Who’s Footing the Gas Bill?

The rise of gasless transactions, Sequencer Fee Sharing and broader implications if it all works.

The “web2” perspective of who should pay for gas is really simple.

Web2→web3 converts use a mix of Dominance Frontier and argument by analogy to predict that transactions will become gasless.

The argument goes like this:

A user wants to click on a button and see an action happen –

They don't want to be signing a transaction and paying gas.

That would be the equivalent of footing an applications's AWS bill.

We now have the technology (smart wallets & paymaster) to fix this so we will.

Unfortunately while gasless transactions will be impactful in many categories, arguing by analogy doesn't make blockchains gasless.

Apps on blockchains are co-tenants on the platform so even base fees are influenced by congestion.

(This is technically also true for AWS but AWS is horizontally scalable with positive economies of scale and no fixed validator set).

Moreover there’s always demand for priority that it wouldn't make sense for apps to pay for.

A different group that uses the dominance frontier idea argues that rollup profits will get eroded away as they get shared with app developers to support sequencer fee sharing.

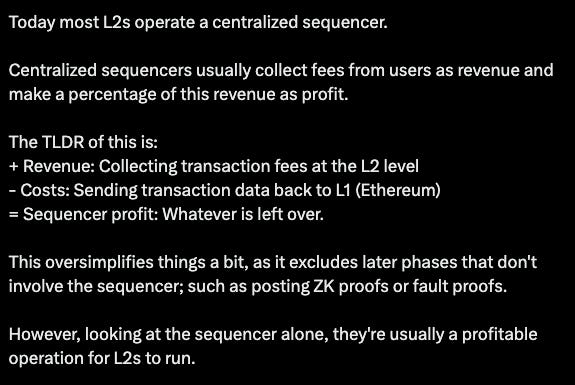

Jarrod Watts did an excellent post on this. Here are the important highlights:

This frames the broader debate: who should be getting the gas that users pay?

Should the users get most of the gas back, with developers subsidizing even L2 settlement fee?

Or should users pay for everything and rollups should keep all the profits?

Or should apps claim at least the profits (including priority fees) with rollups only getting a minimal profit that is required to sustain the network?

In reality, there will be tradeoffs between competition/sustainability across both the user-app axis (settlement + base fees) and the app-rollup axis (priority fees).

Sequencer Fee Sharing is not a slam dunk

The first critique of Sequencer Fee Sharing that devs will hesitate to optimise their apps in a bid to maximize sequencer profit.

While I think this could be relevant for apps that don’t charge a protocol fee but still have significant demand – for most DeFi apps where gas is a concern, inefficient contracts for the sake of inefficiency will get outcompeted away.

The real issue is that there is no evidence that SFS is an optimal means of reallocating sequencer fees.

Mode is doing SFS but the chain has been much more successful at generating TVL than volumes (read: volumes actually contribute to sequencer fees).

Notice that the total DEX TVL and volume is tiny.

For Blast, it’s harder to attribute the impact of SFS given the Blast Points and Gold programs which dwarfed SFS in terms of amount.

But their volume retention has suffered a similar way.

Arbitrum and Base remain the leading chains for DeFi and they haven’t had to directly share sequencer fees with their apps yet.

Most rollups already share a lot of value with developers just in ways that offer them much more flexibility.

OP commits 100% of sequencer profits to RPGF.

Base invests a large amount in ecosystem grants.

Arbitrum runs large incentive campaigns in partnership with protocols.

Sequencer fee redistribution is just one very libertarian model and it’s not necessarily always the most growth-optimized.

Instead, apps may reclaim their own MEV

A slightly stronger argument for inevitability could be a trend of MEV internalization, for example Paradigm’s MEV internalization idea.

Products like FastLane Atlas allow apps to run their own auctions internalizing at least MEV related to in-app transaction ordering.

I expect the most important apps (especially protocols supporting asset trading) will consider internalizing their priority fees.

Paymaster will be used for many consumer-facing apps

While I started this article by highlighting the nuances of gasless transactions, I still expect that certain categories of crypto apps like social networks default to subsidizing user transaction costs with smart wallets and gasless transactions entirely.

The option is there and will make sense in certain cases (but not in others).

The broader conclusion is that I would expect there to be a bifurcation of applications with DeFi applications that create a lot of MEV splitting user priority fees between apps/rollups depending on their bargaining power and consumer apps that use blockspace as a commodity potentially fronting the gas for users.

Blockspace is starting to adapt to this reality too with Worldcoin exploring guaranteed priority for “humans” in World Chain.

This may even lead to different chains specializing to serve different types of apps and gas distributions.