DappCon24 and the Next Evolution of Gnosis

The vertically integrated, decentralized banking system anyone can own.

This post is taking part in the Kiwi x Dappcon Writing Challenge.

Capital's default state is evaporation.

As a prime example, 60% of NBA players (many of them millionaires) go broke within 5 years.

This doesn’t just apply to individuals. In 2020, the average lifespan of a company on Standard and Poor's 500 Index was just over 21 years.

I suspect the problem is even more pronounced for DAOs, especially ones that don’t happen to dump funds in the right risk-on asset at the right time.

(As an aside, if you want to at least better protect your capital, pay contributors and in general extend your runway, consider using a trustless Aera vault.)

Even with Aera, however, you still need ideas how to develop new initiatives and grow.

Gnosis is part of an elite group of DAOs that have proven that they can.

In what they call their “infrastructure phase” (Gnosis 2.0) they developed industry leading products across many categories such as Safe and CowSwap.

But having now spun those projects out created an opportunity for Gnosis to reevaluate what’s next.

Gnosis is decentralizing Coinbase

Gnosis 3.0 was initially announced in March:

For a long time, we Web3 builders have concentrated on infrastructure. It was necessary to get anything done! However, the pendulum has swung the other way now and we’re somewhat over-indexed on infrastructure and under-indexed on actual applications that bring real value to a very significant number of people. It’s time to come out of that very technical niche and build applications for humankind. So we asked ourselves: In which area can we build that will yield the most value to the most normies the quickest? And for us, the answer is unequivocally payments and financial rails. Gnosis 3.0 is Gnosis as you know it but with an intense focus on payments and generalized, open financial infrastructure. We are still building, we’re still investing, we’re still pushing Gnosis Chain, but payments is the direction we are planning to conquer next. What does that look like in practice?

In DappCon24 we heard a more strategic update about the verticals Gnosis wants to tackle to build open financial infrastructure.

Gnosis 3.0 is a cooperative of smaller projects aligned economically through the GNO token and philosophically through a shared mission.

While this is similar to how Gnosis has been operating so far, it’s the focus itself that has shifted from building infrastructure to what Martin Koppelman (CEO of Gnosis) calls “full stack decentralization”.

But what exactly is full stack decentralization and why should people care?

In Vitalik’s own DappCon appearance he explained that crypto’s path to mainstream adoption lies in the “long tail”:

“The value of crypto generally comes from where the outliers are. People who do things that are unusual in some way. Everyone does something that the system doesn't serve well on at least one axis. There are people who make international donations. There are people who want to build organizations that preserve their privacy. There are people who want to use ENS and IPFS. It is all about the long tail.”

⁓Vitalik Buterin, DappCon24

Gnosis is betting on developing this long tail technologies and then bringing them to the masses.

Martin identified 6 pillars to full stack decentralization each with an example set of products:

Everyone should have a digital identity they own. (Safe)

Everyone should be able to transact on a chain they have ownership in. (Gnosis Chain)

Everyone should be able to swap ownership (tokens) in protocols that put user interests first! (CowSwap)

Everyone should be able to use a money system they own. (Circles)

Your sovereign identity and sovereign money need to work in the real world. (Gnosis Pay)

Everyone should choose what they disclose and have access to privacy (Gnosis VPN).

These product focus areas emphasize building payments and financial rails in an open, decentralized way.

This strategy is in important contrast to Coinbase’s own strategy to create crypto onramps with Base and Coinbase Wallet.

Users adopting Base have no way of having ownership in the network, all sequencer profits go directly to Coinbase.

Monetary premium, not blockspace demand

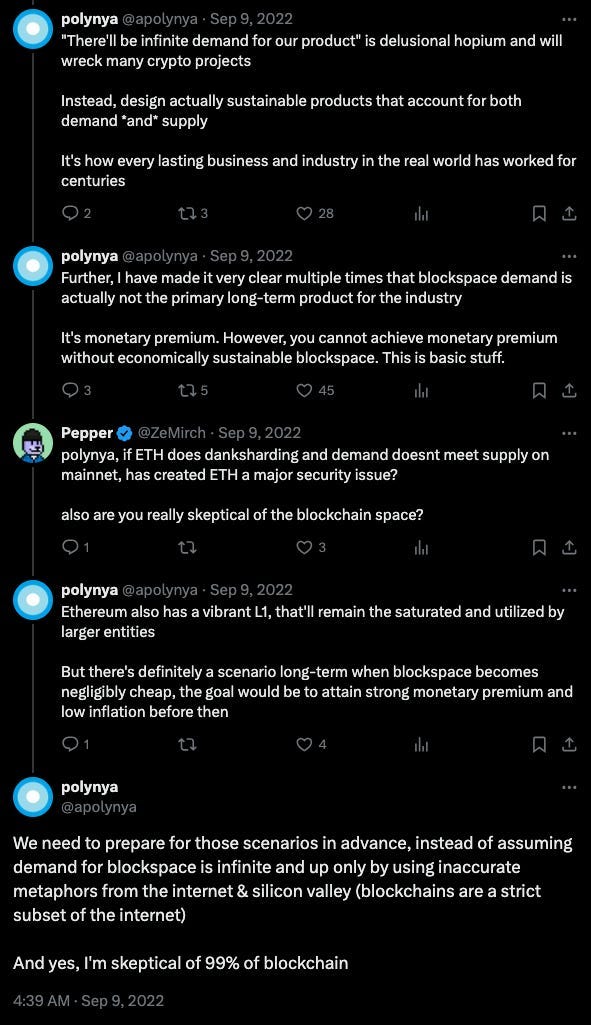

Reflecting on the strategy, we are reminded once again of polynya’s tweet which we featured in On the Marginal Utility of Blockspace talking about how monetary premium, not blockspace demand is the long-term product of the industry.

The data also supports placing less emphasis on Gnosis Chain as a credibly neutral app chain/hub.

But it would be short-sighted to see Gnosis Chain as a failed experiment and Gnosis 3.0 as a pivot.

An open vertically integrated banking system

Instead Gnosis is now in the position to take ownership of the application layer, with what would be cost centers for other businesses acting as profit centers for the DAO.

They are building a vertically integrated open banking system with the rough outline illustrated below by Marcos Nunez (CEO of Gnosis Pay):

Each infrastructure project contributes in some way to this vision, e.g., Safe is used to custody funds for each Gnosis Pay wallet. The service uses Gnosis Chain as its payments network and Monerium as the onramp. Each Gnosis Pay transaction is routed through a Zodiac Rules Modifier.

The natural question is how Gnosis as a collective can acquire market power.

Vertical integration is generally useful when pursuing economies of scale but payment networks don't just win based on cost.

As one of the early owners of a Monzo card, I believe UK neobanks offer some intuition on how this could play out.

The first step is a race to get licensed. But the race to become a global banking onramp is perhaps bigger and more capital intensive than becoming a bank in a single country (like Monzo did).

This usually limits the winners to 5-10 companies.

Next, neobanks compete to offer different low-cost services and aim to bake in their own network effects through dedicated payments.

Interestingly, Gnosis is well-placed to capture network effects both at the application layer (e.g., Gnosis Pay could develop its own user profiles and payments network) as well as at the chain level.

Arguably, if Gnosis Pay becomes widely adopted, Gnosis Chain itself could attract enough users, protocols and liquidity to revitalize it.