AAVE 2030 and the Complexity Moat

The dominant protocol's next big leap.

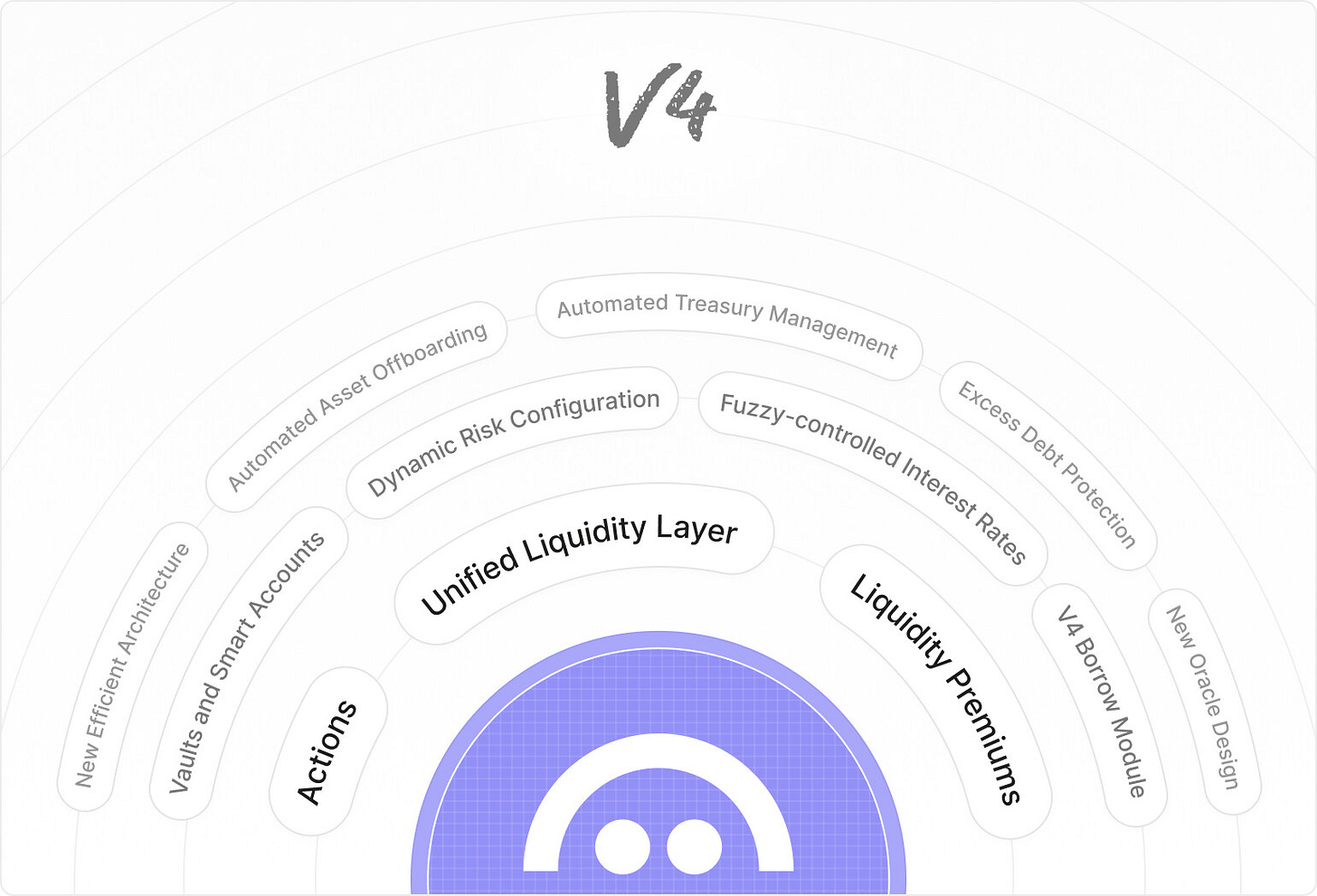

The AAVE 2030 proposal from AAVE Labs is all-encompassing.

Not only does it include a full protocol rewrite, a new network and proposals for building AAVE on alt-L1s, it even includes a complete brand refresh.

Even Starport and Euler’s EVC (two interesting proposals for lending aggregators that we covered previously in the newsletter) pale in comparison.

This kind of complexity is a trademark of the DeFi lending category with AAVE, Maker DAO and others being some of the most complicated constructs in DeFi.

Paul Frambot has previously described these protocols as brokers in attempt to differentiate them from Morpho, citing complexity as a strict negative.

But the market has voted differently, with AAVE having some of the most sustained moats in DeFi.

Token Terminal presented perhaps the best summary of lending protocol dynamics in a single tweet:

While people believe AAVE has a moat, no one seems to know what it is.

The header of this post presents a trilemma between risk management controls, capital efficiency and simplicity.

As we continue to improve lending protocol capital efficiency and add more sophisticated risk controls, complexity soars.

And that tricky interplay between capital efficiency, risk management controls and resulting liquidity network effects may be the moat that is so tricky to pin down.

In essence, complexity in lending may be a feature rather than a bug.

The Proposal

In the context of the AAVE 2030 proposal, if there is one critique of complexity, it’s incentive alignment.

Asking for a $15M cash grant necessarily requires a significant amount of technical scope to “justify” the grant amount.

Perhaps if incentives were more closely aligned between AAVE Labs and the DAO, the AAVE Labs would have identified a smaller subset of priorities to double down on.

But as I read over everything that is proposed, it’s hard not to get excited about the sheer amount of new ideas that could become protocol design trends.

Here are my five favorites.

1. The cross-chain liquidity hub

This has got to be the biggest stepping stone.

With cross-chain liquidity design still in its nascency, it is useful to go back to first principles to understand why this is an important competitive move.

A mental razor I keep coming back to is assume that cross-chain atomic settlement costs will go to zero.

In that world the question becomes – does a given protocol need any additional functionality to overcome the downsides of liquidity fragmentation?

For a protocol like Uniswap, the answer is no. Any swap can atomically use multiple sources of liquidity from different chains.

These pools across different chains don't need to know about each other.

For lending, it’s not so simple because lending protocols maintain state over time. For example, in a lending protocol with unified cross-chain liquidity interest rates need to take into account liquidity on all chains.

Thus, a custom cross-chain liquidity solution is required to offset the downsides of liquidity fragmentation and the first lending protocol to figure it out will reap the rewards.

2. AAVE Network

AAVE Labs propose to implement a dedicated L1 or L2 chain for AAVE.

Aside from using the network as a governance hub and to improve the safety module, it was interesting to note that they will be using Validium.

This may suggest that AAVE Labs is seeking to reduce transaction fees to potentially power a consumer-grade lending application that they could operate in the future perhaps in synergy with the Family wallet.

The network will also provide additional staking rewards which could improve on the current Safety Module equilibrium:

3. Expansion to non-EVM chains

Migrating a protocol like AAVE to non-EVM chains is a significant lift.

There are so few examples of protocols who have done it.

Integrating liquidity would make this step more impactful but there is little in the way of safe bridging between Ethereum and Solana or any of the Move chains that could enable that.

So I don't get this yet.

4. LLAMM

It seemed like most people overlooked the lending-liquidating AMM design in the proposal.

But if you've been reading this newsletter hopefully you didn't.

Uniswap V4 enables liquidations to be triggered cheaply in response to swaps, a radical rethinking of how lending protocols could work.

While LLAMM is different and inspired by crvUSD, it still has some of the same AMM-like properties enabling efficient liquidations.

As for Uniswap V4 based lending protocols, I did a deep dive on how these work that you can watch below:

5. Off-chain intelligence

Finally, after losing their risk manager Gauntlet, AAVE had to present a plan for maintaining capital security.

Interestingly, AAVE Labs is leaning on developing off-chain automated oracles for risk collaterals, interest rate curves and other areas in collaboration with Chainlink.

This seems a little contrarian in a world where every other protocol is betting on coprocessors or restaking induced security to incorporate off chain compute securely.

I'm curious how these designs will work and what trade-offs they will make along the trustlessness and efficiency spectrum.