The Alpen Bitcoin Rollup and the Challenges of Research Driven Crypto Companies

Is Bitcoin becoming more research-oriented than Ethereum?

Check Part 3 of this series on Starknet becoming a Bitcoin L2.

As crypto X continues to “fix Ethereum” (or attempt to), the newest topic is Ethereum Foundation's focus on research?

Here’s a fun tweet for more reasons I have space to cover:

Coincidentally, I've also been reading about Alpen, a Bitcoin rollup built by a research focused team.

My central observation has been on the declining strategic value of research in crypto.

But before we tackle repricing PDFs, lets introduce Alpen.

(If you haven't seen our previous post on Citrea, you’ll want to read it as the two architectures have significant overlap explained in the Citrea post.)

ALPEN, A BITVM2 ROLLUP WITH MODS

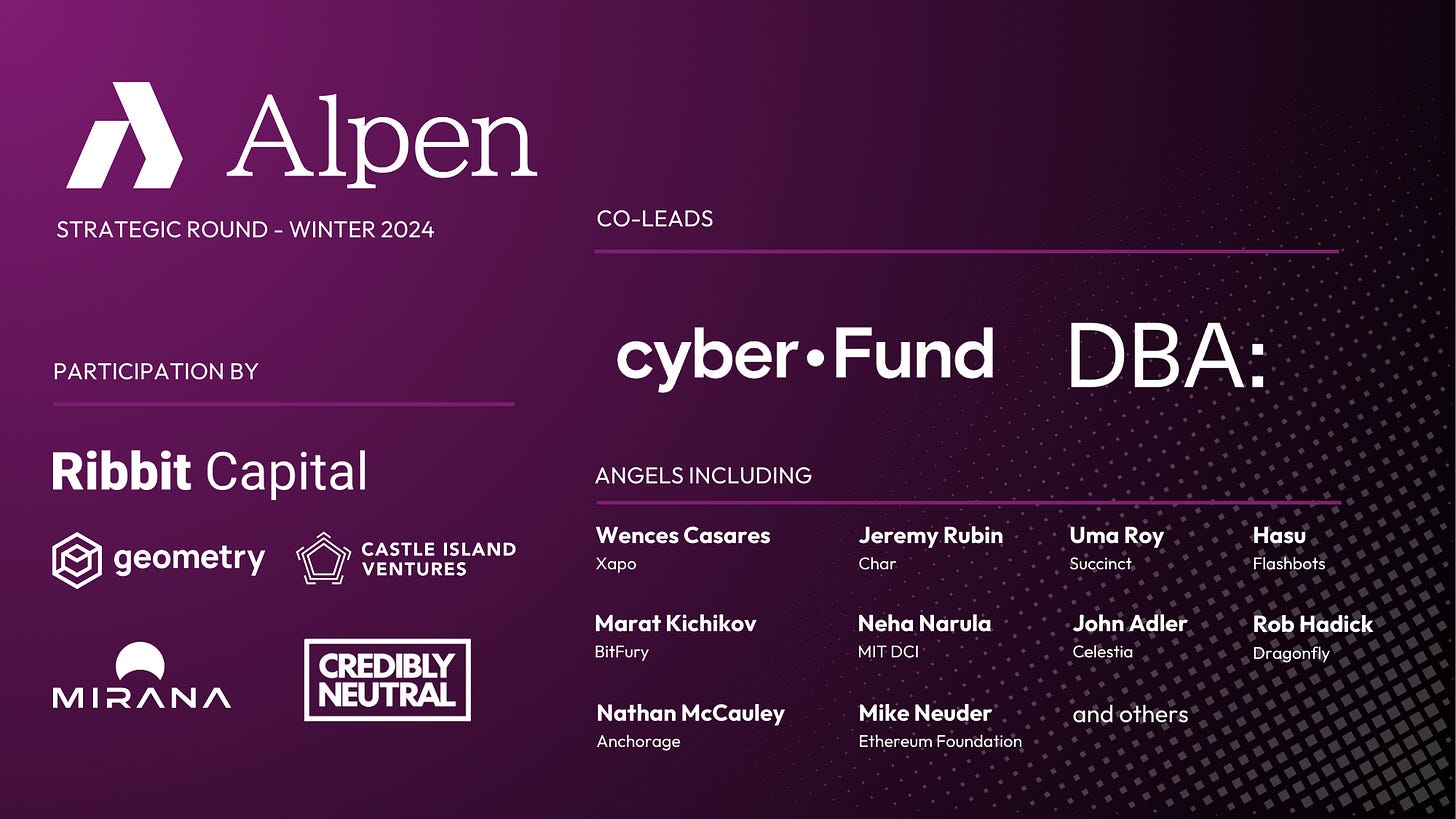

Alpen is ostensibly one of the more “serious” Bitcoin rollup teams with strong researchers and some of the highest IQ backers.

Alpen’s plan is simple:

+ Build the most trust-minimized Bitcoin rollup possible with today’s technology

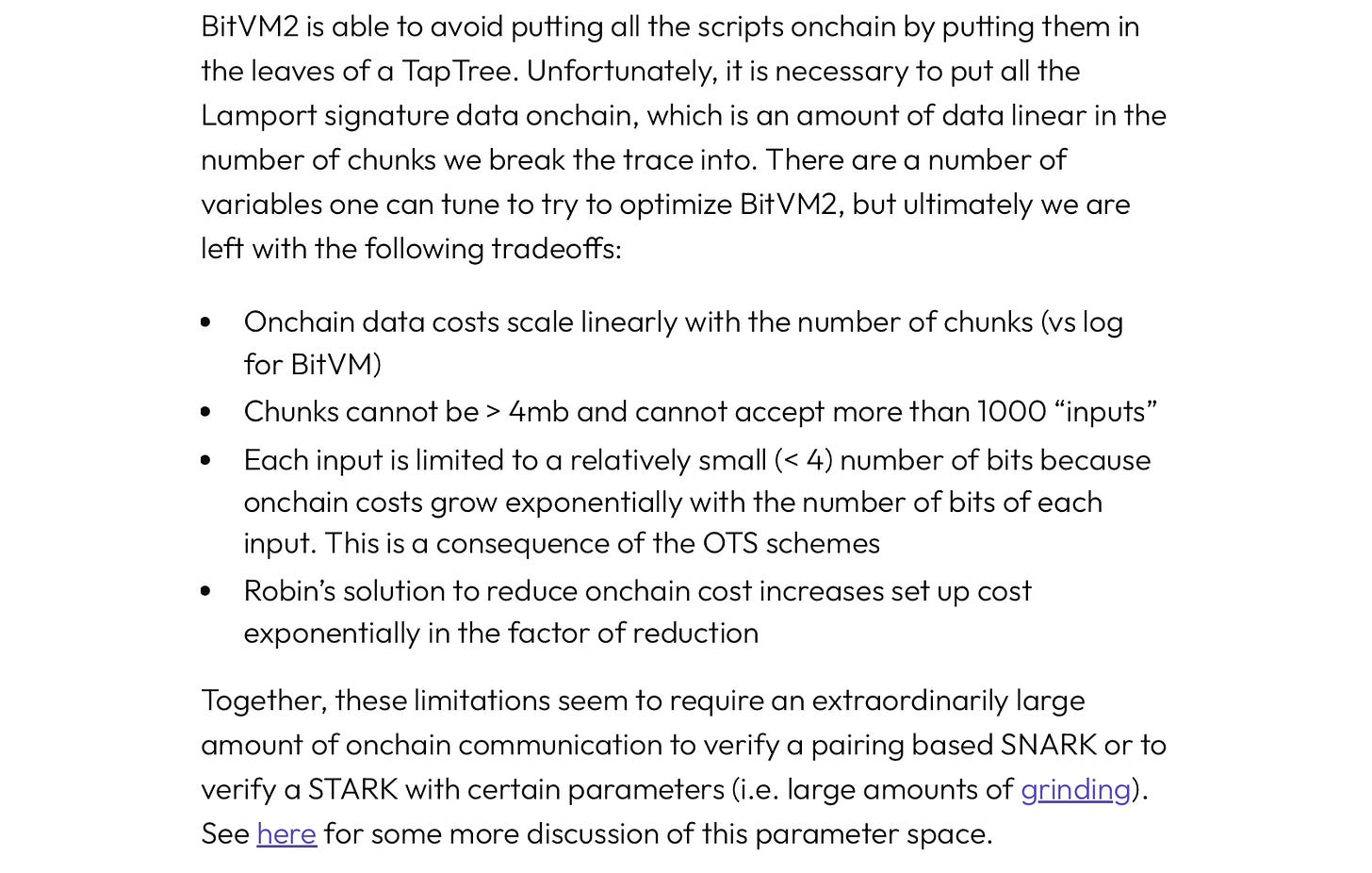

+ Optimize BitVM2 and use it to build an optimistic ZK rollup (like Citrea)

+ Be fully EVM compatible through reth

+ Launch

+ Curate the right curve BTC DeFi stack (payments, BTC-collateralized lending/synths, trading, etc.)

They are also exploring several enhancements like 250 ms pre-confirmations (nothing new in Ethereum-land).

BITCOIN ROLLUP TIME HORIZONS

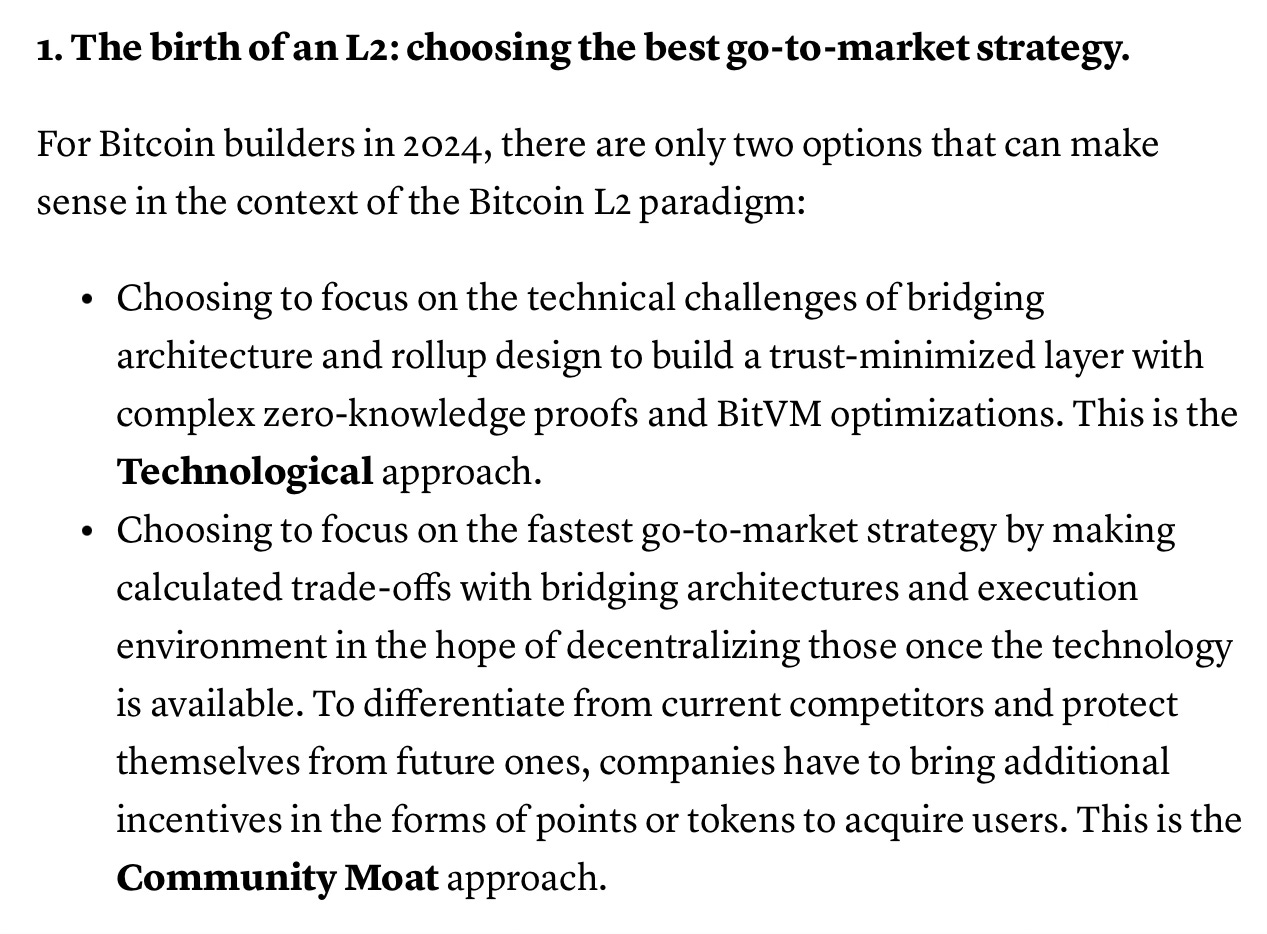

As a recap, every L2 on Bitcoin falls into one of three strategies depending on how quickly they want to (can) launch.

The best analogy here is Magic: the Gathering deck speeds.

Magic has “aggro” decks that attempt to win the game as fast as possible before opposing synergies can kick in.

On the opposite spectrum are “control” decks which seek to control & slow down the game because their victory in a long game is inevitable.

Finally, “midrange” decks fall in the middle, playing a control game against aggro decks and an aggro game against control decks.

The aggro equivalent is sidechains and all other more accessible non-rollup paths to scaling Bitcoin.

The control equivalent are teams like StarkWare that can leverage soft-works to build high powered rollups.

Citrea and Alpen fall into “midrange” strategies. They are still trying to build rollups but have a focus on launching as soon as possible based on the already viable BitVM path.

The risk of this path is that the Bitcoin community may not get excited about rollups with weaker trust assumptions than Ethereum rollups.

But at the minimum, these more pragmatic BitVM-based rollups play an important political role:

+ They validate the demand for a rollup-friendly soft fork

+ They allow application developers to put pressure on fees (50x over 2 years was thrown out in The Rollup’s podcast with David Seroy of Alpen).

THE MIDRANGE CHALLENGE

While side chains and other non-rollups can simply play the GTM game and Starknet can focus on viability, leaning on its existing tech and app ecosystem, Alpen has to succeed both in GTM and be sufficiently differentiated.

Related discussion of moat options in the Bitcoin rollup space from Utxoxo:

This has proven challenging so far as despite contributing to several challenging BitVM advancements, Alpen hasn't established a clear public narrative.

And the point here isn't to downplay the importance of improving BitVM. The shortcomings are there:

It’s just that neither Bitcoin whales or Etherem BTCfi enjoyooors have a mental model to think about the merits of UTXO optimization, improving operator controls or shortening challenge windows.

In crypto, narrative pivots are better tolerated than narrative absence.

“RESEARCH” IS NOT A NARRATIVE

It certainly has been in the past.

Many VCs in 2017 proudly proclaimed to be reading a whitepaper per day.

Research-driven teams always got more attention.

But the times where research-driven have been successful is when they leverage that research to serve existing demand.

Ethena has some impressive simulations and charts on their page but most people haven't even seen them, they saw 30% APY.

While EigenLayer did invent restaking, their TVL arose from points distribution and AVS development has lagged.

This is a healthy correction as most industries already went through this transition.

Remember when Sam Altman was giving talks about how hard tech is easy, every VC pivoted to doing biotech x AI and every exited Founder wanted to build a rocket company?

Crypto somehow managed to piggyback on that and had 5 good years where it could meme as a hard/deep tech industry.

But it isn't.

So what should the narrative be?

WHERE PRAGMATISM WINS

There is a real benefit to being able to understand state of the art research and build on it, however.

The benefit of moving fast and leveraging other open source tools and ideas is that it's quicker to get to a working stack and respond to emerging developments is real.

In that sense, a more responsive strategy is reminiscent of Polygon's approach in Ethereum.

If the Alpen team is confident in their ability to maintain a bleeding edge stack but don't want to handle app GTM, it may have the potential to evolve into the “Bitcoin Superchain”.

As Bitcoin rollups gain traction and impact fee markets, there’s likely room for an EVM-compatible alternative to the OP Stack.

Rollups are enforceably stickier “customers” than apps and Ethereum suggests a significant first-mover advantage.

Every crypto company, no matter how technical, has to find where it can compete in distribution.

Research is a powerful weapon but it has to ultimately be used to attract capital, engagement or users.