Renzo's Dynamo: Issuers Are Done With AMMs

Renzo's vertical integration is the first of many to come.

Renzo just announced their Dynamo DEX:

This may seem like a natural product response to the ezETH depeg in April last year but it’s actually a sign of a greater trend…

EZETH DEPEG RECAP

If you missed the depeg, it came as users withdrew ezETH positions disappointed by the announced airdrop allocation.

While the early withdrawals were simply a reflection of changing opportunity cost, the sudden loss in value triggered further selling, which in turn triggered liquidations of looped positions on lending protocols.

AMMs simply failed to facilitate price stability for restaking tokens.

ISSUERS CAN NOW BUILD AMMS TOO

Until recently, issuers had to rely on existing AMMs without being able to modify their design.

It’s not something they could ignore either. Especially in staking/restaking, liquidity pools often provide the only fast exit path and become a crucial extension of the product.

Lido is not Lido without their stETH/ETH pools.

And to build their market dominance, they had to redirect millions in incentives to Curve instead of their own product.

Uniswap v4 changed this.

It allows issuers to build, configure and own their AMM completely. As we wrote before:

Issuers will tailor how liquidity is generated in safe, tested and economically sound ways.

Uniswap v4 and Onchain Investment Banking

We also explained why the restaking market is prone for custom AMM development in Uniswap v4 is the Sanctum of Restaking.

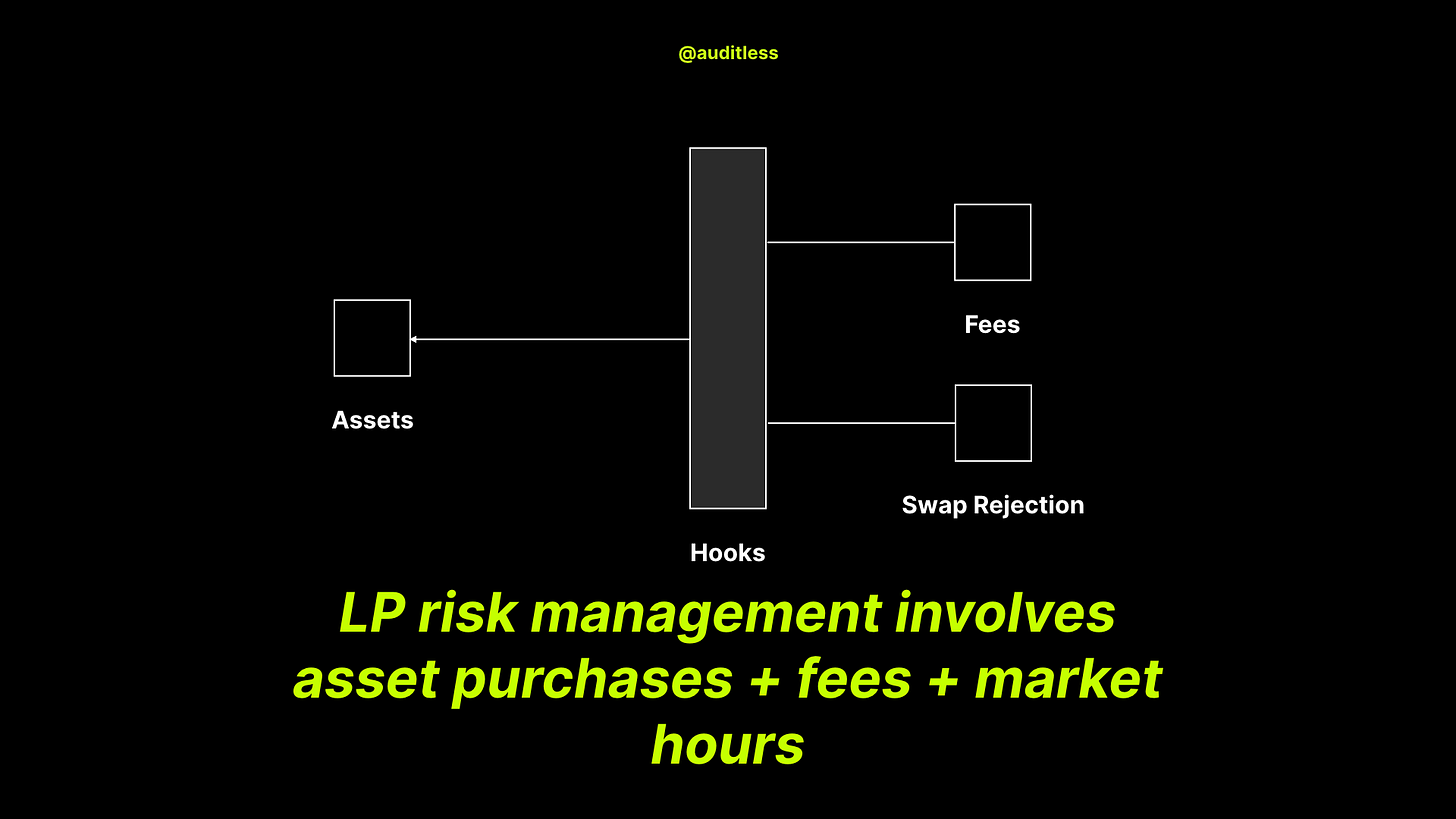

By building a hook on Uniswap, Renzo can control how fees are charged, how liquidity is provided and direct any incentives to a smart contract they actually control.

So what did they do?

AN ASSYMETRIC FEE HOOK

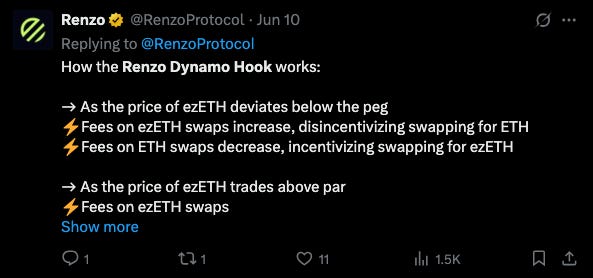

Dynamo is a dynamic fee hook.

Conceptually dynamic fee hooks are one of the simplest and well templated types of Uniswap v4 hooks.

While Uniswap v4 allows modifying the trading curve completely, dynamic fee hooks use the underlying concentrated liquidity AMM and provide a function that modifies what fees are applied to trades depending on the trade itself.

We've previously classified these in the category of hooks that focus on managing LP risk because they can be used to mitigate the risks of impermanent loss and price instability.

By making fees higher for swaps that move the price further from the 1:1 peg, Renzo hopes to add sufficient friction against panic selling.

Fees in the direction of the peg are lower, which means that in an event such as the original sell-off as a result of the airdrop announcement, arbitrageurs could step in earlier and return prices to the peg: maintaining liquidity while allowing ezETH holders to naturally rotate.

Furthermore, the spread in fees is even larger the further price has already moved from the peg.

QUESTIONS GOING FORWARD

At this stage, Renzo have only offered a small preview of what is being built.

When it comes to swap fees, the devil is in the details:

While the validated service space is nascent, slashing events add additional intrinsic risks and result in “true” depegs. It’s possible that a hook like this may penalize holders when selling ahead of a true slashing event;

Withdrawal queues reflect the real inventory dynamics and may not be well reflected in a purely parametrized implementation of swap fees;

The risk of facing higher swap fees if price goes lower may actually lead to more panic selling from sophisticated actors leaving retail “holding the bags” in future depeg events;

This would also lead to penalizing lending protocol books as they usually are forced to liquidate positions when collateral is under-priced. At a minimum, lending protocols may use tighter collateral ratios to reflect increasing swap costs which would result in less efficient markets for ezETH;

Dynamic fees can't fully prevent price movements especially when there is real arbitrage vs. other AMMs (or hooks) where prices move more freely.

I'm looking forward to reading a whitepaper or report explaining the complete design that hopefully addresses these questions and we may have to do a follow-up post once it comes out.

But one thing is for sure: this is not the last time an issuer decides that building their own AMM is the best path forward and it’s certainly not the last time that this type of hook will be built on Uniswap v4.

Uniswap v4 has ushered a significant proportion of net innovation in AMMs in the past 2 years and there’s no signs of it slowing down.