Lies, Damned Lies and The Memecoin Supercycle

Who needs organs when they can harvest your volatility.

Murad's Token2049 presentation about the coming Memecoin Supercycle exploded on CT:

Raoul Pal called it exceptional:

The core message of the presentation was simple:

In any given time period a large fraction of tokens that outperform BTC are memecoins. He used YTD for this statistic but I find hard to conclude anything from this other than the fact that memecoins inherently have more volatility and there are many more of them than “utility tokens”

Retail is exit liquidity for “tech tokens”.

Crypto is speculation-first, tech-second. Murad argues that the most successful crypto products are inherently tied to speculation.

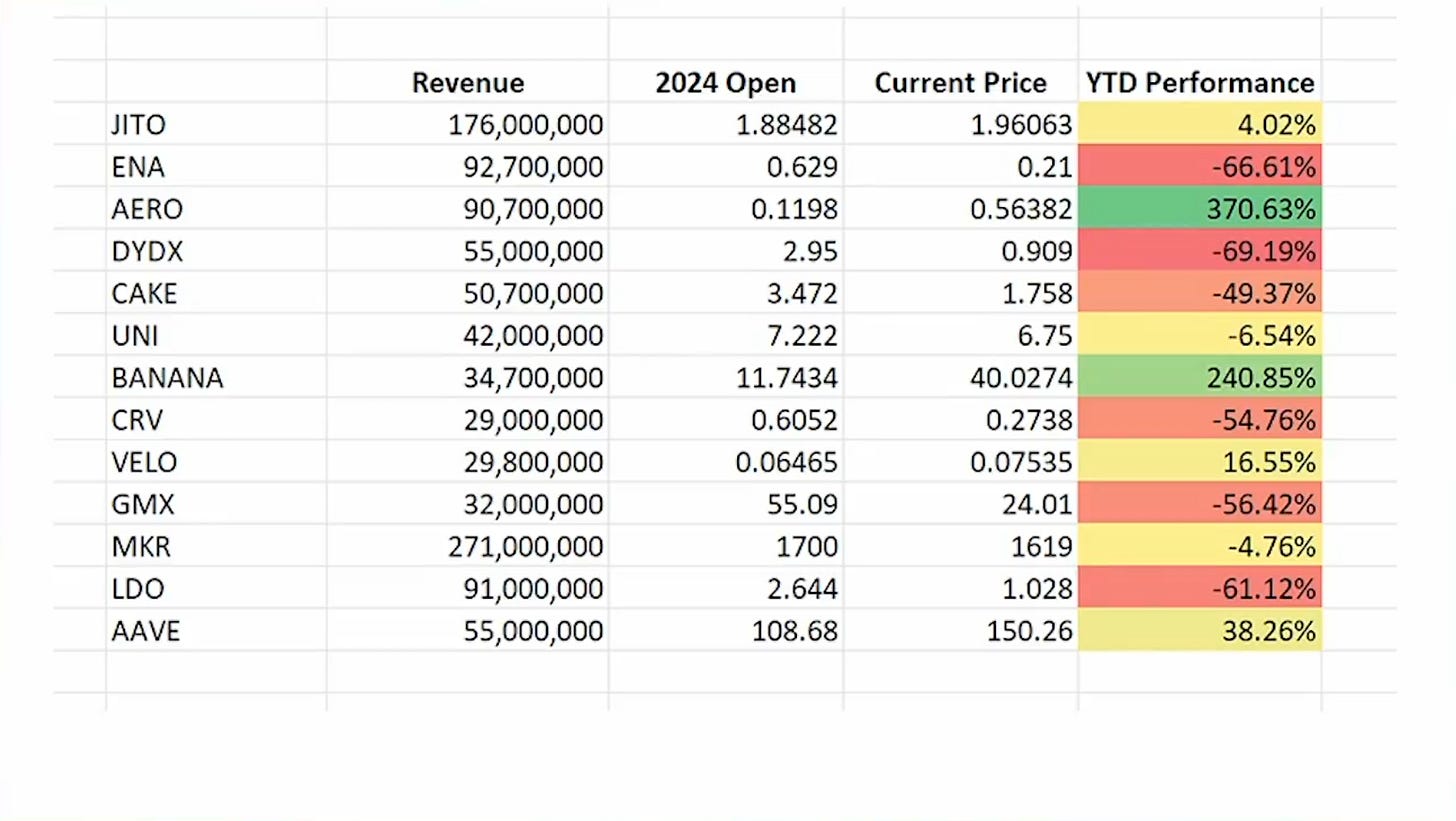

Crypto markets don't really value revenue. Murad points out that out of the revenue generating tokens the only ones with positive YTD performance are tokens benefiting significantly from memecoin adoption cycles.

Recent secular trends that favor memecoin growth. Pointing to memecoins acting as an online religion.

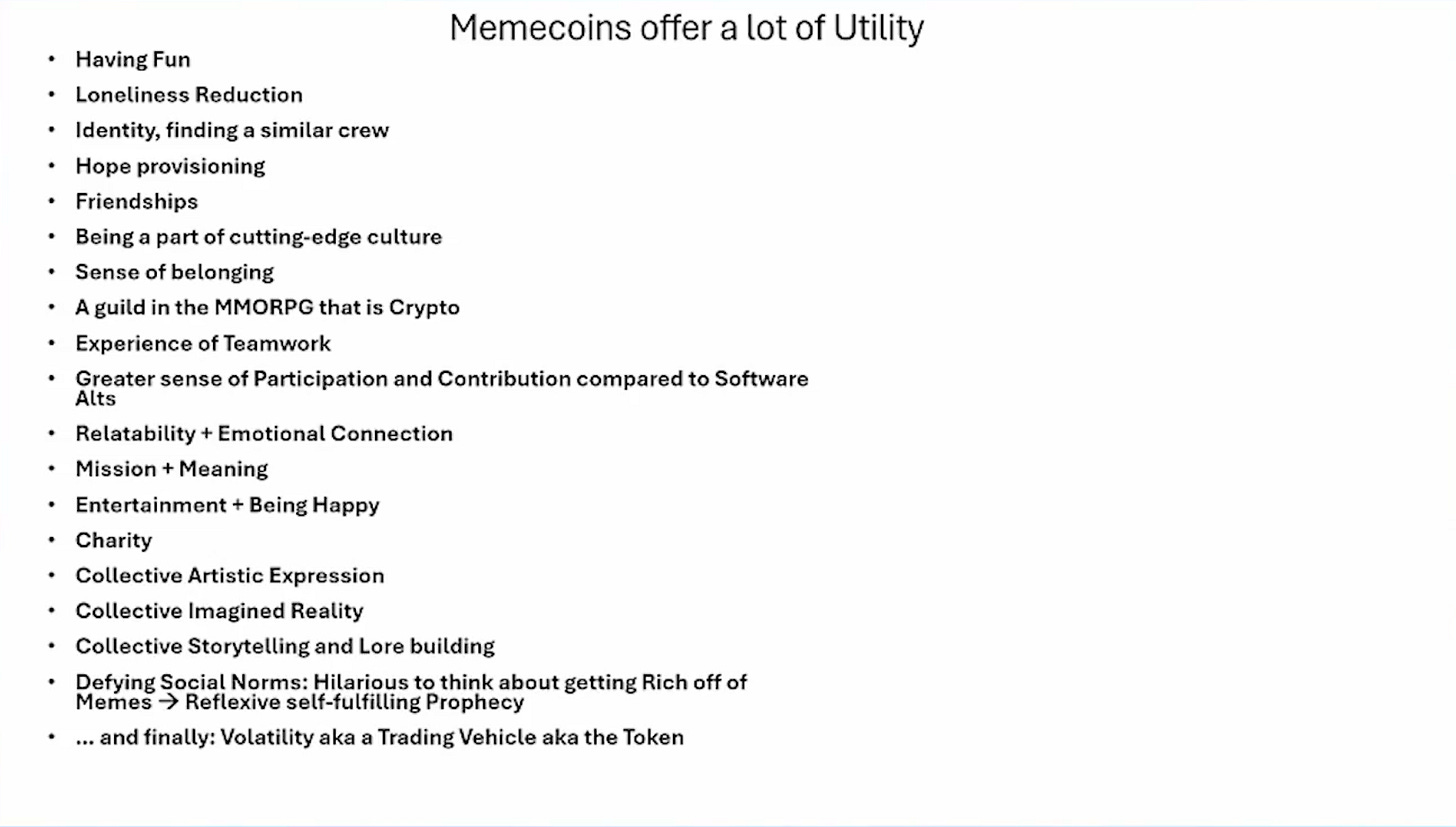

Memecoins do have utility, contrary to popular belief. This complements the idea that the token is the product, a different business model to consuming an organized micro-religion/cult-type service.

The more you buy it the more belonging, identity, fun, the more upside you get alongside it.

Memecoins are vessels collecting dissatisfaction.

There is significant upside in the growth of memecoin market due to new categories of buyers. E.g., blue chip VCs and TradFi institutions have traditionally held off on memecoin purchasing.

That’s it.

It’s worth saying upfront:

Messaging and conclusions aside this was one of the most carefully devised and thoughtfully articulated presentations in crypto.

It also covered a concept (memecoins and tokenized communities) that is both vastly relevant but difficult to understand, interpret and articulate.

And I agree with a lot of it:

People are burned out with tech/utility tokens who have failed to deliver returns;

Memecoin launches are fairer than tech/utility token launches;

We will likely see more (many more?) memecoin cycles;

Narrative pricing dominates value pricing in current tech/utility coins.

Here’s where I disagree.

Speed of getting rich = Speed of getting poor

Any cult that is built around “token go up” has reflexivity in both directions.

The more people lose money, the less belonging and positive reinforcement they will experience.

More doubt will seep in.

The more pressure they will have to sell out, accelerating the downward spiral.

Narrative-based pricing is not the end state

The crypto market is still in a bootstrapping phase.

Speculation and excitement is running ahead of market fundamentals for many tokens, but that does not imply that this is the end state.

Speculation dominates price discovery for several reasons:

There are few sources of predictable revenue. While there are many revenue-generating protocols, it’s not revenue that is usually valued in mature markets but predictable revenue. Crypto has very little of that. The conclusion that crypto markets don't value revenue is false.

In a speculative market development phase, future revenue potential and arbitrage pricing potential is more important than short-term revenue generation. It’s not that revenue-generating tokens are undervalued. It’s that they are recovering from a point of being overvalued and that their peer tokens are still overvalued due to 2024 narrative rotation.

You are the product, not the memecoins

Third and most importantly, there is an overarching tone and implied conclusion in the presentation suggesting that it’s time to seek out and bet on your favorite memecoin as if memecoins can't miss.

Murad’s X profile even says: “Stop Trading and Believe in Something”.

But his own favorite token?

$STFX, a tech/utility token.

Not a memecoin 🤔.

In fact what’s really happening here is volatility harvesting.

The video already touched on inflation and secular pressures of wealth generation and this is the perfect reference.

There are broadly 4 ways of making money:

Group 1. Make a little bit of money with a lot of risk, e.g., run a restaurant;

Group 2. Make a stable and limited amount of money, e.g., have a middle class job;

Group 3. Potentially make a lot of money with high amounts of risk, e.g., buy a memecoin. Secular effects are effectively pushing a lot of people from group 2 into group 3;

Group 4. Make significant risk-adjusted returns with limited risk, i.e., find a way to volatility harvest group 3.

There is no universal rags-to-riches guarantee for people who start trading memecoins.

The real trend here is that there is an unprecedented amount of people who are being squeezed out of group 2 into group 3.

These people traditionally could have held a stable and well-paying job and now have to find additional speculative sources of income to:

Keep up with inflation;

Maintain quality of life;

Be able to afford a house;

etc.

And who is telling Group 2 people to move into Group 3?

Well, naturally, it’s the people in Group 4.

These symbiotic relationships are everywhere:

VCs and their content marketing for venture-backed Founders;

Managers and athletes/musicians;

Franchises and franchisees;

Play-to-Earn games and the players;

Social media platforms, their “creator stories” and content creators;

Top-of pyramid and bottom-of pyramid in any cult including memecoins;

…Memecoin infrastructure builders (Murad) and memecoin buyers (you).

There may very well be a memecoin supercycle.

If it comes you almost certainly want to be on the supply side.

As 0xKyle wrote a couple of days ago: