Uniswap v4 is the Sanctum of Restaking

Searching for the future of Ethereum (re-)staking on Solana.

The future of ETH-denominated liquidity affects $50B+ in value.

[Currently $46B of that is in liquid staking tokens, $11B in liquid restaking tokens.]

All of it is up for grabs.

To explain why and how, we’ll use two unlikely tools:

A deep-dive into Solana’s biggest staking aggregator (Sanctum)

And just one chart…

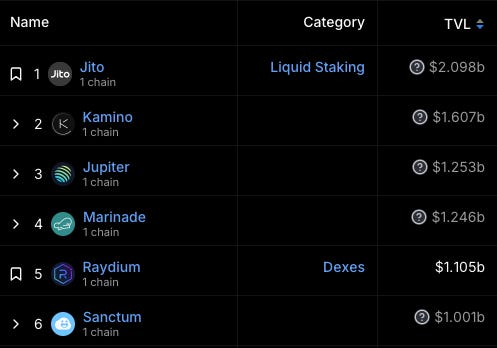

The top 4 pools by volume on Curve:

Read on for some predictions of the future and a protocol idea you should start building right now.

Lido is currently the dominant staking protocol on Ethereum

There is a reason that the only LST represented on the above chart is Lido stETH.

Lido’s dominance is well documented and is so severe that it is often cited as a decentralization/security risk for Ethereum.

The reason this occurred was simple, given Ethereum’s up to 10-day withdrawal queues, a crucial differentiating factor of each LST is its ETH liquidity.

Lido got a head start on their liquidity both in exchanges but also in lending protocols and other DeFi integrations.

This created a liquidity flywheel between users, LPs and swappers of stETH.

By extension, Curve has the highest volume in LST liquidity

[ As Figue pointed out to me, however, Balancer is the primary venue for most of the other LST/LRTs ]

If in doubt, you can consult the chart again for this one.

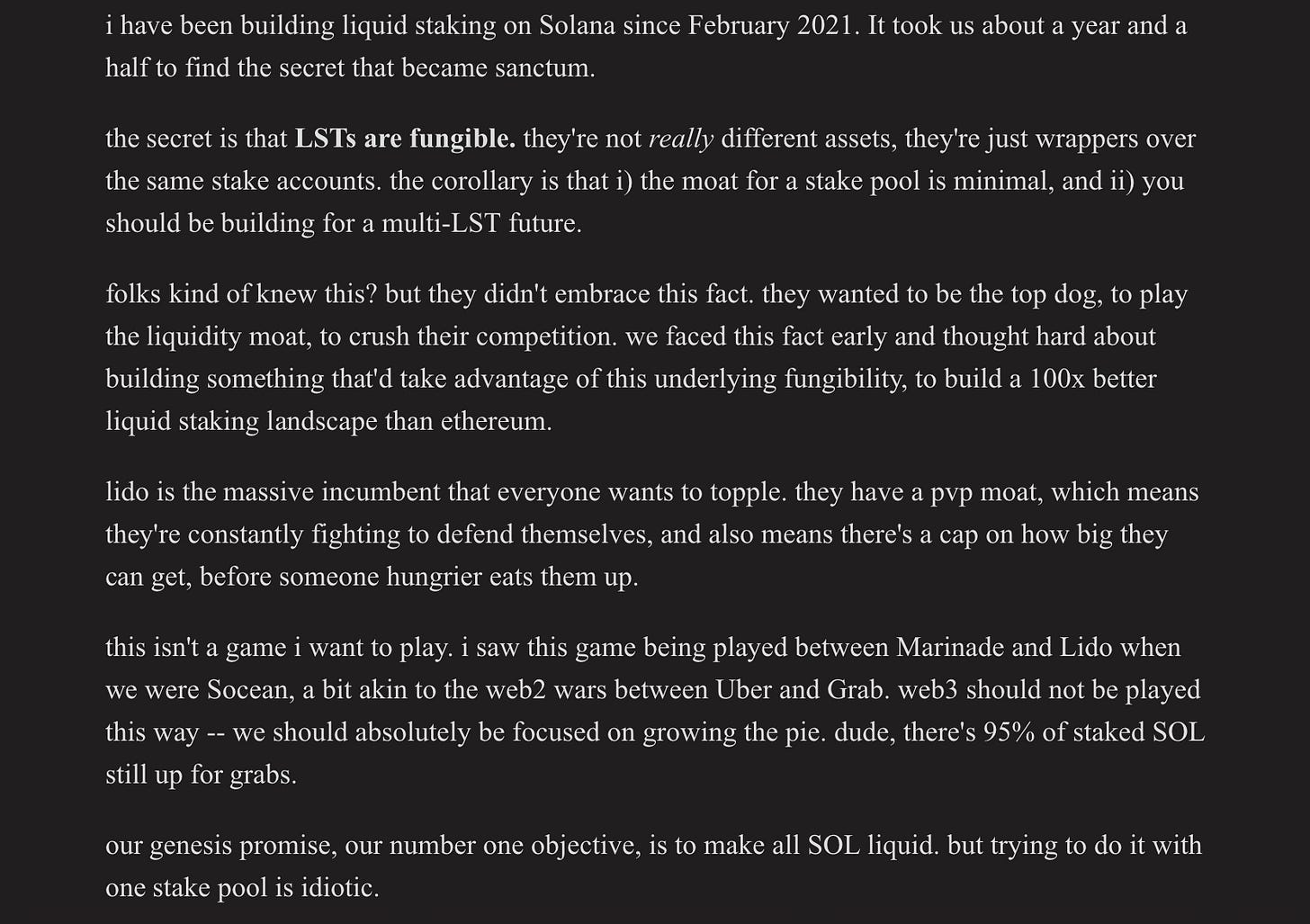

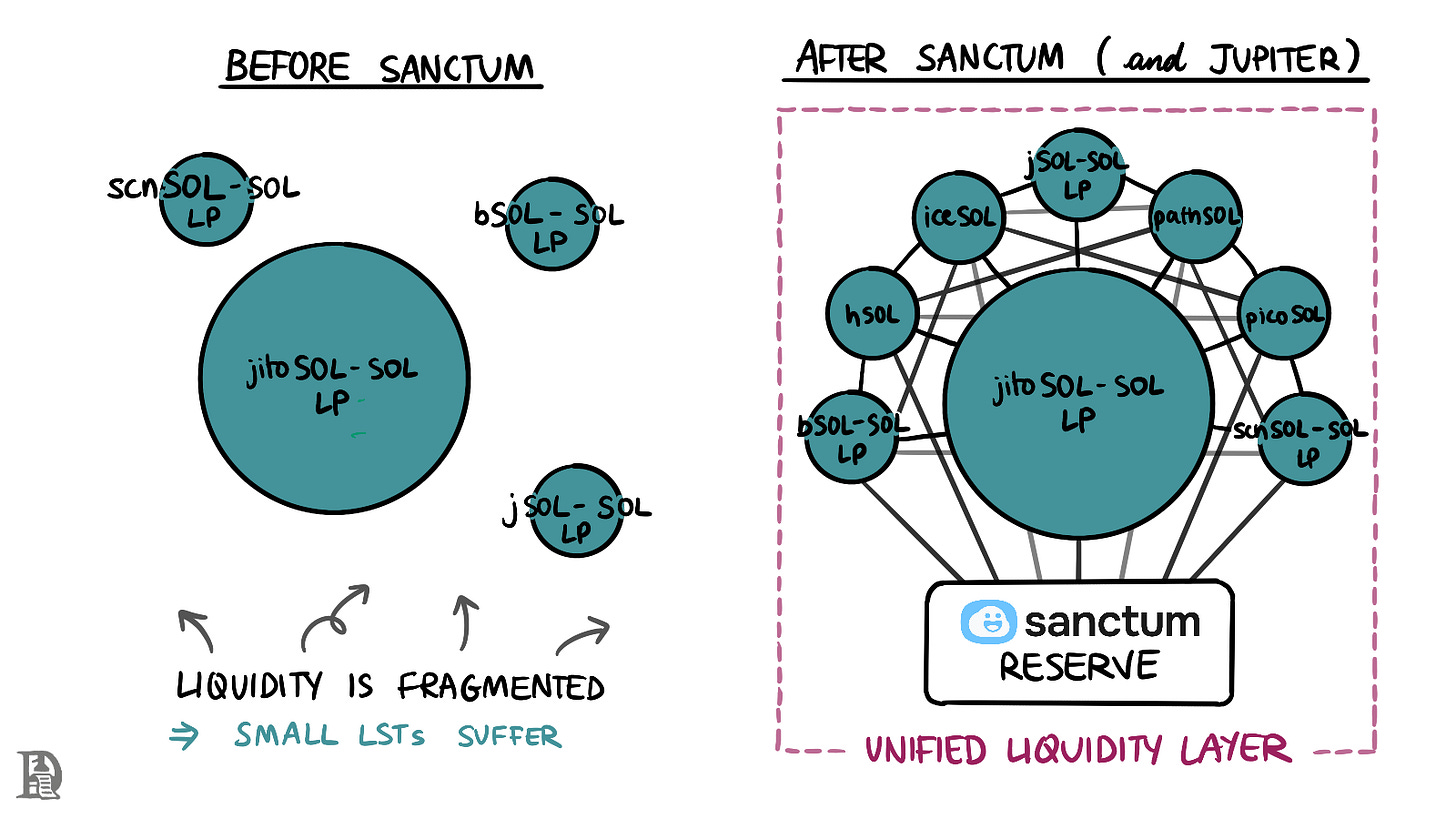

On Solana, Sanctum is becoming home of LST liquidity, but for very different reasons

Sanctum's unique design places it among the top DEXes on Solana even though it is purely focused on staking liquidity.

You'd notice that Jito is currently number 1.

By taking MEV revenue and distributing to stakers, JitoSOL has become the dominant individual LST on Solana but its position is much weaker than Lido’s.

The reason? There are no switching costs to LSTs on Solana since slashing is not enabled.

This means that you can not only deterministically calculate the exchange rate of any two LST, the underlying capital (existing in a staked pool) can be easily migrated too.

Sanctum build their entire product strategy around this idea.

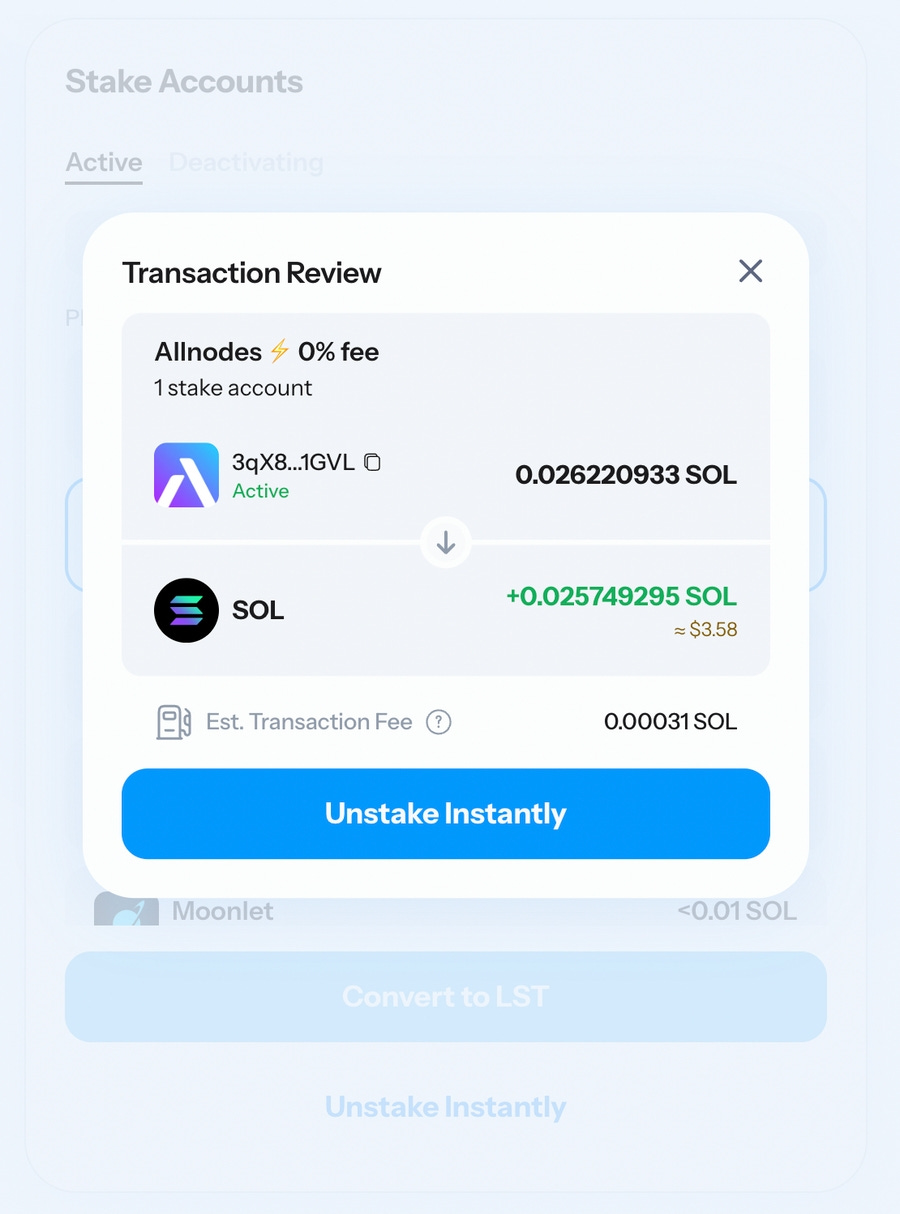

First, they built the Sanctum Reserve which allows instant withdrawals of LSTs.

Since Solana withdrawals only take 2-3 days you have to build a modest capital reserve and you can serve ongoing withdrawals pretty easily (no slashing means you will always get your money back).

Each LST is effectively a 3-day bond for SOL and Sanctum is buying them at a discount to the underlying.

Next, they built the Sanctum Router.

The Router supported LST to LST trades by simply combining the Sanctum Reserve unstake action and then staking that SOL on the desired LST. staking of the relevant token to the desired LST.

Finally, they made these swaps even more efficient with Sanctum Infinity.

Infinity has a single LP token called $INF.

This token represents a basket of 40+ LSTs providing liquidity at the same time.

Each token-to-token trade is executed at exchange rate and adding a cost to both the inbound and outbound token.

The inbound and outbound fees are controlled to maintain a desired portfolio balance.

The portfolio seeks to attain high LST yield ($INF is itself a staking token) while also bootstrapping liquidity to up and coming LSTs.

These trades are more efficient, not requiring unstaking or staking.

Generally combining liquidity in a multi-asset pool is more efficient.

Referring back to our original chart, the 3pool is the dominant vehicle to trade stablecoins.

But why doesn't it have 20+ stablecoins?

Well, depeg risks could lead to severe impermanent loss for LPs.

Only one asset losing value in a multi-asset pool can have a devastating impact on the LP share value.

So 3pool stops at three very blue chip assets that generally maintain a 1:1:1 exchange rate.

Sanctum Infinity can go further precisely because there is no impermanent loss risk whatsoever, slashing cannot occur and all assets are eventually redeemable from LSTs.

So Sanctum’s design is directly enabled by a lack of slashing and short (2-3 day withdrawal periods).

Ethereum restaking = Solana staking (for now)

When looking at Sanctum, they do a lot more than just support staking operators.

In fact they are a proto-restaking service supporting protocol LSTs, creator LSTs and other use cases.

This is where the similarities begin with Ethereum restaking.

Ethereum restaking also has:

A proliferation of liquid restaking tokens (liquidity is not the only differentiator, service & reward management is). Notice the last 2 pools in our Curve chart? They feature 2 different LRTs: ether.fi and Puffer

Short withdrawal periods

(currently) No slashing risk

I think that means that there is a room for a Sanctum style LRT liquidity hub.

This should be a Uniwap v4 Hook

One simply needs to implement an LP token and a contract that holds the underlying liquidity.

Then you can add LRT/ETH endpoint hooks that directly tap into the master liquidity contract at a fixed fee (using custom curves) while also allowing native v4 LPs to provide concentrated liquidity.

Each swap will take 2-hops and could support large trades with limited slippage.

This architecture is what the post header depicts by the way.

So what happens next?

Once slashing is enabled, things will get complicated.

Any up-only restaking token will become a potentially volatile asset and the best way to trade will be to use StableSwap.

At that point the optimal design may revert back to a slashing-aware StableSwap hook that maintains liquidity between each restaking token and ETH.

Interestingly, I haven't seen anyone mention this endgame in a Sanctum context.

Tell me where I'm wrong.