My Attempt at Breaking Uniswap's New Auction Protocol

A game theoretical look at the new Uniswap auction model.

Uniswap just launched the auction to fix all auctions which they call Continuous Clearing Auctions.

They make some bold claims in the Whitepaper including that this mechanism could replace how IPO launches happen in the future.

Even cooler: the mechanism is immediately being put to use by the Aztec team which has decided to launch the $AZTEC token during a privacy boom (privacy-related tokens like Zcash are experiencing an unprecedented bull run).

HOW IT WORKS

The key idea of the auction system is that each bid is spread out over the whole time horizon of the auction. Here’s how things work step-by-step.

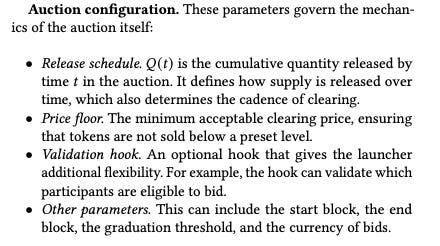

1/ The token issuer creates the auction and decides how many tokens will be available in each block.

This forms a release schedule (think of it as a supply curve). You can add a number of extra parameters too like custom code for a validation hook.

2/ Each block has a single clearing price that matches aggregate demand and supply.

Users express bids in the form of simple intents:

Once a block clears at a certain price, the next block can only clear at the same price or higher.

3/ Bids are spread out over multiple blocks.

Once you make a bid, the amount is spread out over the range of future blocks, meaning that you are automatically bidding on every follow-up block as well.

4/ When a target amount is cleared, the auction is graduated. If it doesn't eventually graduate, all bids are returned.

The main benefit this provides is that sniping is not possible.

Late snipping is not possible. Delaying bidding only makes sense if you think you will get more information. You’ll almost certainly be buying at higher prices later on.

Early sniping is not possible either since you can't concentrate your demand in early blocks.

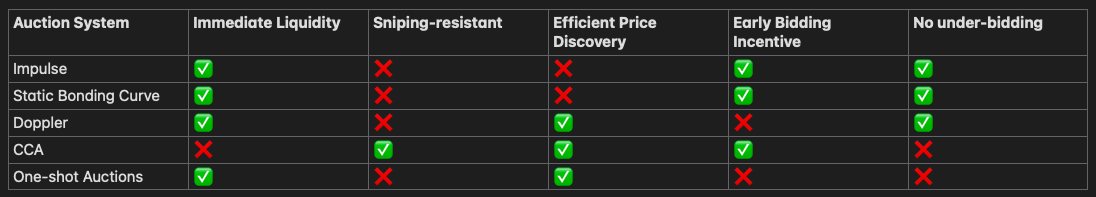

CCA COMPARES FAVORABLY BUT HAS DRAWBACKS

CCA favorably to other auction models, here’s a not so scientific overview:

The main benefits of CCA are that it is resistant to timing attacks, encourages demand to form early and allows for the price to develop smoothly.

It’s not perfect, however. Here are some possible issues.

Under-bidding

However, like unsealed one-shot auctions, sophisticated market participants will be able to under bid (residual bid shading).

Secondary markets

Another issue I don't see talked about is that people could build secondary liquidity markets to complement the auction mechanism and allow participants to sell or hedge their future bids or won holdings (especially post-graduation).

This also could somehow invalidate the validation hooks, allowing users to create proxy accounts that are validated to indirectly support bids from non-validated users.

Attention minimizing

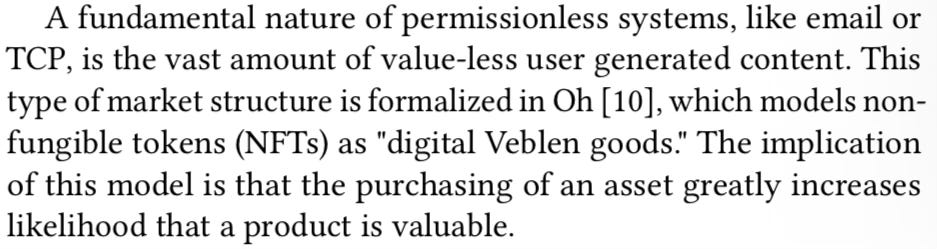

Finally, something Tarun suggested is that attention is an important byproduct of liquidity bootstrapping and in some ways while CCA aims to create as little trading activity as possible, that can be undesirable for discovery especially for “Veblen” goods. From the Doppler whitepaper:

Pre-pool sniping

This is something I'd like to see onchain evidence for but the idea that sniping is not possible during the auction doesn't mean that the transition to a liquidity pool will be smooth.

Some form of sniping may still be possible due to the way that the auction will convert into a Uniswap v4 pool with price equal to the last clearing price.

You could imagine a strategy where automated bidders would make sure to get in early in the auction and then be first to sell at a later clearing price. If they can guarantee early swapping they take very little risk that price actually went up during the auction.

Currently liquidity bootstrappers are encouraged to work with the Uniswap team to plan the launch carefully and they should definitely do so to manage this risk.

HOW TO PLAY THE $AZTEC SALE

As for the game theory of buying $AZTEC, it’s not obvious?

If you’re pricing the token on fundamentals and want to be a long-term holder, on the surface the CCA model encourages you to get into the auction as early as possible and with size.

If you are a larger participant (whale), you may want to under-bid to avoid pushing the market upwards too much if you think this will buy you more depth in the long run.

Since the CCA auction locks in a price floor at the very beginning, you should also consider the real possibility that the price will drop post-auction.

If you’re planning on pricing the token based on narrative evolution, this would be another reason to delay or split your bids early on to understand demand better.

Finally, if you want to snipe the auction, you need to study the specific way the initial Uniswap v4 pool will be seeded and think at what price you'd reasonably be able to sell tokens back into the pool once the auction concludes.

In conclusion, I think CCA does not entirely remove skill and technology as a factor in the auction process. Clearly, even if you desire to be a long-term holder, there are quite a few ways you can end up paying more for the same amount of tokens.

However, with the right post-auction pool design, I think it could require attackers to take on more price risk than they'd like and I expect this alone would significantly mitigate the impact of sniping.

More broadly, CCA opens up an exciting new design space in block-by-block auctions and the protocol design applications beyond token sales are promising.

Uniswap Labs is one of the few teams left in DeFi that can and do build net new protocols and I'm looking forward to the next one.