World Chain's Mounting Advantage

The inevitability of sybil-resistance.

Worldcoin’s migration to its own rollup seems inevitable when you look at their OP Mainnet blockspace consumption (44% of mainnet activity).

In August, I tried to counter the prevailing narrative that they are an orb-harvesting megacorp and explained how they are a platform to bring crypto to emerging markets.

While this is true, the World Chain launch helped me realize that being perceived as an orb-harvesting megacorp is in fact their biggest advantage.

While Worldcoin is focusing on bringing crypto to emerging markets, they have also obtained a massive head start on commercializing sybil-resistance in blockchains.

This matters.

Why sybil resistance is more important than people think

Worldcoin has rapidly bootstrapped one of the largest user bases in crypto by creating a potent blend of web2 and web3 distribution tactics.

These include free joining incentives, gas subsidies and priority blockspace.

Free joining incentive

There are three prevailing ways to onboard users via a monetary incentive:

Offer people cash (the web2 way). Very effective as the friction to adoption is low but expensive to do.

Airdrops and points. Airdrops allow individuals to receive a portion of tokens based on their activity. The cost is lower since a project's own token can be used. However, to avoid sybil attacks, airdrops are usually retroactive and necessarily target a limited amount of users.

Liquidity incentives. Liquidity incentives have sybil resistance because they have a linear relationship to liquidity. However, they disproportionately attract whales and perhaps are less effective at true behavior change.

Worldcoin's onboarding is cheap (use token), sybil-resistant, available to anyone and requires very limited friction to participate.

No wonder they have been able to onboard 5 million users this way.

Not to mention, it enables other primitives:

Gas subsidies

Worldcoin have subsidized grant claims which has a fixed gas impact per user.

This would not be sustainable without sybil-resistance placing a natural upper bound on the number of users.

A similar subsidy will extend to general uses of World Chain.

This means that onboarding to World App feels like onboarding to a regular fintech application and the team can likely tune this to get the right D7 retention numbers before educating power users on the gas blueprints of more frequent transacting.

Priority blockspace

This is where things get interesting with World Chain.

The team claims that they will prioritize payments and other interactions from “verified humans”.

This means in particular that for regular payments:

There will be a reserved amount of blockspace meaning that an NFT sale, liquidation cascade or other periods of speculative volatility cannot block basic payment functionality for users

This should limit MEV and front-running

This should mitigate the need for users to pay exorbitant priority fees to get their transactions included quickly.

Again, all this serves to offset the negative aspects of building financial rails on blockspace rather than serving as a broader statement around automation.

You can think of this as Cloudflare for blockspace.

Counter-positioning

Now sybil-resistance alone is not enough to sustain a competitive advantage.

In fact, World ID is available for other ecosystems to bootstrap on top of.

But they won't do it.

Perhaps because Worldcoin is funded by Sam Altman.

Or because they have philosophical objections to biometric scanning.

Either way, this hatred towards the current iteration of Worldcoin is the perfect example of a counter-positioning advantage.

In this window where Worldcoin has the only viable solution to sybil-resistance, they have a monopoly on using it as a growth strategy.

The longer other teams take to using sybil-resistance, the bigger the gap will get.

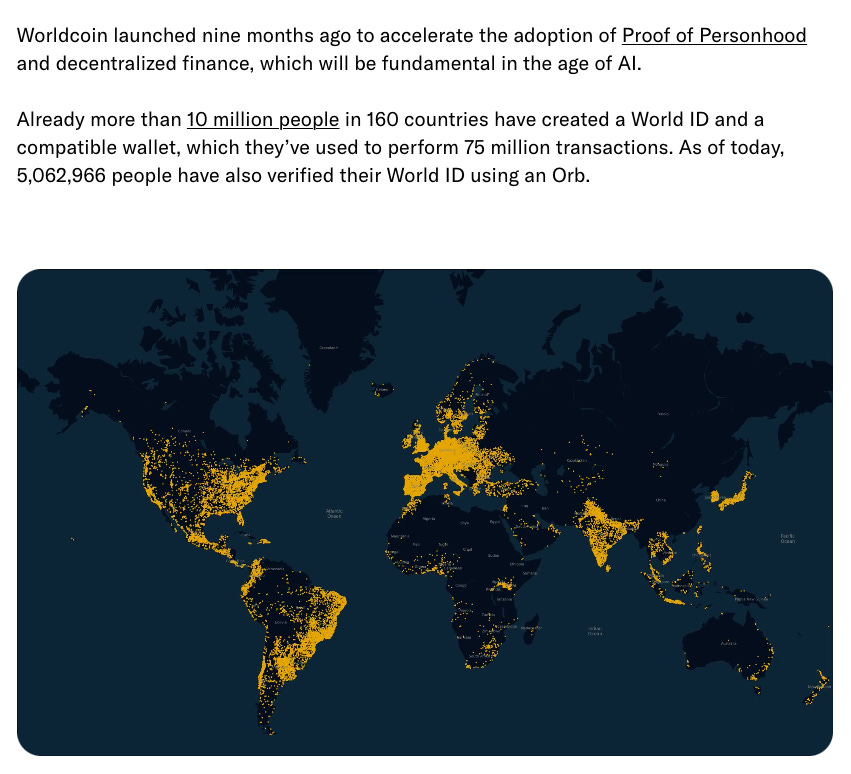

Just how big? It’s already at 5M verified users:

By the time a better privacy-preserving solution to proof of humanity appears, Worldcoin can just incorporate it in their app and keep extending the network. They have already said as much.

A serious team to beat

The advantage of using sybil-resistance for go-to market may seem marginal.

But not in hands of a top tier team.

Worldcoin may already have the biggest team building on the Superchain.

With $240M in funding and aggressive hiring they are certainly not far off.

The announcement post described both their intention to continue contributing to the OP Stack as well as to customize their own deployment (with a focus on the execution client next).

As a result, their rollup may be the most custom on the OP Stack yet (aside from non-Superchain deployments like Aevo of course).

So remember this.

The next time you hate on Worldcoin, you are probably helping them win.