Why Distribution Comes First in 2025

The one thing capital markets™ don't want you to know.

Imagine you are 3-5 years into running a VC-backed startup and it's not working.

Of course, you know this happened because “you didn't find product-market fit”.

The obvious path is to pivot and try again.

Hopefully you learned something useful in the process and will find product market fit faster with the new idea.

But experience alone won't save you.

Experience is not very valuable at the beginning of a startup. Finding product market fit for a new product by definition means doing something new.

Experience doesn't help with going from 0 to 1. This is why a lot of successful Founders end up building studios or joining VC Firms. It's a lower risk way to monetize their skills.

So a lot of Founder time ends up being wasted hunting product market fit and agonizing about whether to pivot or not.

The whole process is built to maximize long-tail upside.

What we really want is to minimize wasted Founder time.

But to do so we have to completely rethink how we look at distribution. Because it matters more than ever.

IT’S HARD OUT THERE

The equation has changed.

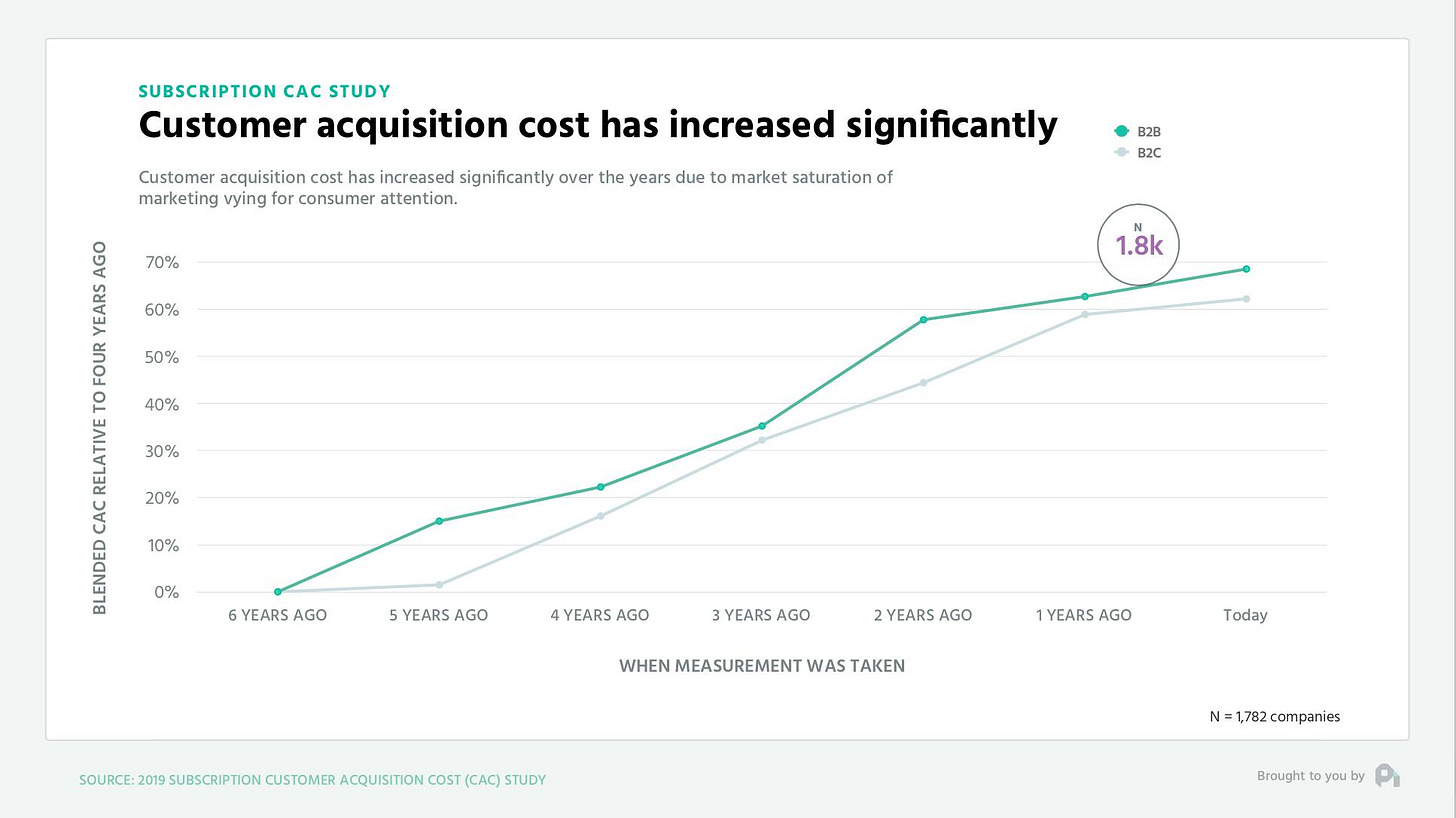

Customer acquisition costs continue to rise.

The observant will notice that this chart is over 5 years old.

(Somehow ever since Patrick Campbell sold ProfitWell to Paddle no one else thinks it important to study acquisition trends.)

I would imagine the numbers look even more tragic now.

Distribution isn’t just powerful; it might actually be more defensible than product innovation.

Product advantages can disappear overnight as a team of skilled engineers using AI can disrupt years of careful engineering. But a strong brand, built on trust and consistent storytelling, doesn't vanish so easily. Even when companies or Founders stumble, audiences often rally around them because they're relatable.

The old advice of “build the product first" might be turning into a lie.

It sounds obvious, even virtuous: talk to users, build something small, iterate quickly. But who benefits most?

Lets consider the incentives. Founders who focus solely on product inevitably hit a point where they desperately need distribution.

And who best to provide that?

VCs can provide capital to fund paid acquisition;

VCs can make introductions to clients and partners;

VCs can help with PR placement;

VCs can help with shoutouts and launches, etc.

By offering the one thing that actually matters (distribution), VCs win better priced deals.

ACTIONS SPEAK LOUDER THAN WORDS

What should be more obvious to Founders is that VC Firms have gradually transitioned to operate like media companies themselves.

In a parallel universe VC Firms would look more like consulting firms, design studios or other value-added service firms but they don't.

This would be expensive, labor-intensive, hard to scale and wouldn't sufficiently impact IRR.

They've engineered a world in which startup Founders need distribution and they are happy to step in and provide it (in the form of capital or otherwise).

Instead, they have podcasts, YouTube channels, communities, conferences, private networks, etc.

Ironically, the thing VCs invest the least in is their own "product": the Founder experience.

I'm not a conspiracy theorist and this is not some “grand scam”.

VC Firms *do* add a lot of value to Founders in this context. Product did use to matter more (and still matters a lot) and most VC Firms developed these media arms mimetically in response to each other.

The media content they do put out is strictly educational some of the highest quality Founder-facing content out there.

The 10-year investment cycle also doesn't favor VCs who want to prove their value through long-term portfolio returns instead of drawing attention in other ways.

“Tech” is a complex evolving system and it has rewarded and reinforced the VC Firms which are known & trusted.

WHAT TO DO

If it’s not clear already, build your own distribution.

Build the company brand and your personal brand in parallel.

Stay in one industry if possible or at least keep marketing content and products pointed at the same audience.

Recognize that distribution takes time so start early and delay your immediate product’s growth expectations if needed.

Consider how distribution impacts what products you can go after.

The more ambitious the product and the smaller the audience, the more capital you’ll need to succeed:

Marketplaces and ambitious AI or hardware plays will almost always require capital.

SaaS apps can sometimes be bootstrapped with a sufficiently large audience.

Anybody can start a service company.

Don't let lack of distribution get in the way of going after what you want but expect to spend more of your time building distribution than you would have 5-10 years ago.

It’s hard out there.

I've been there and what you say is so true, and expressed more clearly than I could!