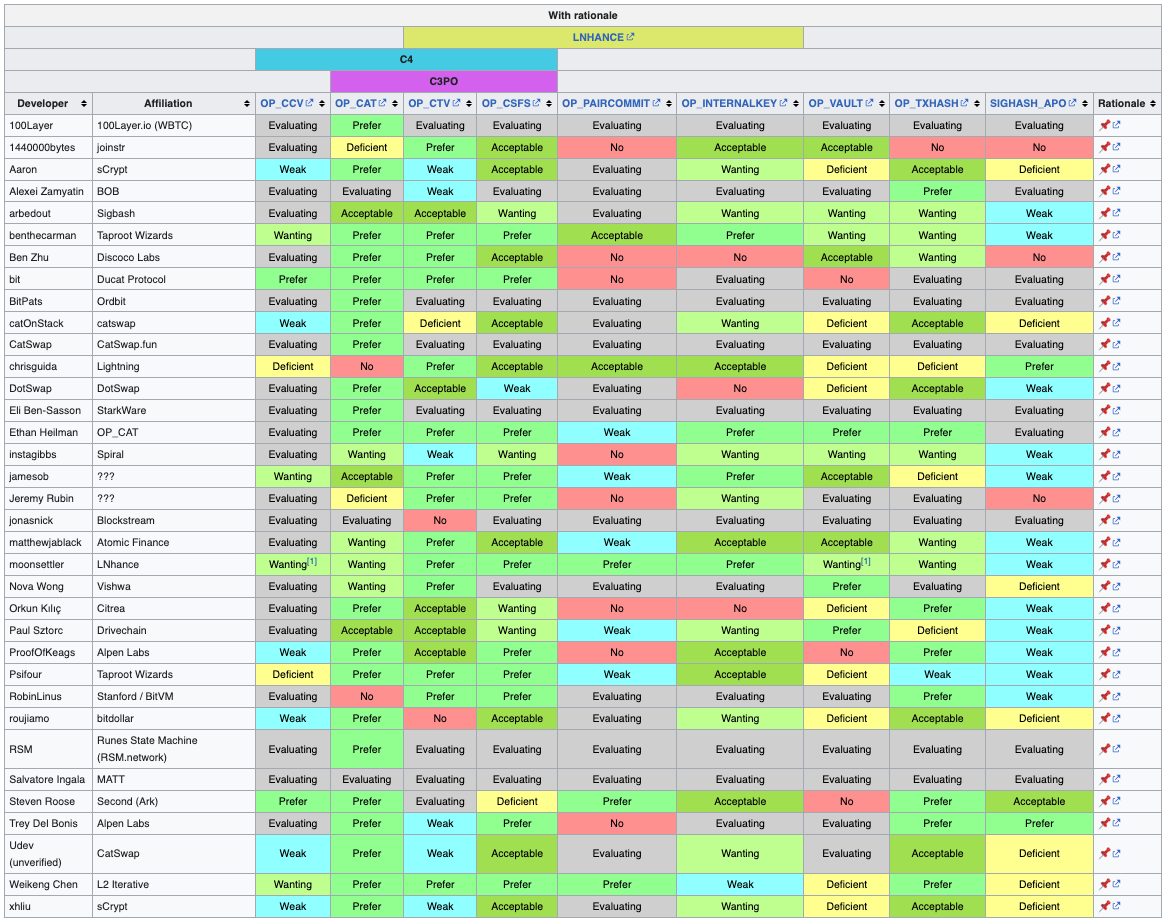

OP_CAT

Last but not least, the best and most direct path would be to add the OP_CAT opcode which would allow STARK validation in BitcoinScript.

The curious thing about the opcode is that it was once part of the network but was removed by none other than Satoshi in 2010.

What it would mean for Starknet is that OP_CAT would make covenants (read: rules governing UTXO spending) efficient.

This is not just a theoretical path as a proof of concept verifier has already been developed.

The work remaining involves as much lobbying as it does technical work since OP_CAT is only one of several ways to make covenants possible and there’s strong disagreement.

For Starknet and Eli, OP_CAT is the preferred path forward but even more universes exist to explore.

Either way, Starknet is coming to Bitcoin one way or another.

Disclaimer: This research is supported by a grant from StarkWare. The views expressed are solely those of the author and do not represent the views of StarkWare or their employers, clients or affiliates. This report does not constitute financial advice. Peteris and Auditless are $STRK airdrop recipients.