On The Marginal Utility of Blockspace

Is the demand for blockspace satiable?

“This is a cult”, I thought.

I was watching a presenter violently go through chart by chart of exponential growth curves detailing every possible measure in computing, manufacturing and science as destined for an inevitable singularity.

This was just one of the adrenaline fueled presentations in the Exponential Manufacturing conference organized by famous futurist Ray Kurzweil.

Today, I wonder if the same inevitability applies to blockchain progress curves.

In particular, the introduction of blobs with EIP-4844 has led to radical cost reductions in both Optimistic and ZK Rollups and has led to speculation as to how these cost reductions may translate in increased transaction volumes.

Hence the question: is there infinite demand for blockspace?

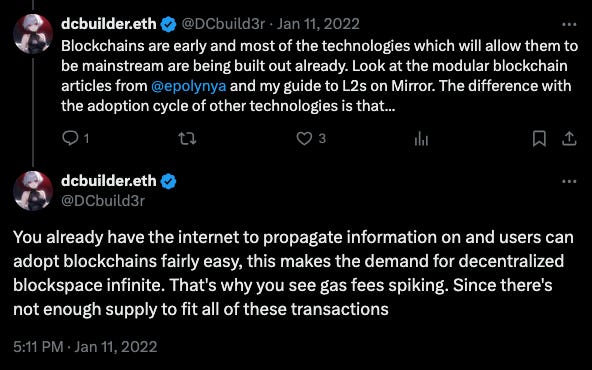

Many have answered this in the affirmative including dcbuilder, who built on the idea that blockchains exist in the information superhighway of the internet and hence benefit from frictionless adoption:

Is the marginal demand for blockspace reducing?

But Polynya shared a slightly different perspective, conditioning blockspace adoption on a healthy monetary premium:

The recent Dencun episode of the Bell Curve podcast also featured an interesting hypothesis that the marginal demand for blockspace is rapidly shrinking as costs go down.

The idea is that we're only a few magnitudes away from pricing levels that end users would essentially find negligible. At first glance, this hypothesis seems plausible and it certainly is to the extent that the user has to be the one sending the transaction.

But it ignores the intent flow as a result of automation, which should be adding sufficient latent demand elasticity to make blockspace demand effectively infinite.

(More simply: less costs → more automated transactions.)

For instance, Gauntlet noted that up to 60% of Uniswap volume already is automated by sophisticated actors:

Segmenting trading volume based on user attributes across the four major DEXes we examined shows that a 40-60% share of the volume originates from sophisticated users employing automated methods in their transactions.

Whichever school of thought you side with (and these perspectives are not incompatible), it’s instructive to unpack where the demand would actually come from.

Spacetime: the interplay between latency and price

While we will focus on transaction fee reductions (as is common), it’s also useful to assume that block spacing is reducing over time as well.

For a subset of use cases (some of which reside in DeFi) there is almost a duality between how one can leverage cost reductions and how one can leverage smaller block spacing.

Arbitrage is one of those areas.

Arbitrage volume

This is the more obvious case of infinite demand elasticity.

As block spacing decreases, arbitrageurs can respond more frequently to deviations between onchain and off chain prices of assets.

Similarly, a reduction in transaction costs makes more arbitrage trades profitable where previously they wouldn't have been.

Since these are fully automated, they would be triggered until the point where the physical compute cost would become a factor.

A point does exist where the compute costs associated with executing a transaction can no longer be ignored. This threshold is significant, for it marks the boundary between theoretical and practical elasticity. Yet, when we consider the aggregate cost—both in terms of transaction submission and settlement—we find ourselves venturing back into the realm of infinite elasticity.

Programmatic orders

Retail users are starting to execute transactions that were once the sole purview of institutional players. These include complex intents, DCA and other generalized programmatic orders.

It’s natural to assume that while a given user won't transact infinitely, an automated script may very well do so on their behalf.

In practice, we are already moving away from a world where users worry about transaction payloads with intents. If we move to a world where users set objectives, their objectives could result much higher volume fan-outs of actual transactions as I explained in Design with Objectives not Intents.

Chain abstraction

Finally, as the differentiation between one block and another is blurred and cross-chain atomic settlement orders become a reality, apps may interface with blockspace in a way similar to how entities currently interface with cloud hardware.

While IPFS is one of the earliest ways virtual blockchain “hardware” resources made their way into web2, more will arrive.

As the gap between compute costs for crypto businesses and traditional businesses becomes smaller, we could see not only the details of the underlying chain being abstracted away, we may also be able to substitute centralized hardware with something more robust.

To conclude, if we assume both the broadcast cost of transactions, settlement costs of transactions and block spacing to keep reducing over time, we should find that developers in particular find ways to demand even more blockspace.

However, this by no means implies that the supply of blockspace is actually infinite…

We will leave that one for another day.

The answer to the question in the heading is that it is unsatiable, just as our devices demand for cpu cores and ram are unsatiable.

But blockchains are subject to the requirement that they keep track of one canonical order of events, and therefore they will remain the most limited technology in terms of raw processing power out of any. All transactions must reconcile with each other, and that puts limits on how much capacity they can have and also means that eventually, there *must* be a premium paid for blockspace that is about equal to the value of using them.