Synthetix V3 and the Margin-as-a-Service Moat

Building on a 2018 gem from Ben Thompson.

NOTE: This post is part 2 of a multi-essay effort to understand Ethena from first principles. Many people have asked me to write a take on Ethena but truth be told I don't know how it works. Each week I will cover a concept that will help me get closer to breaking down the synthetic dollar protocol. This post is focused on Synthetix V3 and Perpetuals. The previous post in the series is here.

Ethena is notorious for using only off chain custodians so it was notable that they chose to use Synthetix Perps V3 as their first onchain integration.

Naturally the best place to start is Synthetix V3, the base layer powering the Perps protocol.

Turns out it's part of a rapidly growing protocol category with other dominant protocols…

Let’s dive in.

It’s really difficult to get an onchain derivatives platform off the ground.

In particular, acquiring issuers is tricky. Due to overly high collateralization requirements, issuers incur high costs of capital which become even higher in a high interest rate environment. Market makers don't show up to low liquidity markets creating a cold start problem.

But there is a way.

Ribbon's early success gave us a glimpse of why wrapping issuance into an easy to use retail product can provide much needed seed liquidity to options markets.

Synthetix also solved this problem in spot & perp markets. Kain has stated multiple times that Synthetix staking was one of the first aspects of the platform that had true product market fit.

What is Synthetix V3?

Synthetix V3 is the next iteration of the protocol that makes issuance available to other builders.

It works in a simple way.

Lets say we want to build a prediction market for gas. We could build it on Synthetix V3:

Develop a Market that describes how assets are issued and settled in our system;

Incentivize different Pools to send liquidity to our market;

These Pools would in turn consolidate liquidity from various LPs who provide collateral. The capital in the pool shares risk across markets and would get liquidated jointly.

For more details on how liquidity and fees flow in the Synthetix V3 system, see this blog post.

But Synthetix V3 is also vertically integrated.

The protocol could be incredibly successful with just this one vertical:

Base Andromeda deployment (their new Base deployment that uses USDC as collateral);

Spartan Council Pool (default governance pool);

Perps V3 (the market implementing perpetual futures);

and Infinex (trading front-end built by Synthetix Co-Founder Kain).

Going beyond that and ascribing strategy outside-in to user-centric protocols like Synthetix is a bit like art commentary.

It has little relevance to how things actually came about.

But I'm really interested if the protocol can acquire market power as a platform so we will try nonetheless.

My thesis is that Synthetix V3 is an example of a broader trend of Margin as a Service platforms that have similar kinds of moats.

Everything is Margin-as-a-Service

A margin-as-a-Service (MaaS) platform addresses three problems for protocols that need reliable margin systems to function:

The difficulty of bootstrapping two-sided exchange markets (liquidity & order-flow). Note: this asymmetry between onchain liquidity (which you could call algorithmic market making) and off chain order flow is characteristic to crypto. Order book exchanges have a simpler N^2 network effect;

Safe development of margin smart contracts. This is particularly important for more complex margin systems like concentrated liquidity;

A healthy risk management system (Synthetix V3 has parts managed by Gauntlet for example).

Interestingly, we have already covered quite a few of them: Uniswap V4, EigenLayer, Starport and Euler EVC.

My mistake was seeing these as aggregators, they actually share much more structure than that. Hence the term MaaS.

Lending protocols

Borrowing is perhaps the simplest primitive for leverage so it’s clear why Starport and EVC which are lending aggregators also function as a MaaS.

EigenLayer

EigenLayer is more nuanced. On the surface restaking seems like a new primitive. But actually it's a margin account with stETH being used as a shared collateral with a binary liquidation mechanism (slashing).

As partial slashing gets introduced, EigenLayer will more closely resemble a capital efficient margin system.

Uniswap V4

The idea of Uniswap as a margin account may be the least obvious but there are several lenses that reveal it:

The way V3 positions go out of range closely resemble impermanent margin calls;

It’s possible to build lending/derivatives protocols on V4;

The moat map for MaaS

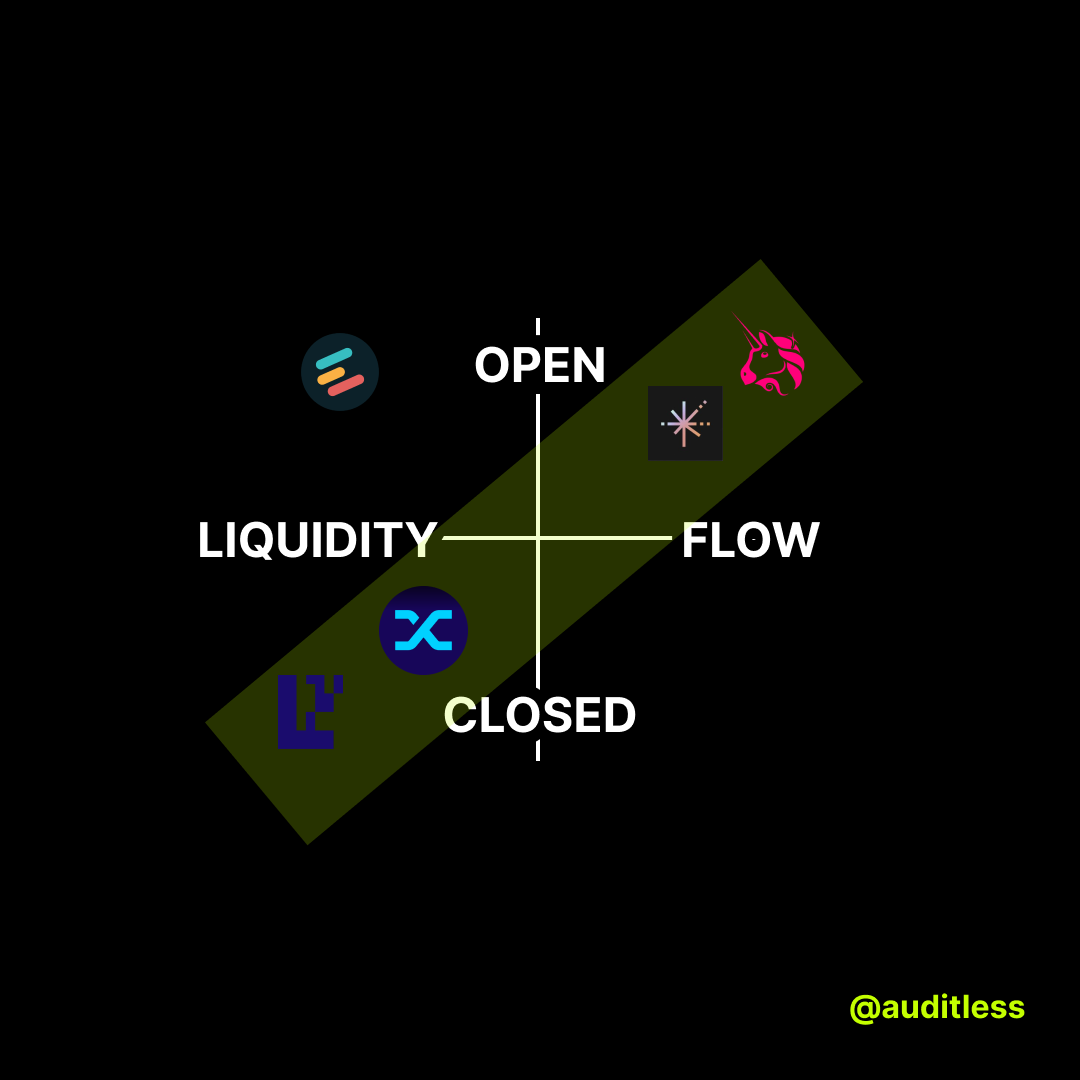

To compare how MaaS platforms acquire moats, I borrowed Ben Thompson’s moat map idea and adapted it.

We look at two axes:

Whether the platform supports developers with Liquidity or Order flow. For example Uniswap V4 hook developers have to find their own LPs but order flow may get routed to the hooks automatically. The opposite is true with EigenLayer. Liquid Restaking Token protocols will make it easy to access restaking liquidity but each application of restaking has to develop its own use case. Note this also informs network effects as each MaaS will have a flywheel of Liquidity → More apps → Liquidity or Order flow → More apps → Order flow;

Collateral diversity (open means more diverse, closed means only finite types supported). Uniswap is the most diverse. EigenLayer only (currently) accepts staked ETH and is on the opposite end of the spectrum.

Synthetix V3 accepts a small set of collateral types but helps developers with liquidity.

Starport and EVC both have high collateral diversity, however, Starport is an intent system providing order flow and EVC is a system that provides collateral efficiency.

This moat map predicts that platforms which provide liquidity need to internalize risk management and therefore can only accept narrow sets of collateral vs. platforms that provide order flow need to support a wide variety of diverse liquidity sources from developers to maximize their flywheel.

EVC’s issue seems to be that while it provides more efficient and integrated collateral management tools, it doesn't restrict the types of collateral supported.

However, it is also perhaps an exception because it still provides at least the smart contract base for many risk management tools including supply/borrow caps and interest rate curves.

With this framing it's helpful to revisit the many ways Synthetix V3 is supporting developers with risk management:

Shared safety parameters such as 5x collateral ratio informed by previous deployments;

Customizable parameters such as minimum delegation duration;

More stable collateral with USDC on Base;

A risk management partnership with Gauntlet.

Its growth flywheels, however, are less obvious.

Delegating to too many markets create contagion risk for LPs so perhaps what matters more is having higher quality markets with more capacity for notional.

In summary, there is a lot to get excited about with Synthetix V3.

On one hand, it’s a carefully architected and vertically integrated system that aims to provide the best onchain perps trading experience while inheriting Ethereum security.

On the other, it's a MaaS platform (with all ensuing benefits) that is focused on the issuance of highly volatile synths.