Crypto Capital Flows in December

December looks a lot like the rest of 2025 with some surprises.

In addition to project metrics, DeFiLlama also publishes public raise announcements. While the data is far from perfect, it presents a useful proxy on what areas both retail and institutional investors are allocating capital to.

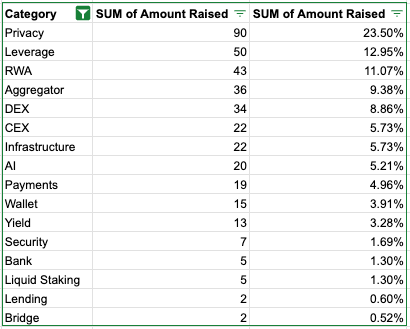

I went through and labeled all the raises from the first half of December, here’s what that amounts to (amounts in $M).

I've taken the liberty of breaking these into subjective categories but there's plenty of overlap. What do you call a company that aggregates RWA perps? I've called them an aggregator by focusing perps/RWA categories for direct issuers but many alternative categorizations exist.

These raises include both VC rounds, token sales and pre-sales. They are also often dated on the day of the announcement, not on the day of the raise itself. VC fundraising in particular often gets tactically delayed.

PRIVACY + LEVERAGE + RWAS LEAD

The “hot” trends of the year are well represented at 45% of capital raised and followed by a trio of “evergreen” categories like aggregators, DEXes and CEXes.

Worth noting that these aren't blue ocean areas. Privacy is arguably the most technically complex area in crypto and one that hasn't had its breakout use case yet. You are also competing against companies like Aztec that have been in the market for a long time and have the best technical talent in crypto.

There is more to build in RWAs especially for non-crypto entrants but you need to slog through regulatory questions. RWA is more fintech than crypto.

And then there are perps (or other leverage tools, but mainly perps). On the surface this is the most accessible area for Founders to build in: you need protocol, good oracles and great UX. Worst case you may get challenged on an algorithm that you don't even need to open source. On the flip side you have to compete with Hyperliquid and unless you are doing something net new like Pendle Boros, it's going to be difficult.

AI AND DATA

Only 5% of capital going to AI companies was surprising and the most exciting companies in this cohort are data companies like Surf, a version of Perplexity that isn't bad at crypto searches which recently raised $15M.

The decentralized model space retains its challenges (hard to beat commercial models and right now that’s what the customer wants). The agentic economy is another rising narrative but it’s led by a set of interoperable standards rather than breakout companies, so we’ll have to see what it amounts to. Thank God agentic launchpads have cooled off and overall it’s nice to see crypto exerting more caution about AI than the wider market (I believe rightfully so).

THE REST

Out of the other categories, Payments is one I'd expect to keep growing and see real adoption. I'm not too optimistic by the competitive CEX/DEX/Wallet products I saw as existing players have strong moats and actually raising their fees (Coinbase, Uniswap, etc.) which only happens from a position of strength.

The saddest thing perhaps is that I didn't have to include an “Other” or “Rogue” category to cover new types of products or innovations. SpaceComputer is a cool idea to build a compute cluster in space but it unfortunately nearly escaped the December list with the funding announcement in November 26.

There’s a lot of opportunity for new Founders to push the industry forward but I'm not excited by these partiular areas. There’s so much opportunity in crypto services, crypto-distributed network states and futarchy infrastructure and doesn't seem like investors have enough meaningful options to support these areas right now.

P.S. I tried this new format since there wasn’t an obvious project I wanted to cover. Did you find this analysis interesting? Is it something we should revisit in the future? Or would you rather see me pick and cover one of these projects?