What Infinex Tells Us About Next-gen Front-ends

Winning in the new battleground.

NOTE: This post is part 3 of a multi-essay effort to understand Ethena from first principles. Many people have asked me to write a take on Ethena but truth be told I don't know how it works. Each week I will cover a concept that will help me get closer to breaking down the synthetic dollar protocol. This post is focused on Infinex. The previous post in the series is here.

Kain’s latest project Infinex is far from just a front-end for Synthetix Perps V3.

Ever since Synthetix decided to redirect 20% of Base fees towards front-end integrators in SIP-346, it made building trading front-ends for Synthetix Perps significantly more attractive.

However, an increased emphasis on the front-end is not just a transition that Synthetix is going through, it’s happening all over the industry

Front-ends matter now? Here’s why

There are a number of reasons the industry is balancing protocol innovation with an increased focus towards true user aggregation by building front-ends and wallets:

Post-Dencun fees. L2 transaction costs are low enough so many protocols can start competing with centralized applications. In fact the header image postulates that as transactions leak less value to blockspace suppliers, more value will accrue to aggregators (front-ends);

Chain fragmentation. Conversely, the proliferation of various L1s and L2s has created chain fatigue which apps and wallets can address by becoming a central DeFi hub for users and making blockspace as invisible as possible;

The search for revenue. In a world of higher regulatory scrutiny, many core teams are looking for additional products they can develop and own independently or in addition of being a core contributor to the DAOs they helped create.

There are several reasons that Kain as the Founder of Synthetix may have decided to focus on end-user experience in this market window:

Synthetix first got product market fit with stakers which ensured a stable provision of liquidity. However, before Perps they struggled to find an asset class that would hold volume reliably;

Lack of liquidity has been the key challenge in bootstrapping onchain derivatives markets, Synthetix V3 did this and were able to productize this liquidity;

Synthetix Perps V2 and V3 made significant leaps bringing the product on par with other onchain markets. Perps V3 is competitive on fees with the use of low-latency Pyth oracles and benefits from a more complete set of trading features like cross-margin accounts;

So the final piece of the puzzle is go-to-market and a great trading experience, which Infinex aims to provide along with other products to keep users in their app.

While Infinex hasn't formally launched yet (they only recently released deposits), it foretells a high number of the most important trends in web3 front-end development.

1. The end of the light front-end

Traditional web3 front-ends would pride themselves on delivering a modest improvement over interacting with the protocol through Etherscan.

Uniswap is a popular example with their minimal front-end representing a convenient way to interact with a router.

The familiar interface has stayed consistent even through significant changes in the back-end allowing for NFT trades and intent-based trading with UniswapX.

But these changes are a radical departure from what the original Uniswap front-end was. In fact, UniswapX as a general intent resolver would happily redirect order flow to Curve, Balancer or even off chain liquidity.

Equally, Infinex promises to support 3 categories of products 1) products built on Synthetix like the Perps market 2) products integrating with Synthetix like Ethena and 3) products that have nothing to do with Synthetix like lending and yield products.

2. The rise of pro-tail

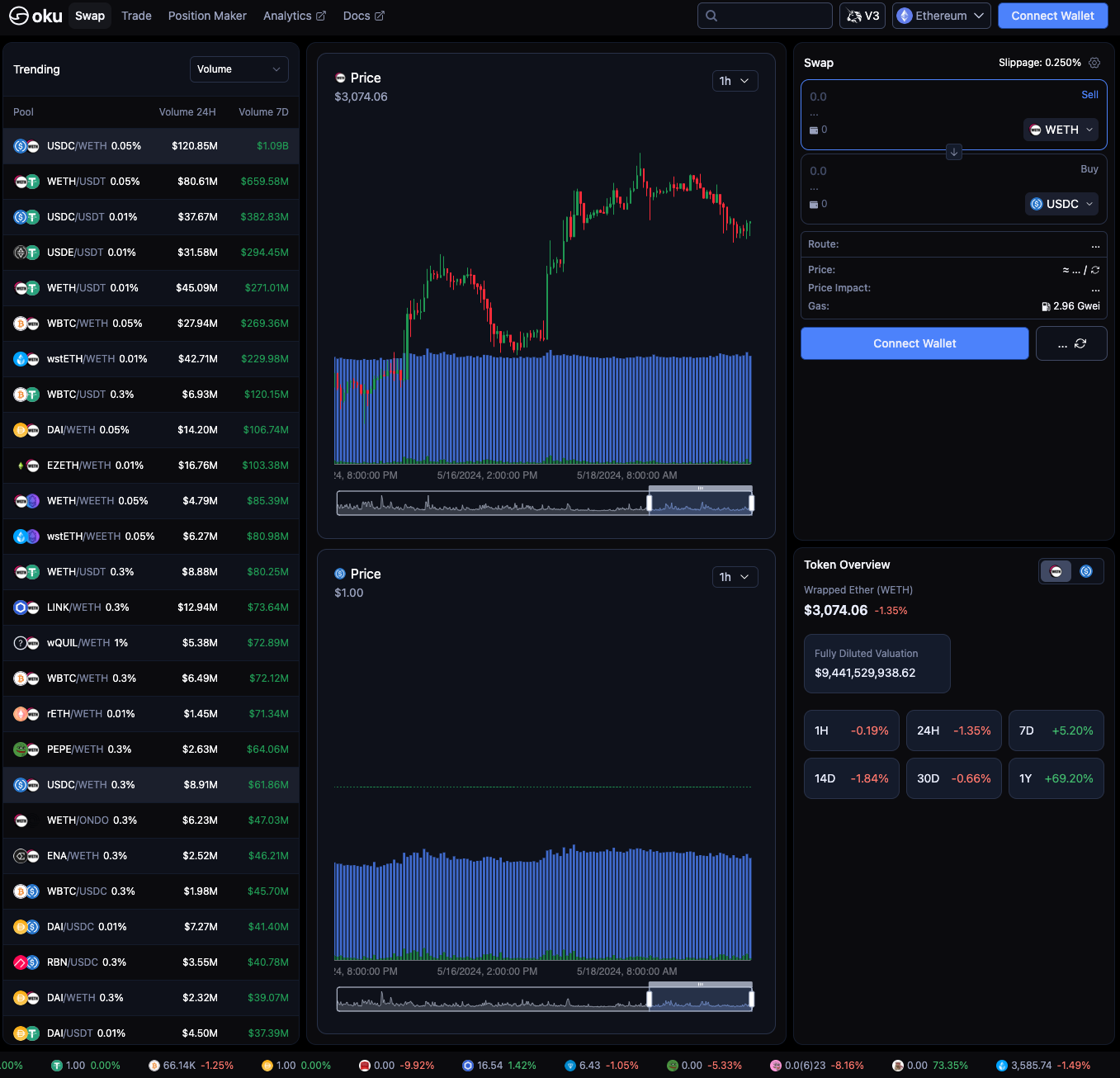

Oku offers an alternative Uniswap trading experience that incorporates ideas from tradfi spot trading platforms revealing more details about real-time price discovery on the AMM.

The front-end seems best suited for a hybrid between a retail user and an institutional user, targeting a more sophisticated segment of “pro-tail” users.

We have not seen what the Infinex front-end looks like but based on comments by Kain I find it unlikely that it would anything unlike a top-end CEX perps trading experience.

3. Account abstraction & Arcade accounts

With a little help from Vitalik, account abstraction is becoming a reality for EVM chains.

Infinex is embracing account abstraction to aim to deliver the best mix of web3 composability and web2 security and recovery.

Expect new web3 front-ends (which now see personal custody as incidental complexity) to experiment with account abstraction and arcade accounts in an attempt to make wallets invisible.

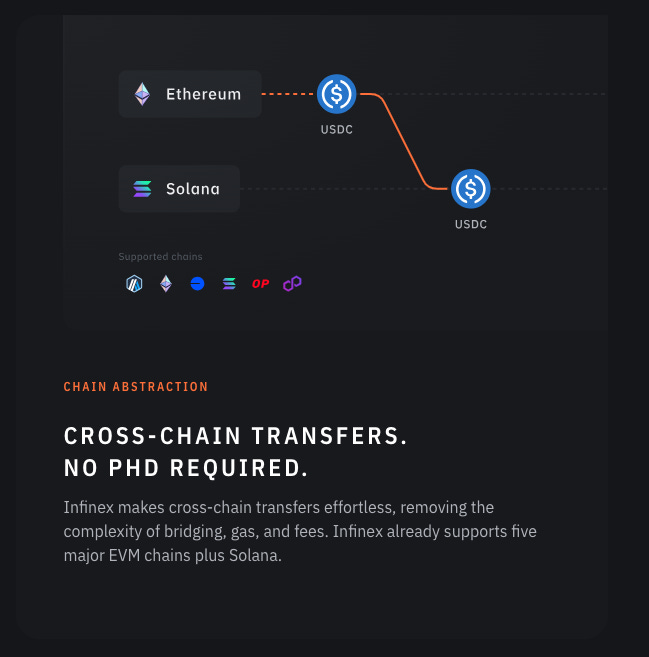

4. Chain abstraction

One of the most unique aspects of Infinex, is the inclusion of Solana protocols on day 1.

The chain abstraction trend is already making its way into wallets but has usually meant abstraction across EVM chains.

Whatever your views on Ethereum security and philosophy, Solana’s architecture has lent itself to some of the most important DeFi applications of this cycle and there is more overlap between the user bases than people may philosophically suspect.

5. Improved performance

The web3 front-end stack is being continually rearchitected. Modern front-ends will likely embrace some or all of the following:

Better indexing. The era of open source front-ends that rely on the decentralized graph network is being replaced with front-ends who prioritize a performant end-user experience and use faster indexing stacks

Caching and server-side rendering. The dominance of Vercel is putting pressure on web3 front-ends to find ways to offload rendering to the server

Viem. The adoption of Viem directly or through wagmi hooks is contributing to more performant front-ends

6. Progressive Web Apps

Perps apps are generally optimized for a desktop trading experience but many simpler products will support PWA installs, allowing apps to occupy a spot on the users’ home screen.

The most popular example is friend.tech. You can read more about their onboarding in this dedicated piece:

7. Their own mechanism design

Kwenta’s incentives program is an example of a highly granular incentive campaign.

Front-ends are starting to incorporate onchain incentives whether through referrals, dedicated grants or their own tokenomics to attract and aggregate users.

8. Governance

Synthetix is well known for its community-led development since inception.

However, I was truly surprised to find that Infinex is already operating a community governance process:

Traditionally, decentralized governance is seen as slow and ineffective, not something you introduce early on.

In short, we should expect front-ends to combine the best parts of protocols and super apps and from thin open source wrappers over protocols develop their own unique moats and revenue streams.

We may be entering a phase where crypto becomes easy enough to be used by our friends and that’s really exciting.