The Secret World of Telegram Bots

The search for power after hitting $3M in daily fees.

It’s easy to think that the future of crypto interfaces lies solely in fancy PWAs or high fidelity React front-ends.

I’m as excited about them as anyone of course (I recently wrote about Infinex in fact).

But there’s another category of interfaces rapidly gaining traction and serving a completely different use case.

Turns out Telegram bots are not just scams looking to take your coins.

The bots collectively have been earning as much as $3M in daily trading fees in June.

While high leverage trading is the degen side of perp exchanges, memecoin trading is the spot market’s least risk-averse expression.

Telegram bots are purpose built to serve memecoin traders and have many dedicated features.

These features allow them to charge exorbitant fees, much higher than any trading front-end.

1% fees!?

Just how much?

Turns out it’s pretty common for most Telegram bots to charge 1% on trades.

Here’s BONKbot’s commitment on how they use these fees, a relatively benevolent example (many bots charge the same fee without any commitment to direct capital flows).

The amount seems absurd at first glance. While the convenience of using a Telegram bot is one aspect and the price insensitivity of memecoin traders another, these bots actually offer much more sophisticated features than a plain crypto user interface would offer.

How Telegram bots work

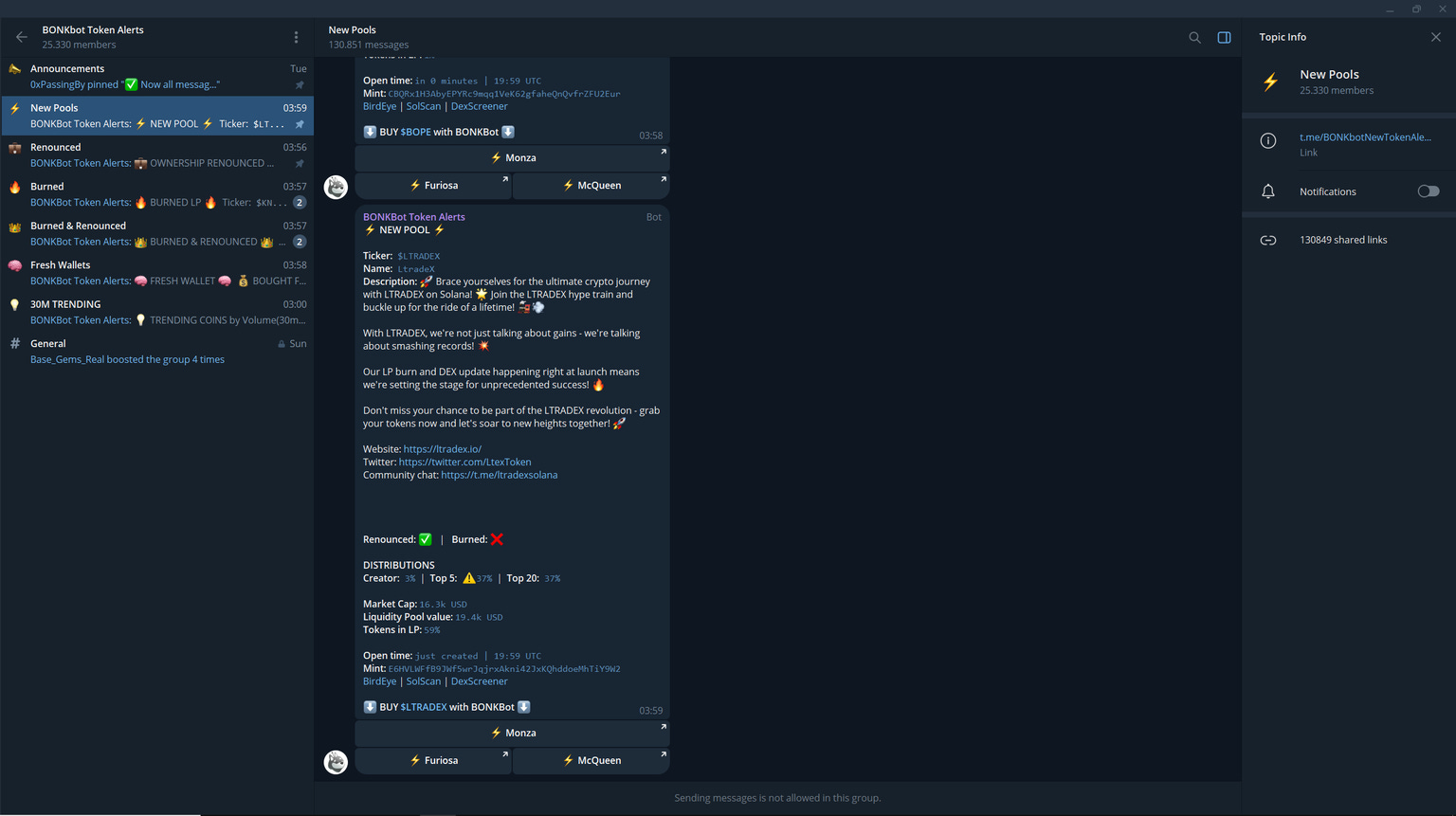

Telegram bots use Telegram groups as a hub and individual chats as the interface. See BONKBot below.

While most security-savvy crypto users wouldn't trust a third-party Telegram bot to manage their keys, they've carved out a substantial niche offering value-add features to memecoin traders.

Consider Trojan, a top 5 Telegram bot by volume and the range of buying options it provides to traders.

Of course it supports basic buying (and selling) of tokens and limit orders but it doesn't stop there.

Want to set up an ongoing dollar cost averaging flow? No problem.

Or copy trade other users with specific filters?

Each trade is logged as a position that can be reviewed later.

Bots also offer “sniping” features specifically for token launches.

Here’s how sniping works with Banana Gun:

Buying can be made even more robust.

Bots often use MEV protection and even “anti-rug” protection that can be seen as a rudimentary form of risk management.

Here’s the relevant feature for Maestro bot:

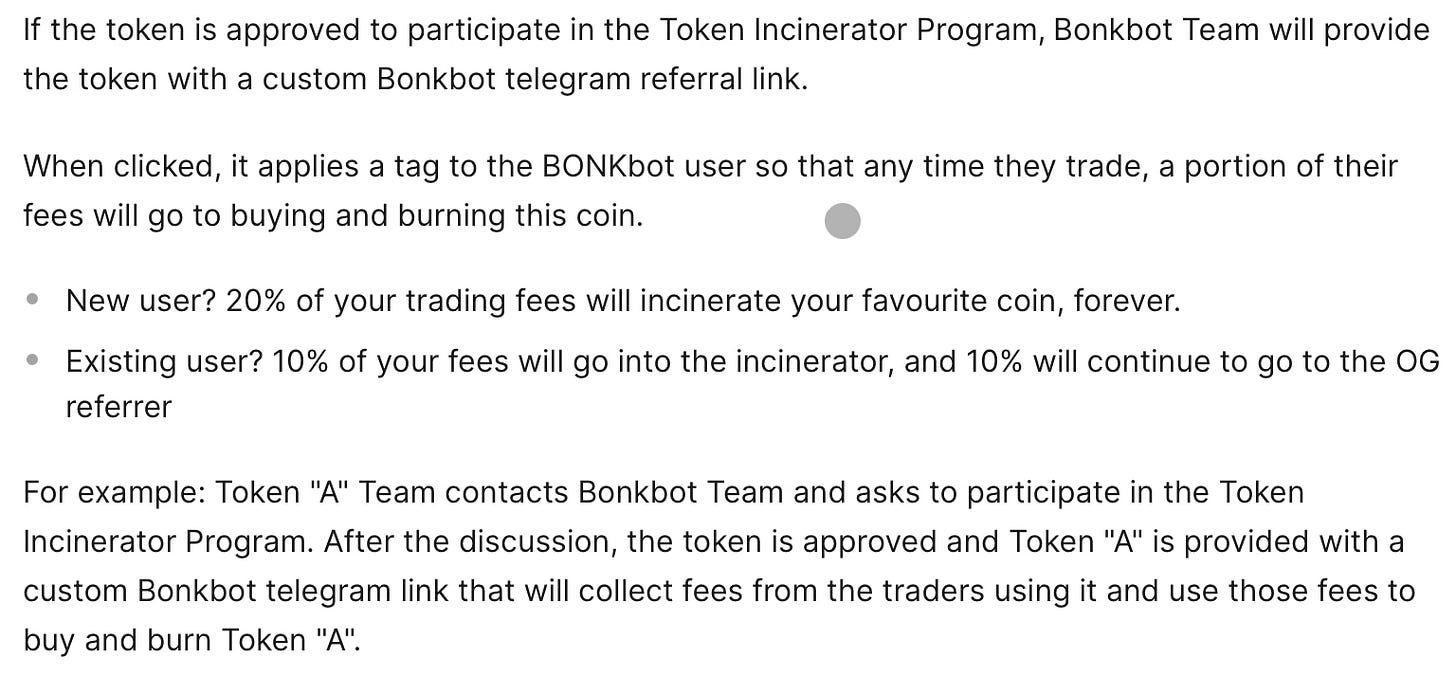

Without going too deep into the rabbit hole, my favourite feature was the incinerator feature by BonkBot which automates token burning (?).

This is at worst a misunderstanding of supply & demand game theory as it applies to the trader, and at best some collective form of (3, 3) games or market manipulation.

(Author’s note: I don’t understand it. Feel free to comment if you do.)

Not everyone will consider the trading theory behind these bots to be sound but one can agree that they do quite a bit on behalf of the users.

These bots can effectively manage multiple wallets and a whole array of automations across all these wallets for a single user.

Some of them can even frontrun other users and serve as MEV extracting in networks with observable mempools.

The alternative of building a MEV bot directly is a lot more involved.

Chasing Product Market Fit

Getting to Product Market Fit with a trading front-end that charges 1% per trade is no joke.

Indeed, bots use a variety of app-based distribution tactics to grow their respective user bases.

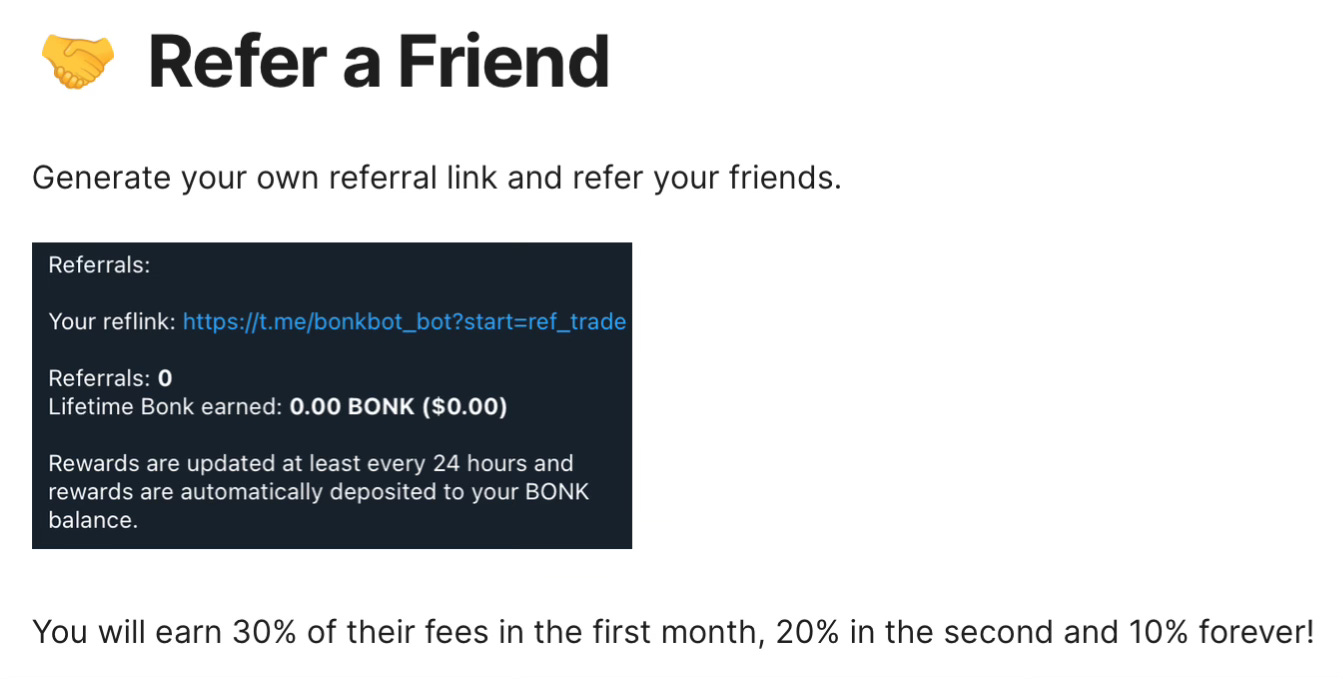

Referral programs

Referral logic is built into the bots. This is BonkBot’s referral program below.

Some bots partner with several DAOs as affiliates to drive referral demand and others like Trojan have pyramid-scheme like reward configurations:

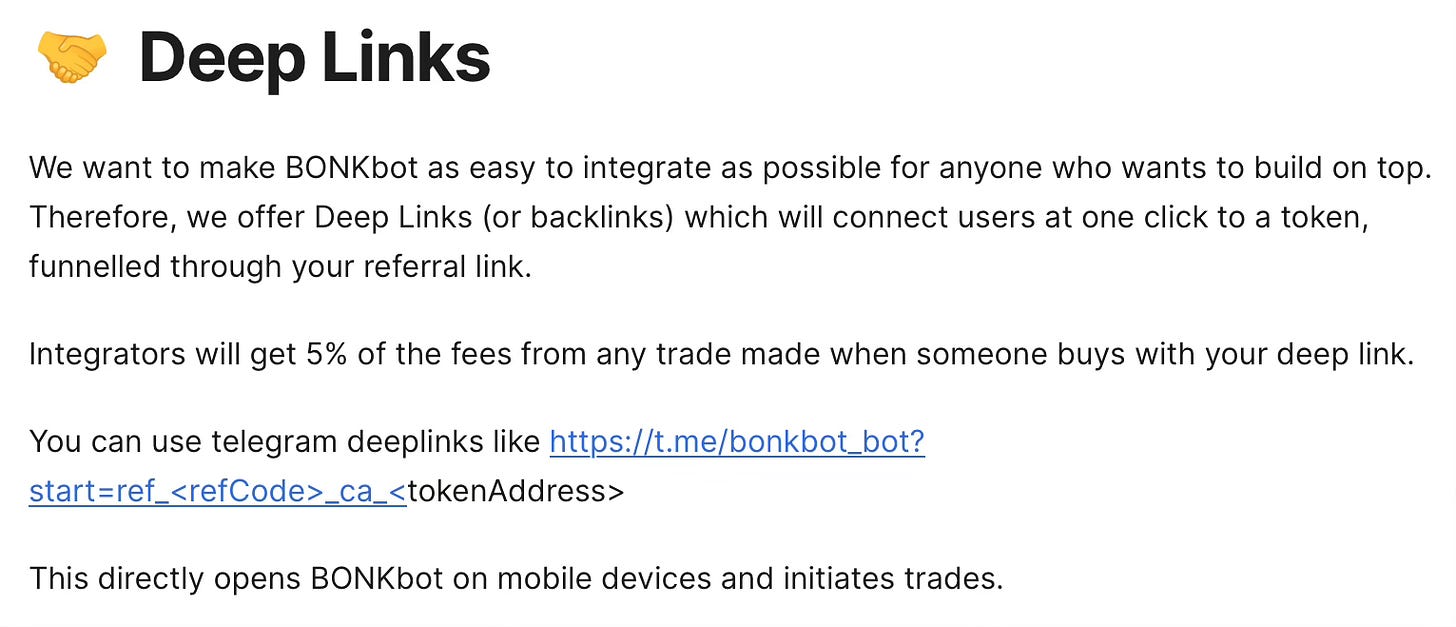

Deep links

Other websites can directly deep link and prepare specific actions:

Finding their network

While it’s clear Telegram bots have strong product market fit especially during waves of memecoin activity, they’ve yet to find how to turn these revenues into a form of lasting market power.

Many bots operate DAOs

Perhaps unsurprisingly that Telegram bots which support memecoin trading activity would be open to launching their own tokens.

Many indeed have a token and DAO in some form, but these feel more opportunistic and philosophical than synergistic with the bot itself in a way that makes sense in the long run.

Going mainstream?

Another interesting development is Banana Gun’s roadmap which predicts a robust web based front-end and even a native Apple app (not clear whether this will be a MacOS or iOS app).

This is a preview of how memecoin centric Telegram bots may eventually flourish into more serious ecosystems.

But as of right now, Telegram bots don't seem to have strong network effects that will help them succeed in this transition other than large (100k+) user bases.

That alone is pretty impressive, especially considering that these include crypto-native whales.