L2 Issuance Was Fun While It Lasted

The emerging liquidity fragmentation crisis on Ethereum.

Thanks to Tarun Chitra for sparking the idea for this essay.

Vitalik's Valentine’s Day gift to the Ethereum community – Reasons to have higher L1 gas limits even in an L2-heavy Ethereum – was an almost offensively rational take on the emerging debate of whether to scale L1.

If you’re not caught up, this is the crux of the debate spurred by various factors:

The search for Ethereum’s “North Star”,

Addressing Solana’s dominant growth,

The unwillingness to commit to a rollup-centric future.

We covered it in December:

What caught most people’s attention was the critique on issuing tokens on L2s:

ROLLUPS ARE CURRENT ACCOUNTS, REMEMBER?

We've talked previously about this idea. The money that really matters is the cash you deposit (i.e., L1-issued tokens). FDIC insurance applies to funds in your current account and in the same way rollups support forced withdrawals of directly L1→L2 bridged tokens. Everything else you do in the rollup has weaker security guarantees.

Each rollup has a smart contract on L1 that keeps track of state and releases bridged capital. If you have the upgrade keys you can effectively change the proof system and how state works on the rollup which includes as Vitalik points out, minting unlimited amounts of L2 tokens.

This applies not just to L2 memecoins but also Cross-chain bridged assets like Layer0 OFTs and Native Real World Assets (e.g., L2-native versions of fiat-backed stablecoins).

The other axis risk of L2 issuance risk is the ability for the L2 to “exit” Ethereum.

ISSUANCE IS KING

To challenge the validity of L2 issuance isn't a trivial concern.

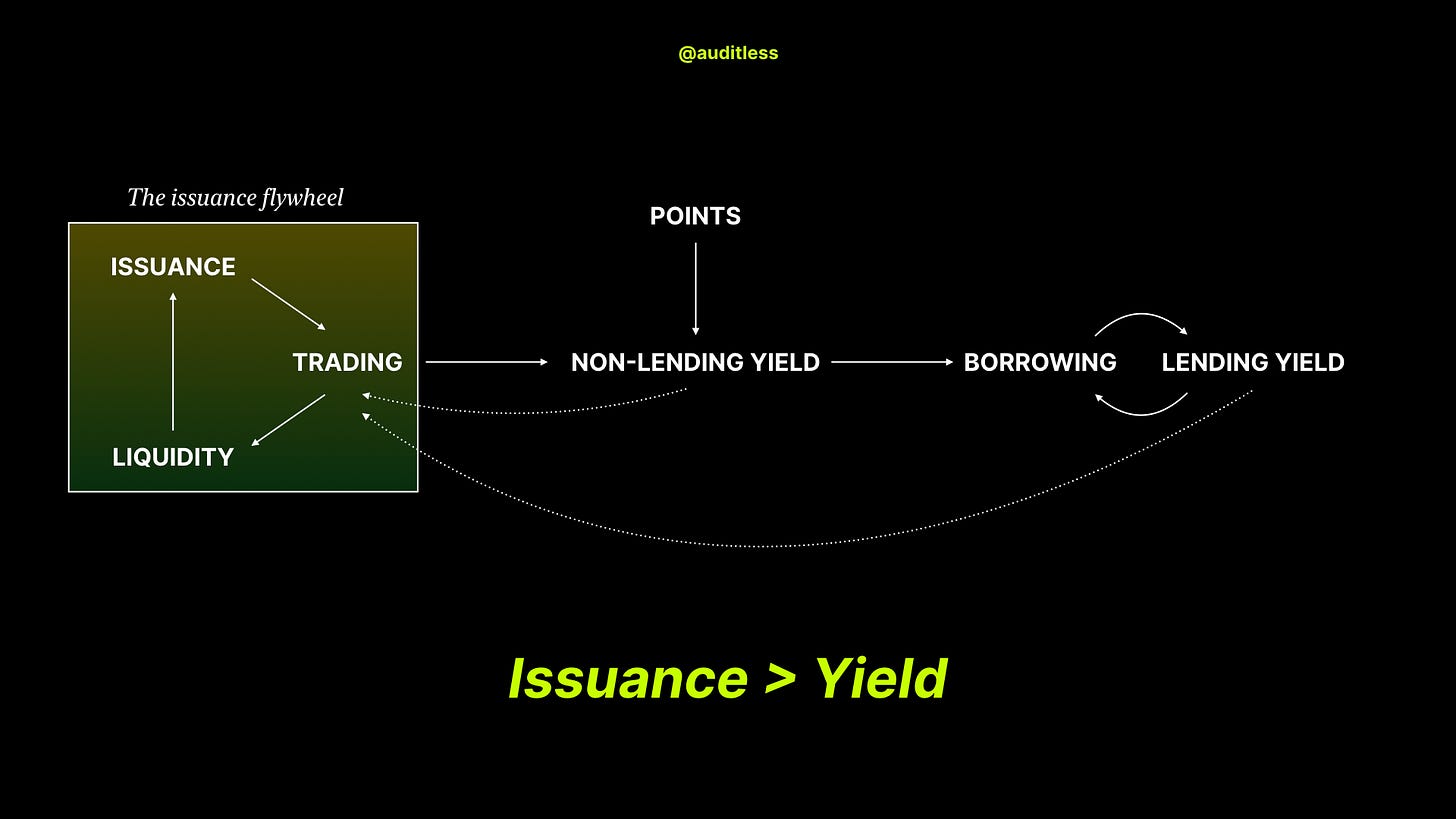

The emerging consensus is that despite Ethereum having excellent points programs, lending markets and incentives, it can't compete with Solana’s pure organic issuance flywheel.

Issuance attracts traders, which make LPing profitable and attract liquidity. Then people issue where the liquidity is. And so on.

Even Base which had a good issuance run in 2024 and at the start of the AI agents meta has not been able to keep up.

ETHEREUM NEEDS L2 ISSUANCE TODAY

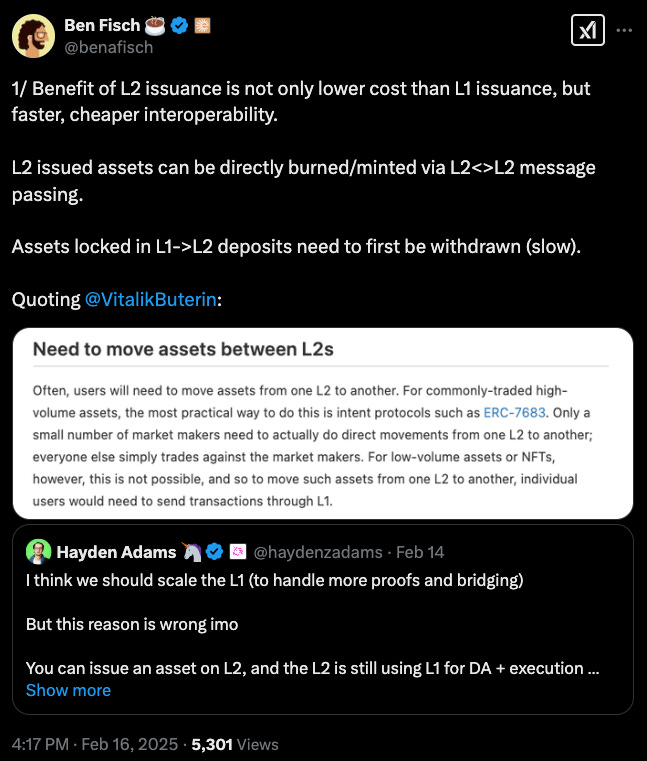

Unfortunately, as Vitalik points out, having all tokens on L1 is not currently viable for various reasons.

L2-to-L2 interop

Direct issuance cost

MAKING L2 ISSUANCE WORK

L2 issuance precompile

Dedicated precompiles is an interesting idea, modifying the L1 to support L2 issuance.

Cluster tokens

Rollup clusters (Superchain) or shared liquidity bridges (AggLayer) could assign promotion rules to cluster-native tokens.

Using these, an L1 ERC20 contract could be created for them as another form of exit mechanism with some carefully calculated bounds on supply (e.g., multiple chains have to agree).

ZK

Since ZK solves everything, it’s possible that validity rollups have better gadgets to address these problems in the future. Perhaps through some form of supply invariants or enshrined proof verification.

LIQUIDITY FRAGMENTATION CRISIS

Time to reassess: how important is issuance for rollups?

For example, if rollups don't control the asset directly but are the liquidity hub for it (most liquid trading venue), is that a similar level of market power as having direct asset issuance on Solana?

This question is not just philosophical, another way of looking at Vitalik’s proposal is whether it would contribute to a liquidity fragmentation issue?

Which token are you supposed to use on a rollup?

The L1→L2 bridged version?

The cross-chain bridged version (e.g., OFT)?

The protocol’s natively issued L2 version?

OR the most liquid of them all at a given point in time?

These choices doesn't even include the choice of the rollup itself.

Solana not having this issue has got to be nice.