Coinbase's System Update Raises Questions

Will crypto companies act as responsible financial advisers?

My belief in crypto could be directly attributed to a project I did at McKinsey. I had to work with a retail bank and no that doesn’t mean in the HQ (although there were plenty of those projects as well). I got to physically work in a branch for 2 months.

As part of that I got to sit in and listen on advisory conversations. I saw sad situations of customers requesting to consolidate their debt, a bank adviser telling them to not do so because interest rate would be higher than any of the individual loans and still having to complete the request because the customer thought it was “simpler” to have one big loan.

I'm a fan of Coinbase and hold the stock but I worry about the direction they are headed in post System Update (their latest release event). I don't think Coinbase appreciates how much trust people will place in their advice. Nevertheless, there are some products here to get excited about so lets go through it all.

BRIAN IS QUESTIONING CONTENT COINS

We've written about the complex reality of Content Coins already. It's not entirely right to think of them as being antithetical to non-custodial trading. As we show in the piece, Content Coins are in fact the most trading-oriented implementation of social media possible onchain.

But Brian highlights a UX problem: Base App replaced Coinbase Wallet instead of evolving it.

The app now allows you to switch back-and-forth between the two apps but if you want to create private claim wallets in Base App, it’ll be annoying having a social profile and content coin forcibly attached to each of your accounts.

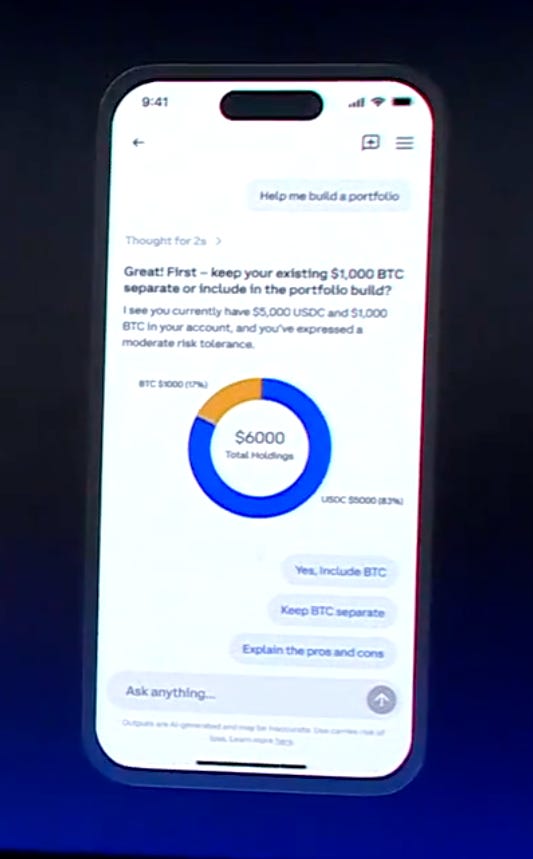

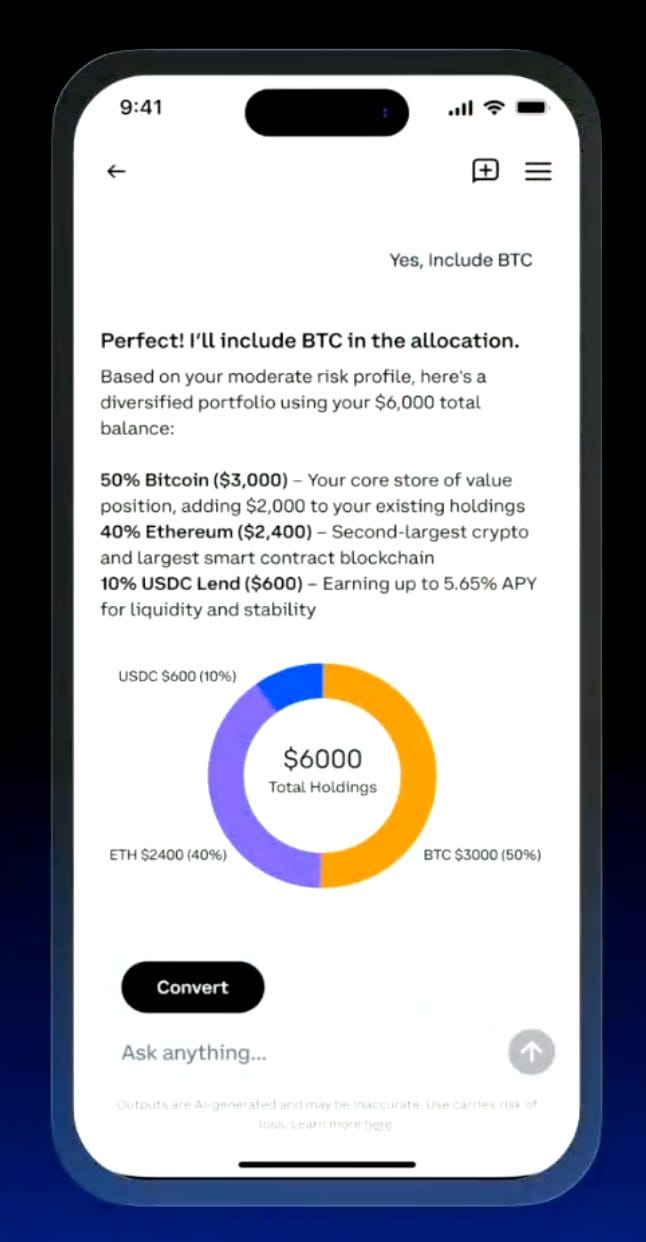

COINBASE ADVISOR RECOMMENDS TRADES

There’s no better way to summarize the current regulatory climate than Coinbase releasing an app which gives AI generated investment recommendations and lets you execute trades directly.

Here’s a portfolio that “managers with combined 75 years of experience” would recommend. A combination of:

Coinbase held BTC which offers 0% yield and none of the noncustodial benefits of holding BTC;

Coinbase held ETH which offers an abysmal 1.7% staking yield and a 1% withdrawal penalty;

Coinbase held USDC which offers 0% yield unless you pay for a Coinbase One subscription (only One subscribers will get access to the Advisor anyways).

This is obviously just a repackaging of Coinbase’s product line instead of a serious portfolio adviser so be warned.

You could argue that at least Coinbase is a pretty good custodian for your coins and the price is giving them all the yield.

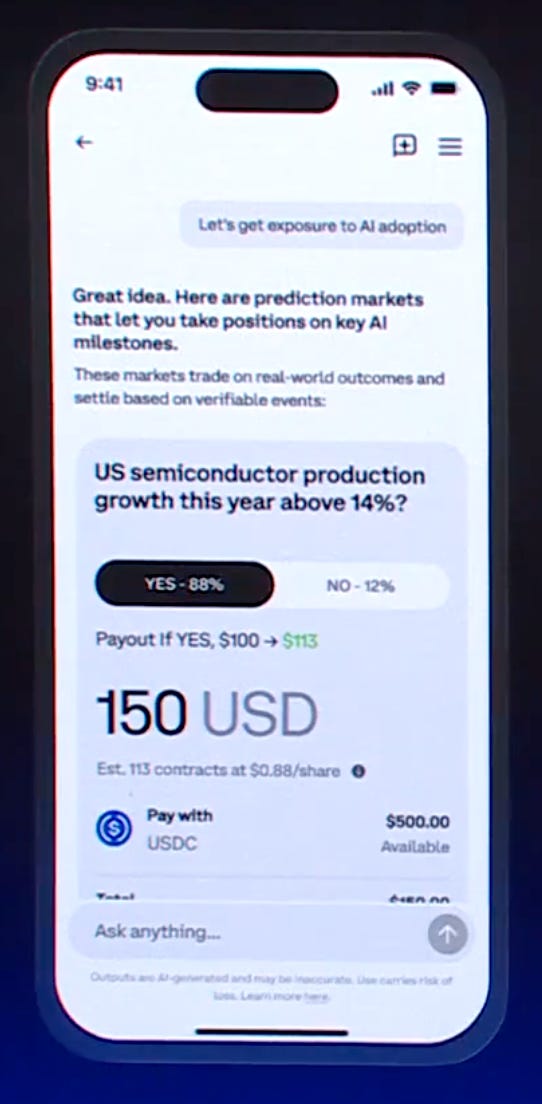

It gets worse though: Coinbase Advisor will actively recommend you to take positions in prediction markets. I still believe people under-estimate how much of these prices are driven by insiders.

During the System Update call, Coinbase seemed to suggest that there were many good options to speculate on AI development through prediction markets or semi-conductor companies at a time when prediction markets are rampant with insider trading and many consider AI equities to be overpriced.

I think a company that prides itself on making the financial world more transparent and accessible should also seek to innovate on the way financial products are marketed. Vanguard is still top of class here.

THE FIRST M0 COMPETITOR

We covered M0 recently, showcasing its unique protocol design and early response to the demand of custom issued stablecoins:

Aggregators, games and other applications which would naturally end up facilitating user wallets and payments now have an easy pathway to create their own stablecoins without having to worry about the issuance side at all.

The most elegant thing about M0 is that they’ve abstracted the complexity of issuance and cross-stablecoin liquidity behind a single ERC20 token and a set of smart contracts you can deploy and use.

Rollup stacks created a proliferation of L2s launched by apps which allowed the apps to access sequencer fees as a revenue stream. Similarly, M0 will allow more apps to issue their own stablecoins to reclaim yield.

Based on the post, it seems like the tradeoff is that you get additional distribution from Coinbase (e.g., tradability in their venues) and can manage the supply in a simple, custodial way with Coinbase Prime. Whereas M0 allows more onchain native distribution and more programmability in how you configure the stablecoin, allowing rewards to be sent onchain, distributed to users, etc. Based on that I think Coinbase/M0 will be competing in two distinct (yet somewhat overlapping) niches.

TOKENIZED STOCKS ARE HERE

Stock tokens have clear potential of dwarfing every other crypto asset in scale, have clear benefits (24/7 markets, lower trading costs) and a launch by Coinbase suggests that we are ready. This is a big moment and the only thing to look out for is volume in onchain venues like Uniswap vs. off chain.

All in all, Coinbase just made another step forward to becoming a bank: a place that you deeply trust and never change but monetizes you pretty aggressively through subscriptions, high fees and low yields.

On a positive note, they are making meaningful technical strides along the way:

They could have just added stocks and started competing with Robinhood but instead figured out how to tokenize them;

They could have ignored Base App in favor of pushing Coinbase as the super app but instead they made Base App available to everyone and are trying to simultaneously build the best custodial and non-custodial experience out there;

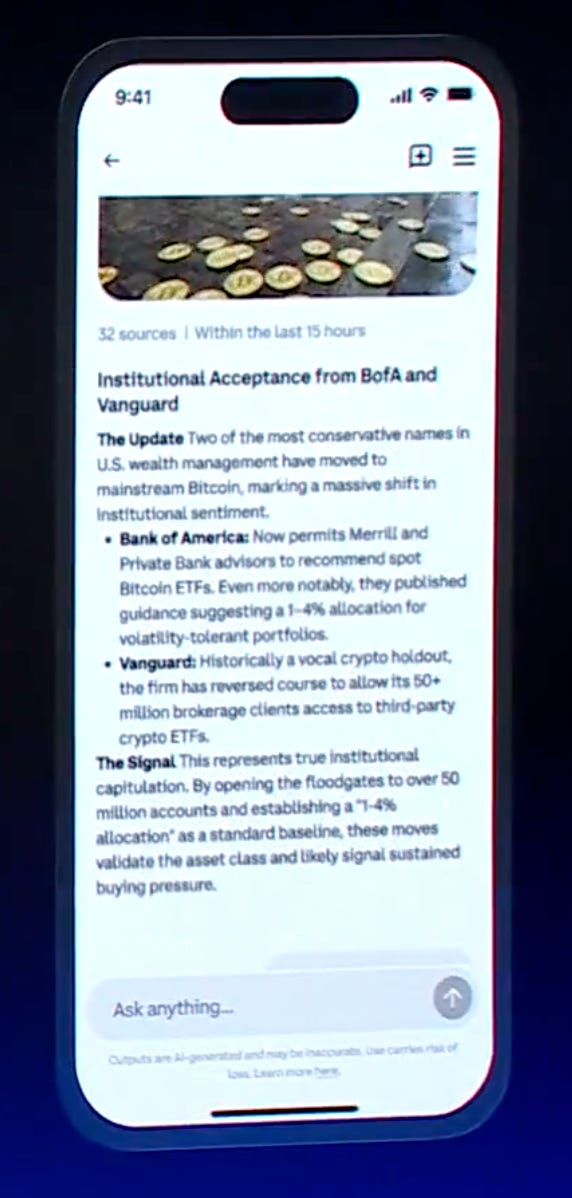

They built an AI advisor that (while not perfect) recommends exposure to crypto-native assets while showcasing how crypto is connects to the real world (through prediction markets and news).

I just hope they lean on helping users save more money as opposed to trading it all away.