Why Pendle's Boros will be Bigger than V2

Derivatives markets continue to broaden.

Pendle recently announced Boros, a new derivatives market that is focused on tokenizing funding rates and other yields without a receipt token.

(A more comprehensive explanation of Boros can be found in the Edge podcast YIELD TALKS: First Look at Boros, Pendle's New Margin Trading for Yields.)

This was a positive surprise to the Pendle community which expected a third protocol version with more marginal improvements.

What is Boros

Pendle is a protocol for tokenizing yield.

The existing V2 protocol works as a physical option.

Each position holds a yield-bearing receipt token and turns it into:

a PT (Principal Token) that tracks the principal of the position,

and YT (Yield Token) that just accumulates yield until expiry.

With Boros, Pendle seeks to tokenize other types of yield such as funding rates which don't have “physical” receipt tokens.

This was positively received by the community which expected an incremental version upgrade to Pendle V3.

This has contributed to a further decoupling of the Pendle price from shrinking V2 TVL:

Back to receipt tokens…

To create synths from yield that does not have a receipt token, Pendle have to instead mint these assets through margin accounts.

This would be a perfect application of Synthetix V3 but Pendle may not use Synthetix at all for strategic reasons.

As we wrote in May, it’s not exactly that Synthetix is counting on wide platform adoption anyways, they’ll likely compete with Boros head on as a vertically integrated exchange.

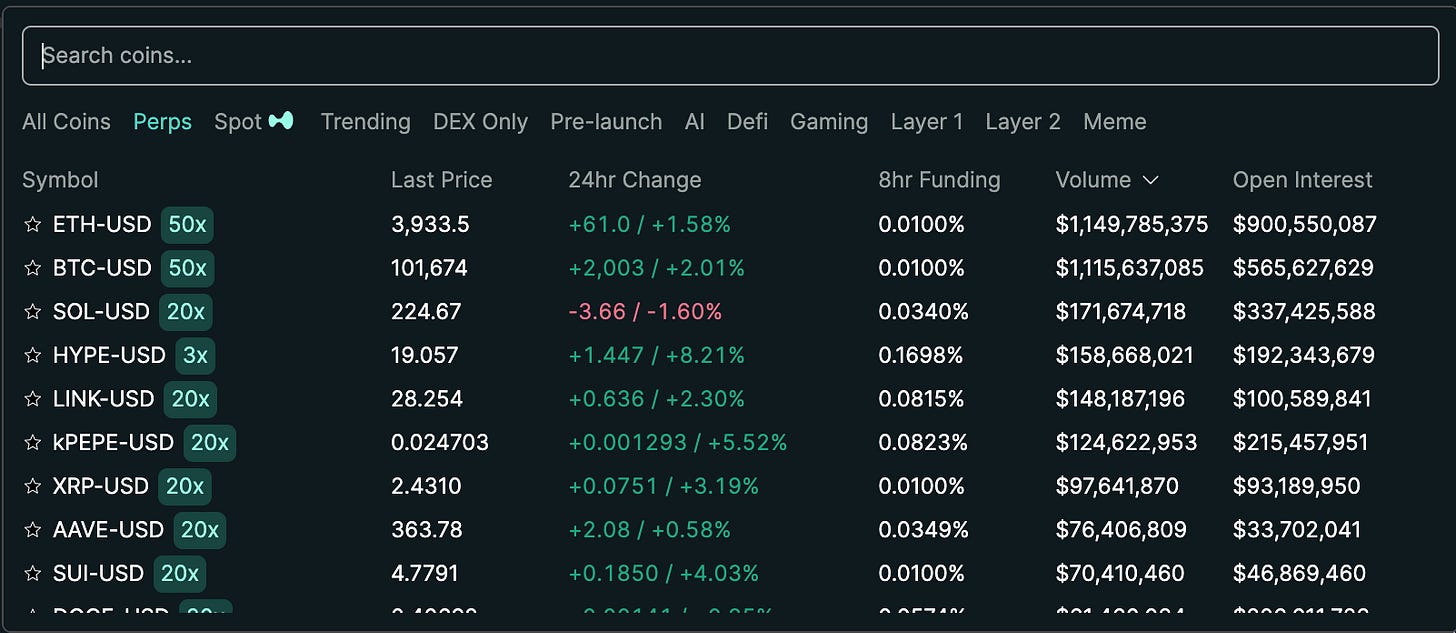

The first use case in Boros will be perps funding rates.

Beyond that, they are looking at staking rates, for example, being able to support exposure to staking rates on other chains.

Any of these synths will also be available for leverage, a feature directly enabled by the use of margin.

Pendle aim to have a great user experience that rivals Hyperliquid but have no points program planned for now (citing the availability of leverage as an argument for why additional yield is not required).

Is Boros just a perps market?

The curious thing about referencing Hyperliquid’s UX is that the Boros product itself may not be that different.

While Pendle V2 is a unique mechanism for splitting a token into two tranches, the idea of using margin accounts and an oracle for synths is well studied in perps markets.

Perps products like dYdX and Hyperliquid are very focused on offering leveraged trading of known assets.

The reason funding rates exist for perps is to ensure that the price of each perpetual tracks the underlying asset.

Some of this is up to the Pendle team but synthetic yield could be built without a funding rate and instead just have an implied market price of the yield (just like YT tokens).

Nevertheless, I don't think there is a significant fundamental difference between pricing the “margin YT” at 0 and having a funding rate or letting its price move around (but please educate me if that’s wrong).

Competing against large synths platforms

This equivalence, however, begs the question: how will Pendle compete with leading perps protocols like Hyperliquid ($2B TVL), Jupiter ($1.7B TVL), Drift ($860M), etc. who already have most of the architecture required to support something like this.

This goes back to understanding moats of perps/synths DEXes.

They are 2-sided markets between market makers and traders and have liquidity flywheel effects. See this tweet from Felipe Montealegre.

But because there are no existing markets for yields, Pendle can use this as a wedge to enter the leveraged synths market.

They can also tap into their existing user base that already has an established appetite for either market making in yields markets or trading yields with leverage.

Pendle can even have a multifaceted go-to market strategy.

They can serve protocols like Ethena that have complex hedging needs due to exposure to funding rates.

Or they can provide exposure to Solana staking yields to users on Ethereum and even offer leveraged versions of these yields that are considered “up only” to their users.

The latter especially could be highly attractive given the up only nature of staking yields and the ever insatiable appetite for boosted ETH/SOL-denominated yield in the market.

Look forward to Boros in early 2025.