Angstrom Makes LPs Profitable But at What Cost?

Breakdown of the Whitepaper and what it means for the block supply chain.

As is typical in blockchains, the theoretical constructs and infrastructure platforms arrive before the apps.

Application-sequencing has been on the horizon for a while and both Solana (through Jito) and Ethereum (through Flashbots) already have pathways for native block programmability. Rollups and roll-apps (perps platforms) have been the primary users of off-chain transaction sequencing but have been non-composable with transactions at their base layers.

Angstrom hints at the future.

It bootstraps its own validator set and order book while remaining fully composable (post-block) with Ethereum transactions through its unique unlocking mechanism and remains fully composable with other Ethereum order types by virtue of being a Uniswap v4 hook.

I spoke with the team a long time ago while supporting Uniswap v4 strategy and they immediately struck me as one of the most talented hook teams.

Now that the Angstrom whitepaper is live, it’s time to unpack how exactly the protocol works and what it means for block building going forward.

VALUE LEAKAGE IN AMMS

I don't need to dwell on this but being a liquidity provider in AMMs is a gamble. You are hoping that the fees you net from organic trades (somebody needs to buy an asset) offset the fees you lose from arbitrage between pool and market price. In practice, things are even worse because passive LPs sit around and eat LVR all day but if a large organic order comes in, new liquidity is added just-in-time (JIT) and receives most of the fees.

Swappers in AMMs also bleed value as they get sandwiched by searchers who both front-run and back-run their transactions. In response, batch auction systems have emerged which primarily match orders off-chain through solvers removing even more organic trade volume from liquidity providers.

As a result, retail liquidity provisioning is largely unprofitable outside of new asset discovery and incentives.

The sequencing in practice works as follows:

Within every slot (time between two blocks), market prices naturally change;

In parallel, users submit swap orders to the AMM;

At this point, block proposers can do three things:

1) They can add/remove liquidity to capture fees from user swaps

2) They can sandwich user transactions

3) Finally, they can introduce arbitrage swaps that reset pool price towards the market profitably (by offsetting with a smaller trade on another onchain exchange or an offchain exchange).

ANGSTROM’S ARCHITECTURE

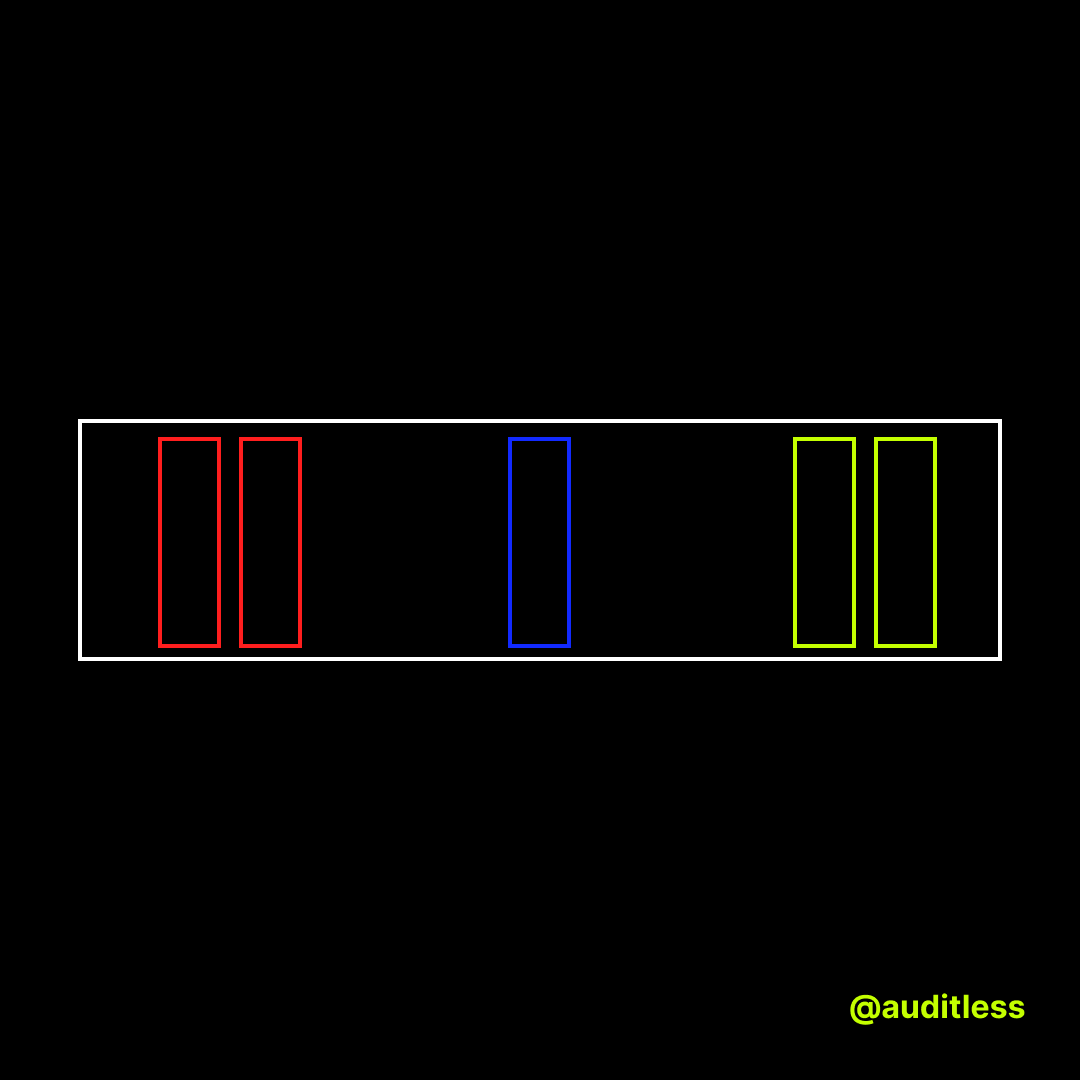

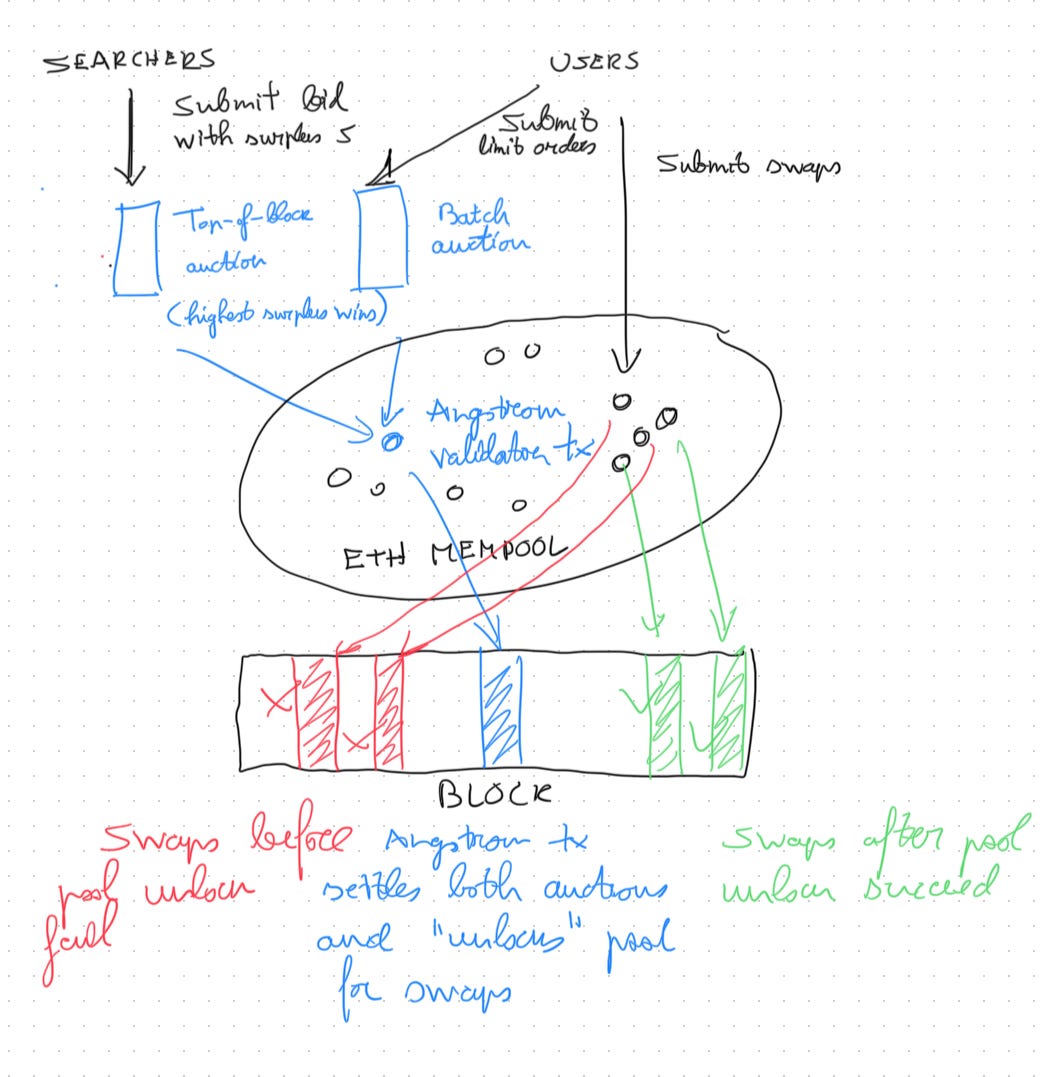

Angstrom changes the sequence of events by introducing two auctions. The first is an auction for the right to place a swap top-of-the-block and the second is a batch auction for limit orders:

Step 1: Market prices evolve between slots (this is unchanged);

Step 2: Searchers notice market price evolution and submit “top-of-block” swaps to Angstrom. Effectively they bid for priority access to swapping in the pool;

Step 3: Users submit limit orders to Angstrom and swap orders to the AMM;

Step 4a: Angstrom validators run an auction which selects the top-of-block swap which creates the largest surplus (explained below);

Step 4b: Angstrom validators run a batch auction to settle all the limit orders;

Step 5: Angstrom validators submit the settlement transaction to the mempool;

Step 6: As the block executes, any user swaps before the settlement transaction automatically fail cause the pool is locked. Batch orders execute with additional hooks which may trigger other onchain actions. Swaps after the settlement transaction are valid.

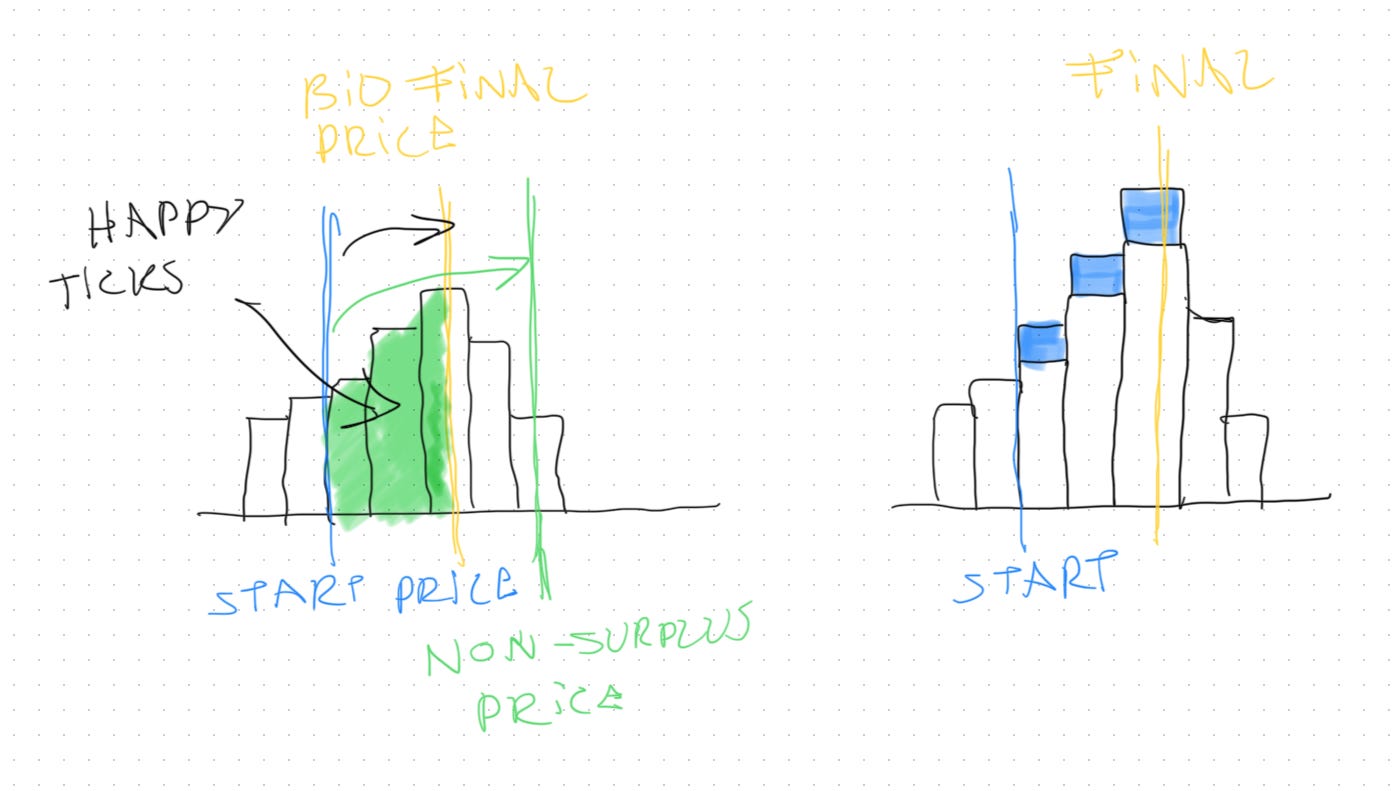

Batch auctions are well understood but the first auction is pretty unique. The way it works is that each searcher bids with a tuple

which represents a total bid amount of the sell asset and a final price.

In practice when you swap on an AMM, there is always price impact moving the price from P0 to some other price P*. If this price is larger than Pf, Angstrom calculates a surplus: how much could B be reduced by so that the final price is actually Pf.

Then, each liquidity provider’s liquidity is virtually inflated in proportion to the surplus so that the amount B only moves price to the desired price Pf.

So the larger the value B in relation to Pf, the higher the surplus and more value will be directed to LPs.

Note how Angstrom addresses three ways block proposers can leak value:

They can add/remove liquidity to capture fees from user swaps

As most user orders now move to the order book auction and, JIT liquidity attacks become less profitable. Instead, the best way to absorb large orders is to participate in the order book directly which is subject to a fair universal settlement price across the batch.

They can sandwich user transactions

Because users can now now submit limit orders directly to the AMM, the impact of sandwich attacks is mitigated.

They can introduce arbitrage swaps

The pool is now arbitraged by the top-of-the-block bidder so most of the value is actually returned as surplus to LPs in the auction.

IMPLICATIONS

What’s unique about Angstrom is that it enables composability in two ways: hooks on batch orders and user swaps after unlocking.

There is a cost to block proposers which is that they now need to be sequencing user swaps following the Angstrom settlement transaction. Having many more apps like Angstrom impose additional constraints on block proposers could negatively impact proposer decentralization.

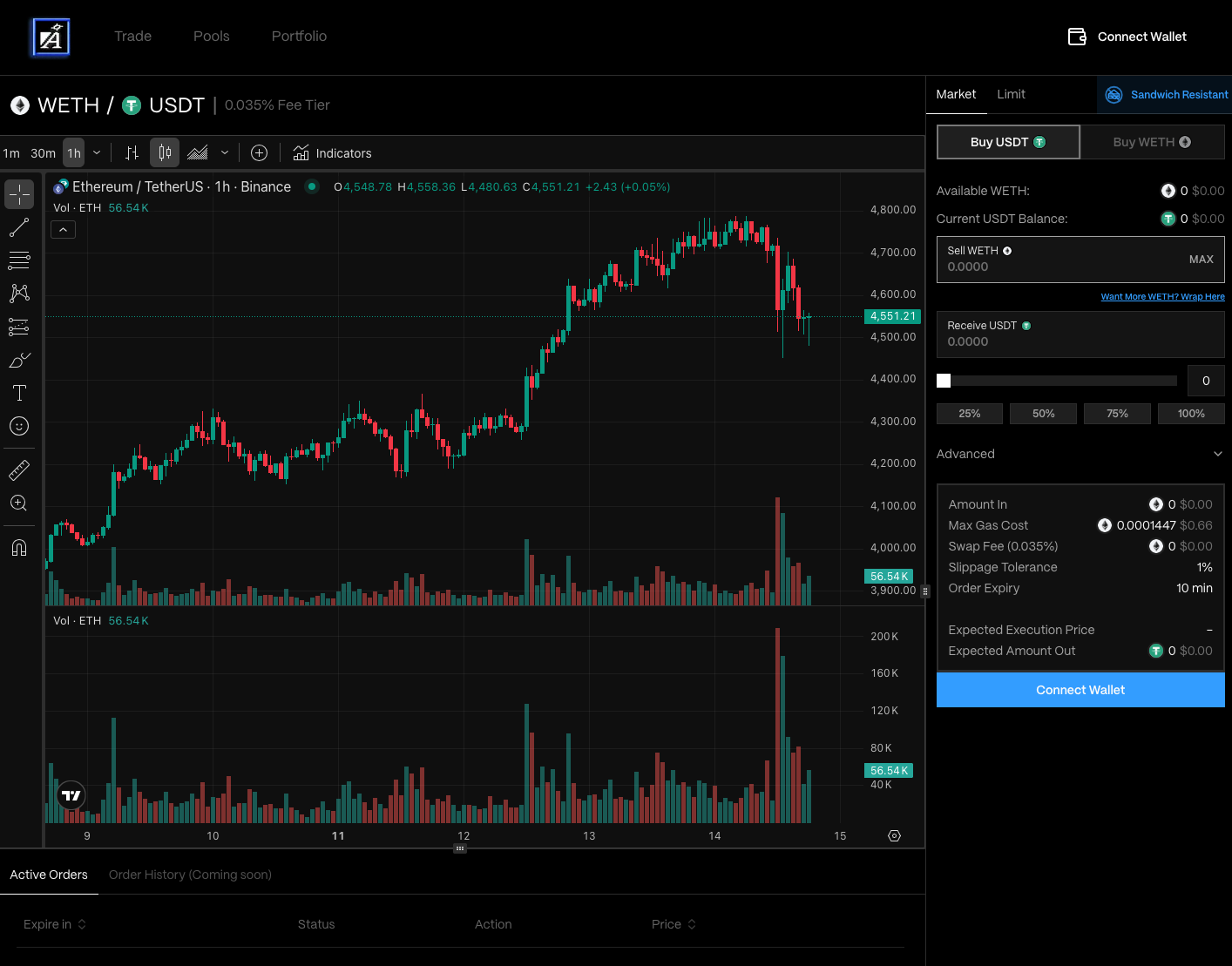

Angstrom are providing a trading-like experience for users submitting limit orders, directly showing CEX prices since the 2-auction mechanism creates an incentive for limit orders to get executed close to the market price:

Three ways LPs benefit

This is a new playbook for bootstrapping liquidity.

There are three reasons for LPs to participate in Angstrom:

Given Angstrom’s built in LVR protections, LPs can be more passive than with other AMMs and hooks;

Any amount of limit order volume that Angstrom can attract results in additional fees to LPs;

Finally, Angstrom supports swaps which means it will still get organic order flow from Uniswap v4 routers.

We've also seen in the past that AMM can sometimes grow irrationally even if LPs are unprofitable (e.g., Fluid) so Sorella Labs will still have to execute well.

But this design is the best I've seen so far for universal passive liquidity provisioning between de-correlated assets.