Stop Ossifying Ethereum

The true base layer endgame.

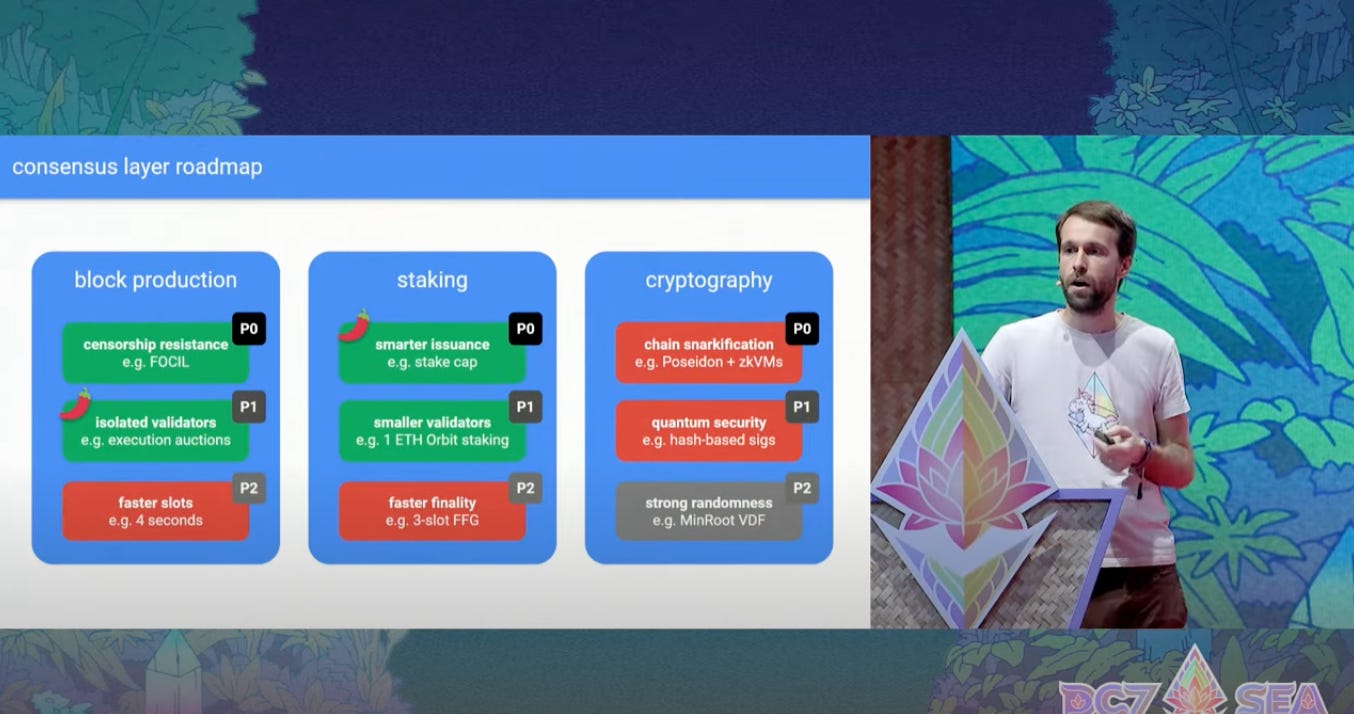

Justin Drake presented the “Beam chain” during Devcon, a memetic wrapper over certain parts of the Ethereum consensus roadmap that he believes should be accelerated.

Crypto Twitter didn't love it.

sacha argued that Ethereum is not being ambitious enough:

Péter Szilágyi expressed concerns about coupling and complexity.

The timeline is a little long, stretching into 2029…

…but for good reason. As Bankless pointed out, Ethereum has 5 consensus clients which have to be tested in conjunction.

I personally have nothing against the proposal but the mention of accelerating the ossification of Ethereum didn't feel right to me.

Here are a couple arguments why I believe it’s too early to push for ossification:

We aren't short of ideas yet for base layer designs

We don't know Ethereum’s best positioning yet

We lack clarity on use cases

There are more radical ways base layers can evolve.

We aren't short of ideas yet

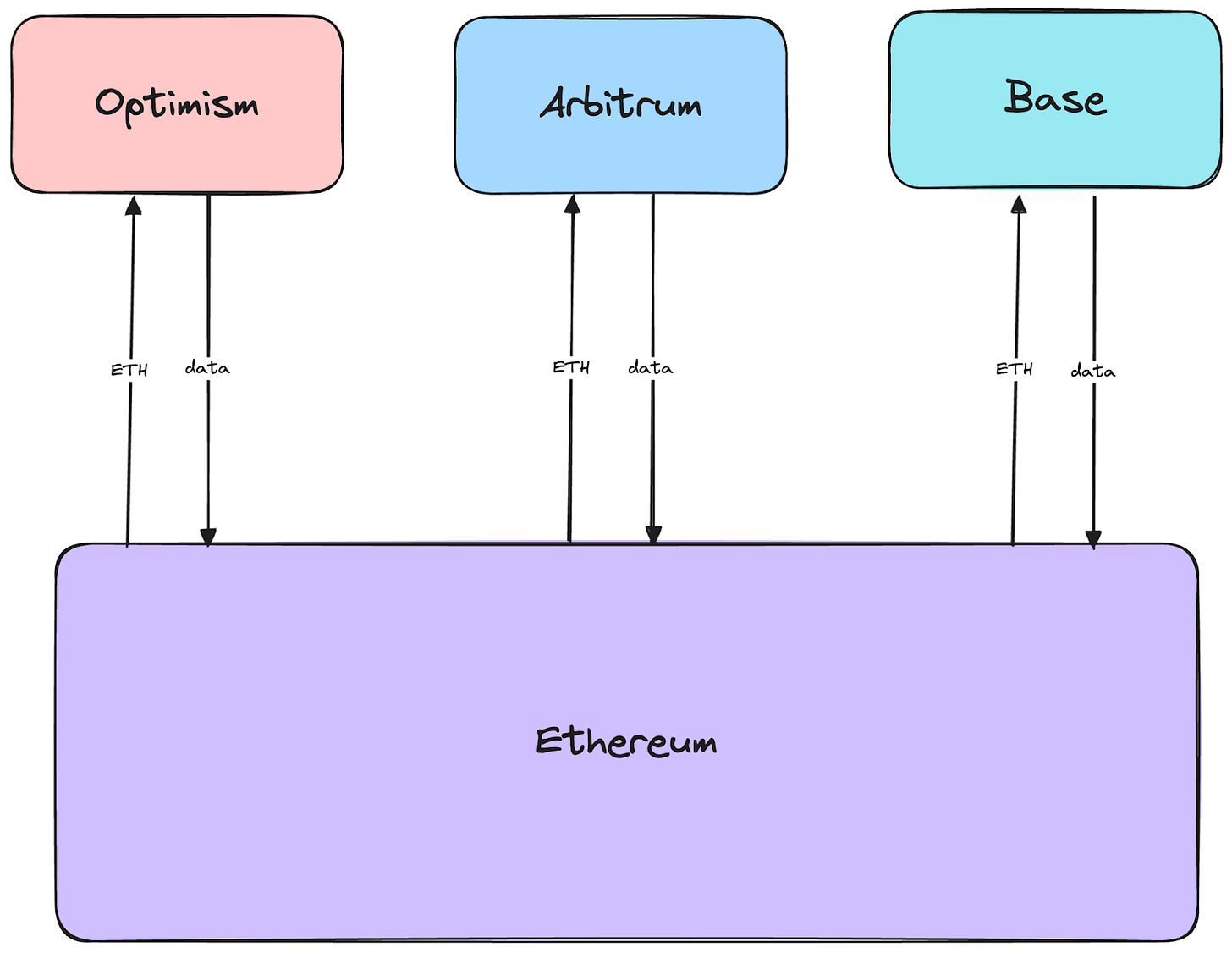

In Consensus Where it Counts: Rethinking Base Layers for the ZK Era, the authors explain how Ethereum’s design limits rollup TPS.

The article takes the thought experiment where Ethereum should just be a base layer for rollups instead of its own serious execution layer

Namely, rollups need to rely on base layer consensus even for transactions that don't share state with other rollups.

They propose a DAG-based structure where only a partial ordering is enforced.

A base layer like this doesn't need to invoke consensus on non-shared state transactions.

This is analogous to the impact that AggLayer has (covered before) although with different economics.

But is Ethereum truly a base layer for rollups?

I don't think that’s clear yet.

The many possible futures of Ethereum

Some believe that L1 execution can become so competitive that rollups wouldn't be necessary (the Solana bull case).

Others believe in base layers and rollups.

Some critics, however, predict that rollups will destroy Ethereum.

I'm definitely not as extreme on this as people who claim that rollups are parasitic.

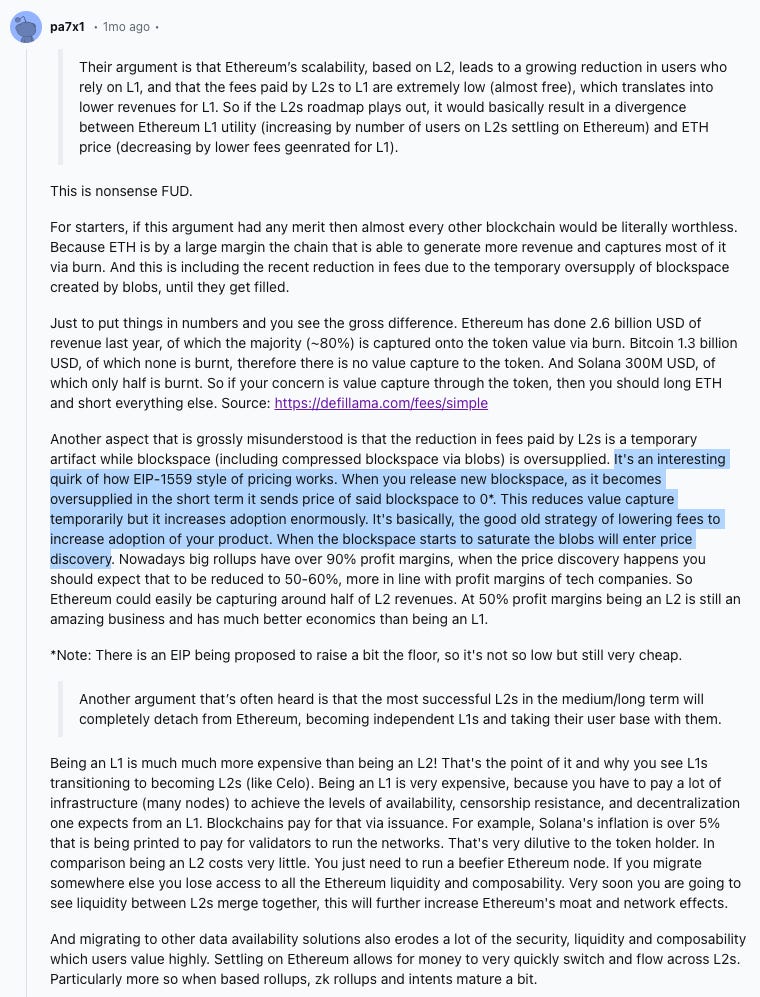

There’s a very strong argument on reddit for why EIP-1559 style pricing actually helps Ethereum monopolize execution.

But lets assume this is not true.

While apps can force away MEV revenue from their settlement layers, Ethereum doesn't have to give up execution fees to rollups at all.

Ethereum could develop enshrined rollups an lower relative DA costs to the point where other rollups (and other Ethereum apps) wouldn't be competitive.

So if rollup architectures are the natural end state AND assuming that value accrual moves to rollups, it’s still not clear that Ethereum will concede all its advantages (liquidity moat, decentralization, monetary premium & stability) so easily.

There are just two credible scenarios where we don't even need rollup-centric base layers outside of Ethereum.

Too much stability is not Ethereum

Back to Beam chain, while it’s compatible with a rollup centric future, there is a risk to Ethereum becoming just a stable data layer for rollups.

If the Bitcoin ecosystem decides to embrace Bitcoin rollups, there may be an even better stable and decentralized base layer.

We covered this risk already:

So we do need more ideas on how Ethereum can continue evolving and we do need to work actively to continue capturing block space demand.

Whether it’s DAG based settlement or using Cairo VM as discussed in our Starknet post there are many more architectures to explore.

Furthermore, we know little about what use cases blockchains will end up serving and it feels premature to ossify a solution to a problem that’s not clearly established or agreed on.