Symbiotic is Taking Restaking into the Margin-as-a-Service Era

Our big prediction.

Earlier this year I wrote about EigenLayer:

The article made three predictions:

Time is running out for the competition due to EigenLayer’s aggregation network effects,

Restaking is too important an opportunity for current LST leaders like Lido to ignore,

There will be more assets to restake than stETH.

With the entry of Symbiotic, all three predictions are coming true.

Symbiotic was funded by the Founders of Lido together with Paradigm to create a modular alternative to EigenLayer.

Symbiotic’s Approach

One of the benefits of following EigenLayer is that restaking concepts are much better understood.

Symbiotic’s documentation is very clear and reveals how our industry’s improved nomenclature explaining restaking and shared trust should work.

The basics are the same: Operators correspond to AVS operators in EigenLayer while Networks correspond to the “consumers” of shared security.

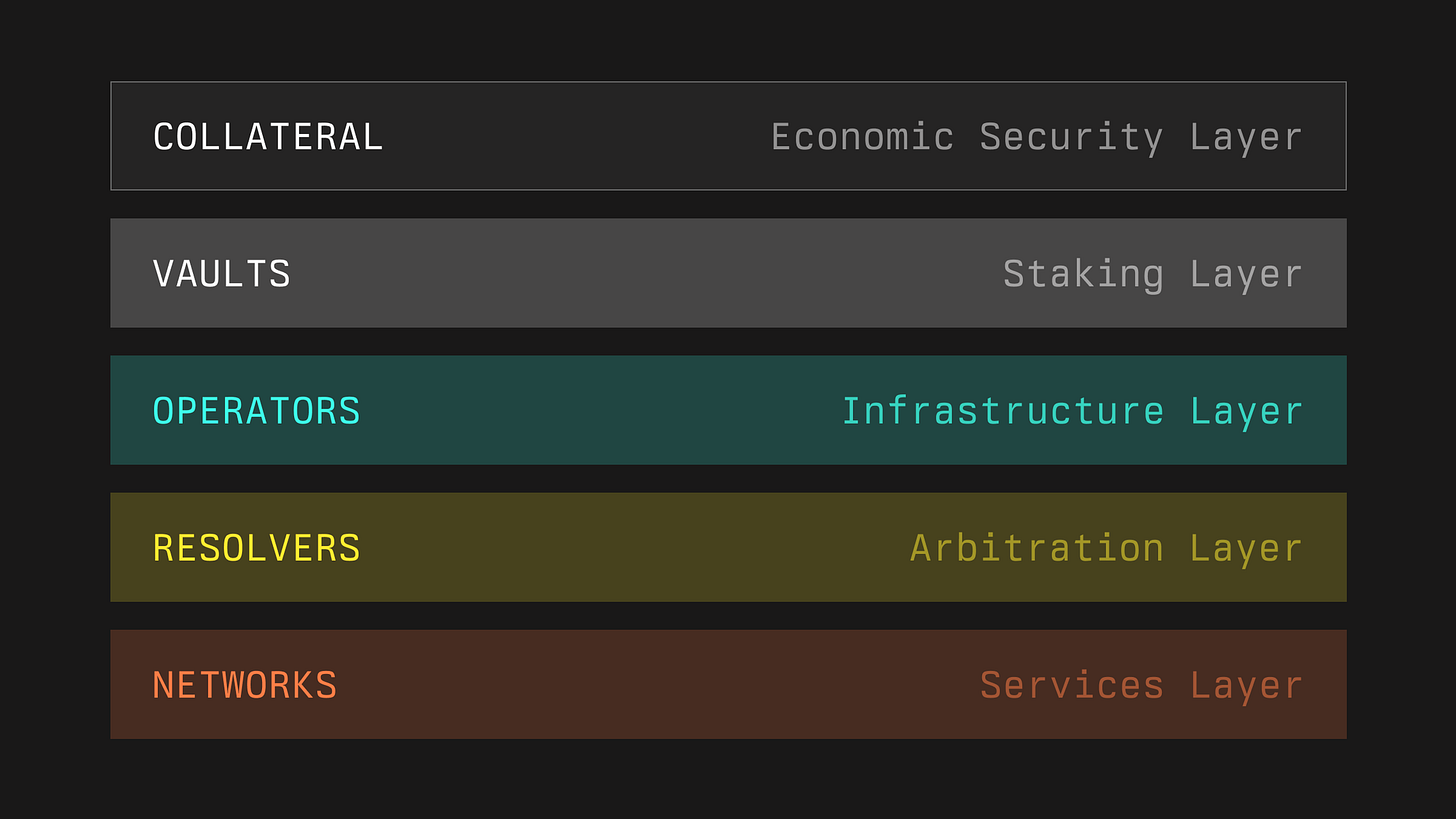

The main differences are in collateral, vaults and resolvers.

Collateral reflects Symbiotic’s increased flexibility in not only supporting various LSTs but also being open to enabling ERC20s or even more complex “assets” such as withdrawal rights.

Vaults (taking a page from Morpho’s book) can be deployed by various entities including LST providers, operators, LRT providers and more. Each vault has a plethora of configuration options allowing to fine tune the operator set, slashing conditions and arbitration, supported collateral asset and more.

Finally, Resolvers implement an arbitration layer that can encode any type of slashing condition ranging from conditions that can be fully encoded onchain to more sophisticated or interactive conditions that require committees.

Furthermore, Symbiotic heavily leans in on immutability making most contracts non-upgradable and also giving vault deployers the opportunity to develop pre-configured immutable vaults for maximum security guarantees.

Restaking and Margin-as-a-Service platforms

Later, I also wrote about how EigenLayer is just one example in the broader Margin-as-a-Service category of platforms that help users achieve certain payoffs with slashing/liquidation/margin call conditions.

EigenLayer is more nuanced. On the surface restaking seems like a new primitive. But actually it's a margin account with stETH being used as a shared collateral with a binary liquidation mechanism (slashing).

As partial slashing gets introduced, EigenLayer will more closely resemble a capital efficient margin system.

By necessity, none of these MaaS platforms are universal and they are currently seen as completely different categories.

AMMs are focused on impermanent loss/impermanent margin call type conditions where the reward is in the form of trading fees (usually).

Lending platforms provide floating interest rates in exchange for liquidation risk.

Perps platforms like Synthetix are focused on a more traditional margin call mechanism to achieve a specific payoff.

Symbiotic is in the position to aggregate all use cases with an operator/delegation based slashing condition.

But there’s actually no reason that an operator has to be involved at all.

🤔

Exotic use cases for Symbiotic

Symbiotic could be used to build much more.

Consider prediction markets as an example.

“Stakers” on each side of the market could effectively be placing bets. The resolver would resolve the prediction market outcome and users losing their bet would get slashed. Of course the prediction market would have to be careful about what networks it would be happy to co-locate with to prevent overlapping slashing conditions.

Insurance funds (a la AAVE’s Safety Module) is potentially an even better example of what Symbiotic could be good for. The insolvency case is pretty rare and could be coupled with other uses for that capital.

This is not just a theoretical exercise, shared security could help draw more capital towards these mechanisms. You could be staking simultaneously to insure a lending protocol alongside supporting the more usual examples of oracle/keeper networks.

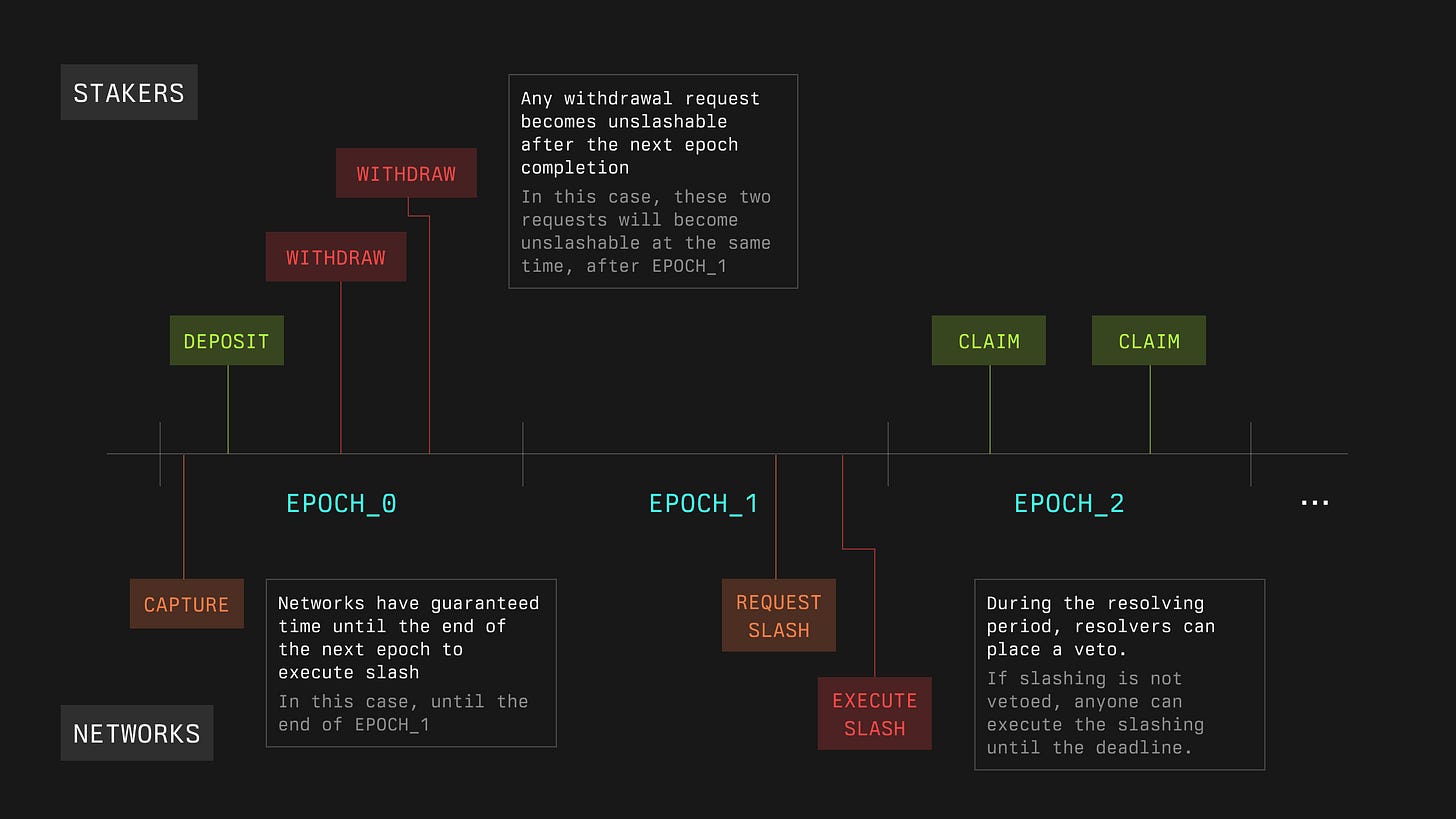

The way Symbiotic is currently constructed and its epoch mechanism may not be the perfect fit for more exotic uses of slashing but in general it’s constructive to think beyond restaking.

The idea to take away is that each Symbiotic vault represents an isolated margin account.

When it comes to comparing EigenLayer and Symbiotic, on a market power level I think they work in similar ways. Positioning, distribution and partnerships will likely play a bigger role in the short term.

But Symbiotic does have the advantage of potentially having more runway (currently) on its network effect due to wide support for customization and parametrization and the potential to embrace its role as a MaaS platform.