You're Thinking About Creator Coins Wrong

Content coins are the only way a rollup can get excited about creators. But be careful, the house always wins.

Crypto Twitter didn't react well to the $JESSE launch:

(And the above tweet was among the more reasonable and grounded complaints that I found.)

Others pointed out:

Bad timing (the launch came too soon after David Phelps post complaining that Base is overly focused on Creator Coins);

Extraction concerns, basically claiming that $JESSE extracted significant transaction fees from the sale;

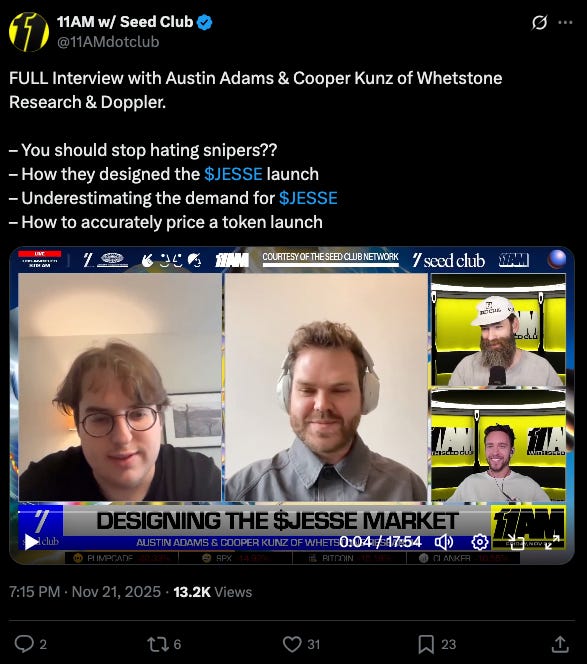

Sniping. Since $JESSE used the Zora x Doppler bonding curve auction, it inadvertently attracted snipers.

But I don't buy into these concerns.

Timing was a little unfortunate but I'm guessing Jesse had already been planning to launch for a while and before his birthday.

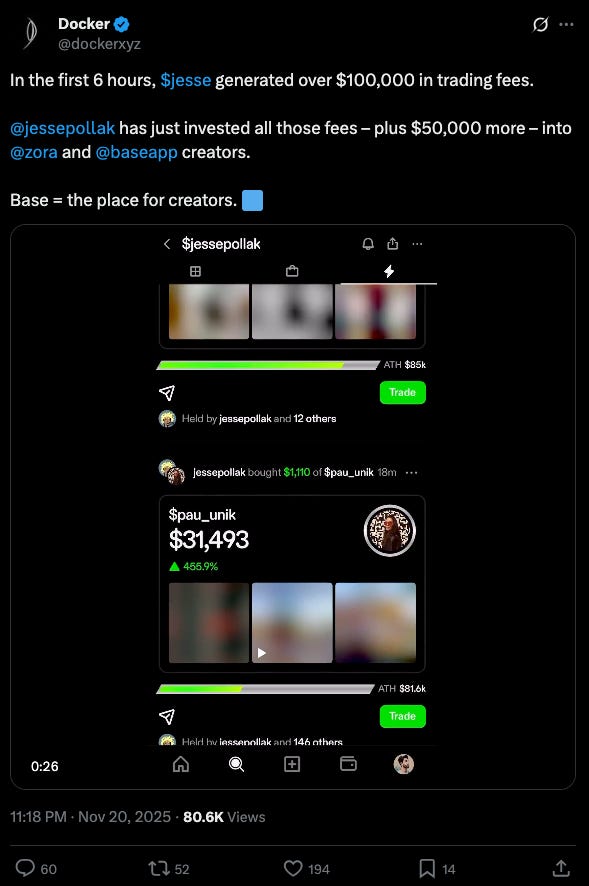

It wasn't extractive either, during his Birthday stream he was able to reinvest fees into other creators on Base. He claimed that he doesn't intend to ever sell the tokens.

Finally, there was a pretty good conversation with Doppler and 11AM that addresses sniping:

We’ll go more into depth on the pros/cons of different auction mechanisms in next week’s issue but Austin has thought about auctions more than every single person who complained about sniping on X.

So if not for malicious reasons, why would Jesse do this?

THE REAL REASON CREATOR COINS ARE PUSHED

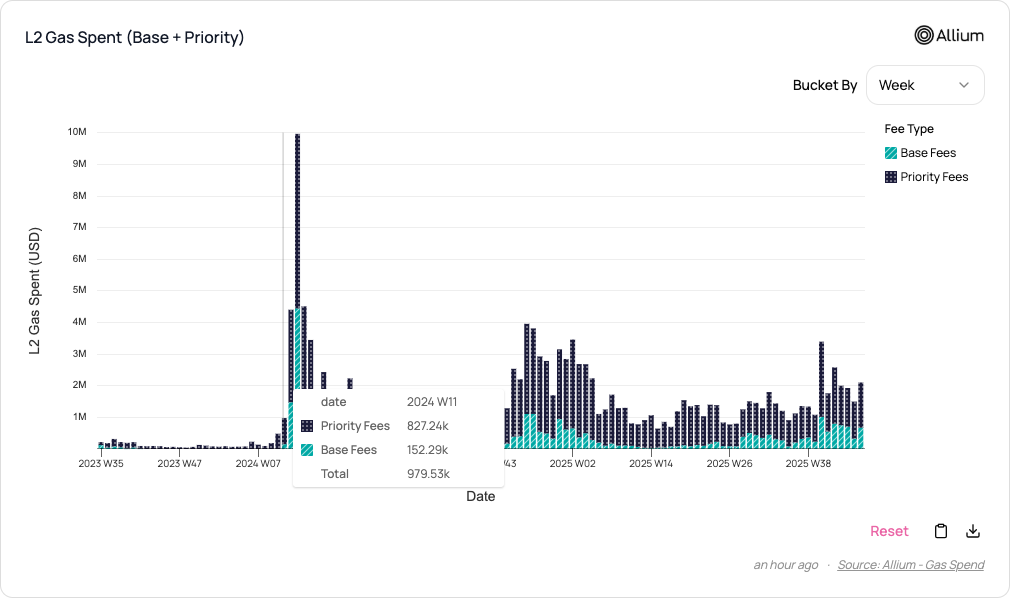

Rollups make most of their sequencer fees from trading.

To date, Base has generated more revenue from memecoin trading than any other activity.

Issuance of new tokens and resulting speculative volume is a major fee driver.

It's likely that Base is spending more than ever on the core team, grants, events, own apps like Base App and supporting Founders but none of that is materially growing Base’s contribution to Coinbase’s balance sheet as a rollup.

Creator Coins and Content Coins are a very clever solution to this problem:

They create even more tokens than memecoins (issuance is a primary battleground for rollups);

They generate trading/speculation activity;

They are built to translate attention into onchain fees. Anything that is going viral by definition will have a Content Coin attached to it;

Even more so than memecoins, they don't require any underlying economic activity, nor a community, or promises.

While gas spikes are framed as a negative by users, creating excess demand for block space is actually success.

No other form of creator monetization would have the same effect:

Payments (e.g., donations) of any kind don't have enough volume let alone payments to creators.

Rewards. Base do use these to seed Base App but rewards have negligible impact on revenue.

Advertising. Onchain advertising doesn't really exist to speak about sequencer fees.

etc.

ARE THEY ACTUALLY GOOD?

It’s clear why Creator Coins make sense as a focus area for Base, are they actually the best mechanism for users and creators?

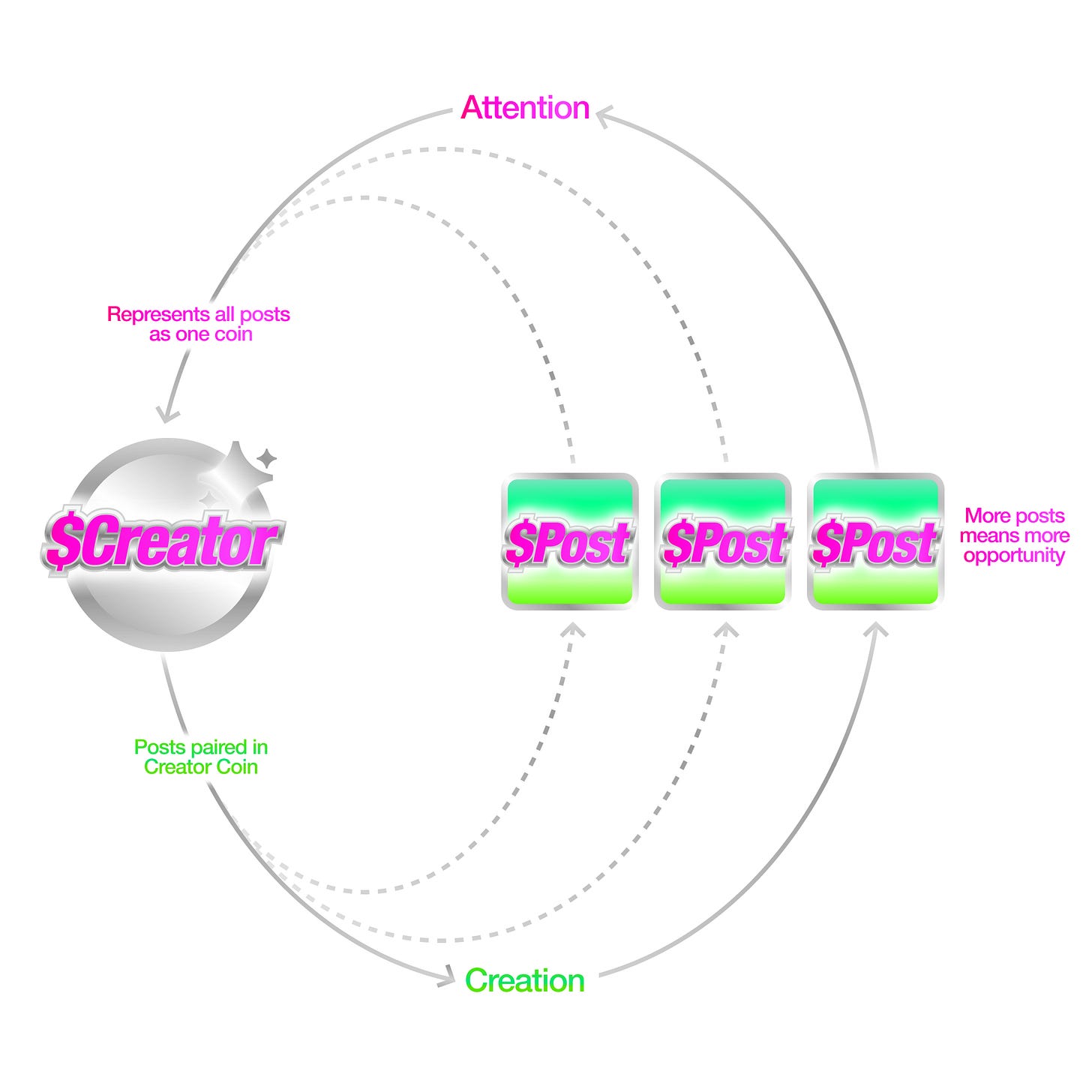

The flywheel is simple:

If you post, it’s a token. You own 1% of the supply.

Each Content Coin can only be purchased via your Creator Coin. If you launch a Creator Coin, you own 50% of the supply (vested).

Demand for your Content Coins naturally creates demand for your Creator Coins. This aligns incentives so that you are motivated to create great content and benefit from ownership of your Creator Coin and the trading fees.

At some level, Content Coins behave like a Patreon membership. If you buy $1000 worth of a Content Coin, your opportunity cost is investing that $1000 to get yield at market rates elsewhere. This forgone yield operates as a creator subscription. In exchange, the creator may decide to reward you for holding the tokens. These rewards could be tiered like Patreon, scaled or random (lottery).

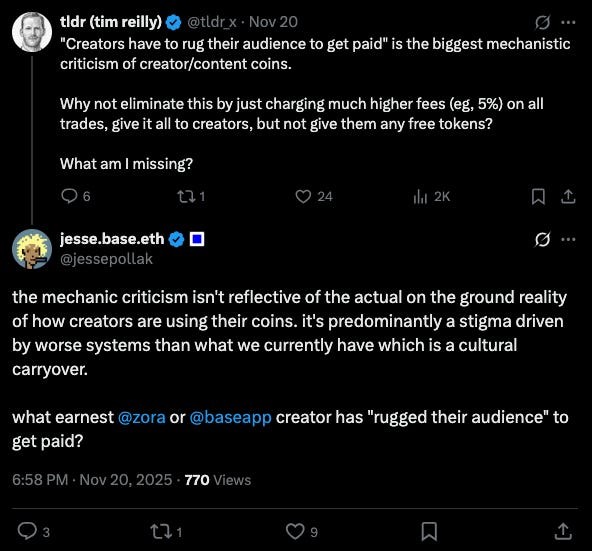

However, the creator doesn't directly receive the subscription unless they dispose of their Creator Coins. So even though your costs are in the form of a yield subscription, not all of that is effectively transferred to the creator you are supporting unless they “rug you”, Jesse pointed out this issue as well:

In addition, Content Coins behave like a fan collectible. The more popular an artist becomes, the more valuable the rewards they can offer to “subscribers”. Therefore, Content Coins have a speculative element. Even if you don't care about supporting the artist or the rewards, you could purchase a Content Coin just to speculate on the value of the rewards (material or immaterial) associated with holding the Content Coin later. This can be equivalent to buying a first edition CD from an artist you enjoy, you may be able to resell it later for more value.

The (significant) downside of this aspect of Creator Coins is that they are well and truly a financial instrument and their market may have institutional participants that have more sophisticated tools than the average fan.

It takes a real fan to recognize, preserve and invest in vintage CDs or swag. It just takes a smart trader to snipe or otherwise speculate on Content Coins.

A one-off slippage donation upon selling. Finally, to “exit” your membership you have to sell the tokens and will incur slippage. The less liquid the Creator Coin AND ironically the more you were contributing, the more slippage you will incur. Content Coins penalize the biggest patrons in this way.

THE HOUSE WINS

My ultimate problem with the Creator Coin model is that it attempts to combine patronage and curation in order to maximize trading volume and gets the worst of both worlds?

True patrons have to deal with price volatility, adversarial market participants, trading taxes, etc.

Curators have little guarantees around future rewards because the Creator Coin is not tied to creator equity or other value streams explicitly. Curators are speculating on unknown demand for future unknown rewards.

It front-loads revenue generation for the creator, likely resulting in a larger amount of trading fees in the initial price discovery phase but unclear whether volume is sustainable (we will see with $JESSE). This doesn't result in great incentive alignment between the creator and the holders.

The result is that the underlying blockchain and trading venue (in this case Uniswap) extracts way more than a payment solution would in a simple membership model.

You could argue that the curation markets fulfill an additional function but the two cannot be cleanly separated.

As a polar opposite, we can study Craig Mod, he built his own membership stack, focused on keeping the setup as lean as possible and it works.

He can also proudly say that nobody lost their hard earned money trying to support him.

What I'm drawn to in Craig’s model is that the focus is on what is being created (books) as opposed to the content or the creator itself.

Personally, I think a creator economy that is focused on engagement is inferior to one that is focused around a real exchange of value and just using the content as a discovery mechanism and a way to work-in-public. A free tier of sorts.

I also think that these issues could be fixed and no doubt that the Zora and Base teams are working hard at it.

At least Creator Coins represent a real attempt to try something new in creator monetization and even if it doesn't prove to be the best model, it’s worth a go.

The comparsion to Craig Mod's membershi model is spot on. When trading fees become part of the monetization mechanic, everyones thinking about prie action instead of value creation. Its an intresting experiment but it feels like the infrastructure won at the expence of the creators.