Will Jito's BAM Recapture Institutional Interest from Ethereum?

Solana's programmable transaction sequencer is here.

So it’s mid-2025 and we are talking about Ethereum adoption and Solana tech?

Indeed, Jito’s Block Assembly Marketplace (BAM) is pretty interesting. So we have to dust off the Solana topic and talk about it again.

Given that a majority of Auditless readers are more familiar with Ethereum, this post starts with a recap of Solana’s MEV landscape. Feel free to skip ahead to “How BAM works” in case you know it already.

THE “BIGGEST CHANGE IN SOLANA HISTORY”

I’ll take mert’s word for it. It is somewhat illustrative that the “biggest change to Solana yet” isn't even a real network upgrade unless you believe JitoDAO is a proto-governance layer due to Jito's market leadership.

$SOL AT $200

The market certainly agreed and $SOL dipped into ATH territory. What’s attractive about BAM is that it both addresses transparency in the existing MEV stack while making transaction sequencing programmable, potentially creating new streams of value. So lets unpack whether BAM could have this kind of impact on the network.

HOW SOLANA’S MEV WORKS TODAY

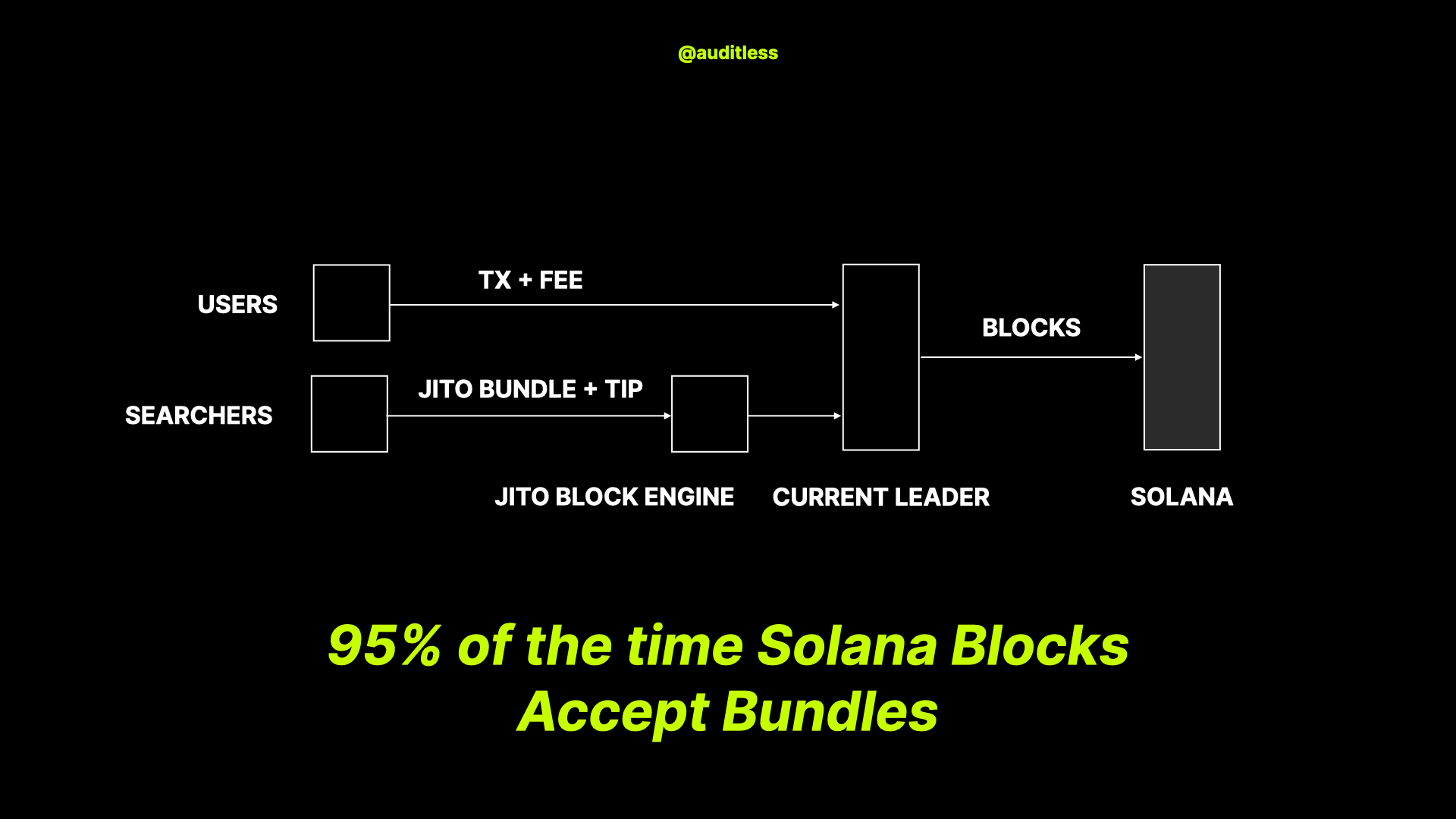

Lets recap Solana's transaction flow today:

Validators rotate every 4 slots or every 1.6 seconds (4 x 400ms per slot). The active validator receives transactions from users directly with a priority fee. Using “Gulf Stream”, transactions can be intelligently forwarded to the upcoming leader. There is no public mempool whatsoever.

95% of validators also run the Jito client and can accept bundles from searchers.

The bundles get submitted to the BlockEngine service, which picks the winning bundles to broadcast to the current leader.

Finally, transactions and bundles are combined to form blocks.

This leads to a few issues…

SOLANA’S MEV CHALLENGES

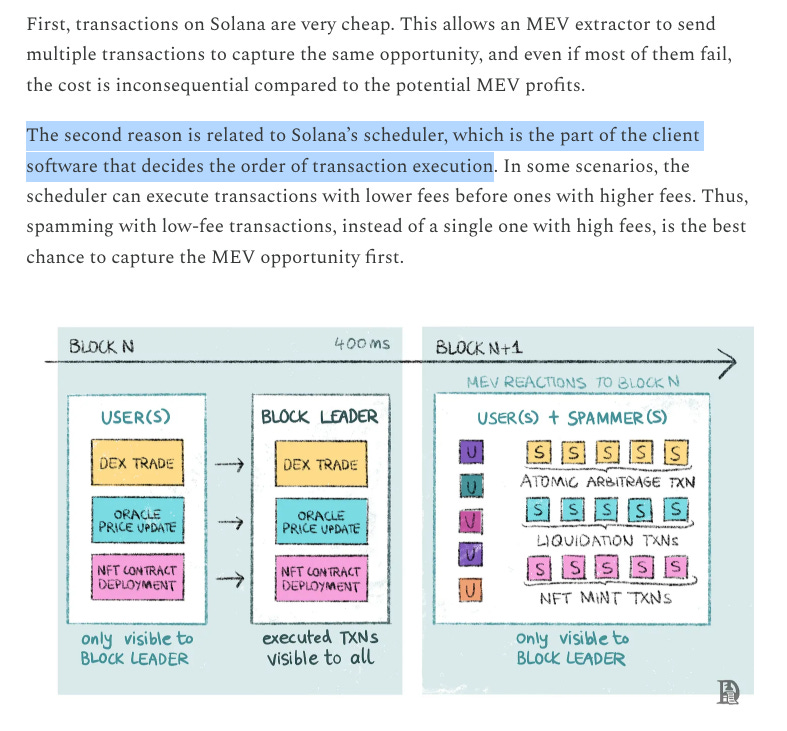

First of all, Solana still sees more transaction spam than Ethereum due to lower fees and because of scheduler rules (see above).

Second, block leaders see transactions first and have a unfair advantage at exploiting MEV opportunities.

Finally, applications have a lack of control and transparency. Because they can't observe the public mempool, they can't reliably reason about or dictate how their transactions should be ordered.

There are also potential risks related to centralization but I think it hasn't inherently led to any problems at this stage and clearly Jito itself are being proactive about further decentralizing the transaction value chain.

HOW BAM WORKS

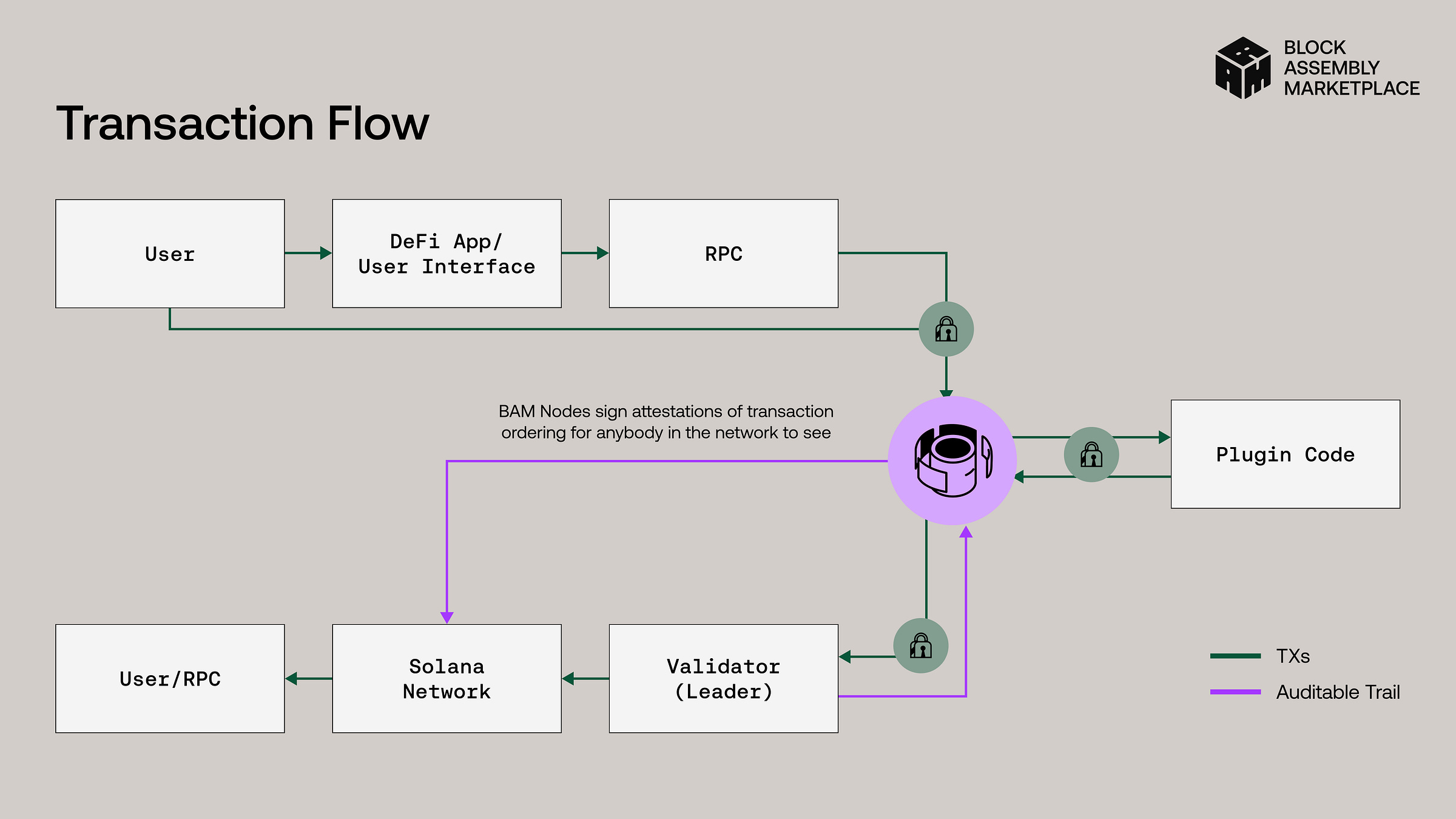

BAM introduces a new type of nodes (BAM nodes) which use TEE to sequence transactions in a deterministic way.

Submission: Users — whether traders, market makers, or applications — send transactions to the BAM Node.

Sequencing and Attestation: A BAM Node receives, filters and orders incoming transactions inside its secure, encrypted enclave and sends them to the Leader. As part of the ordering process, it may add a transaction via a Plugin (for instance, an oracle update that will guarantee optimal execution for a user). Finally, the BAM Node signs and saves a cryptographic attestation with the sequence of transactions sent to the Leader.

Execution: The current Leader receives the transactions from the BAM Node and executes them as instructed, providing an attestation to the BAM Node of correct execution.

Public Audit Trail: All attestations created by the BAM Nodes and validators are publicly available, creating an audit trail that anyone can use to confirm the Leader followed the prescribed ordering instructions.

The benefits are clear:

More transparency. If every transaction included by validators comes from BAM Nodes, then attestations exist to show that all transactions were ordered deterministically.

Only Plugins can add transactions and they can do so in pre-determined ways.

Application developers can build Plugins to customize transaction sequencing for their applications powering uses cases such as just-in-time oracles (an improvement over Pull oracles like Pyth), order cancellations / modifications (a common feature of trad-fi order books), blockspace futures, fee-less transactions and more.

The Plugin ecosystem even has the potential of creating a new value layer on top of MEV extraction.

Of course, BAM isn't particularly novel. It’s more of a repackaging of the Flashbots stack like SUAVE and Mev-share to decentralize transaction ordering.

The more important question is how it changes the competitive landscape?

IS BAM WHAT SOLANA NEEDED?

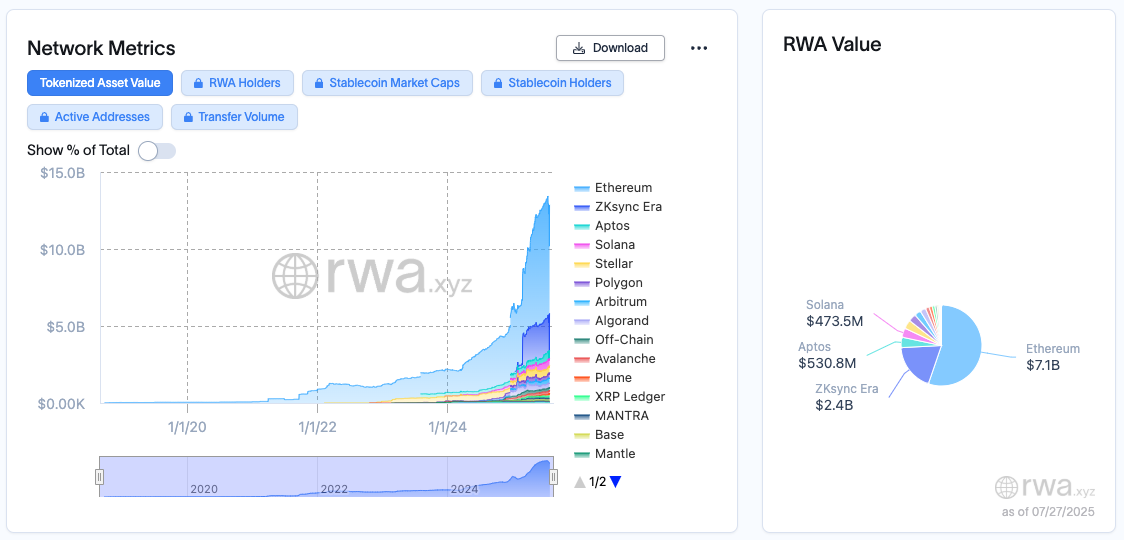

If you believe that the dominant arc of adoption is now Real World Assets as opposed to memecoins or content coins (and you should), then you have to ask what was missing?

Despite recent growth, Solana is still lagging behind Ethereum.

This could be due to a number of things. Pick your favorite: FTX fallout, ETHs potential commodity status, early bank pilots on Ethereum, lack of tokenized compliance options on Solana, lack of embracing rollups, network downtime or something more exotic (e.g., developer tooling, although I doubt it).

Now how many of those underlying reasons will improve with BAM?

The silver lining could be the apps that BAM enables. We could see more sophisticated perps venues that can take advantage of the Plugin system to build more efficient market. The counter-point is that it’s not like Hyperliquid is really affected by mainnet’s limitations anyways.

It is interesting that as Ethereum finds ways to achieve more performance while maintaining its key tenets, Solana is becoming more decentralized and trustless while maintaining performance. Instead of occupying different computational niches, Ethereum and Solana are converging to their unique expressions of a very similar underlying architecture.