Your DAO Can't Grow

The difficulty of compounding capital in crypto.

A 25 year old YouTuber understands something that most DAOs don't.

Mr. Beast, perhaps the most well known creator on the platform, stands out through his early commitment to reinvesting most profits back in making new videos.

At first, it started as a $1,000 here and there, often donated to someone in the video and used to attract attention to the title. This drove more viewers in return and generated ad revenue that could be reinvested further.

Today he invests over $1M in each single video doing things such as building film set quality set ups, hiring staff and so on.

The best companies exist as capital compounding flywheels

There's a hierarchy between companies that are focused on increasing share value, dividend companies and bootstrapped companies.

The former have abundant access to capital and can reinvest it;

The dividend companies can't use as much capital to grow as they distribute dividends;

Finally bootstrapped companies need to generate their own capital in the first place so naturally have even less to reinvest.

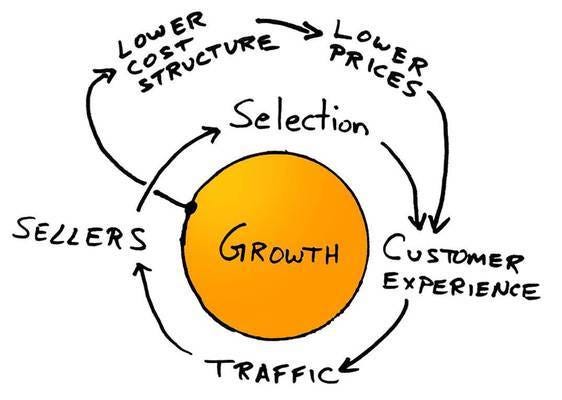

It’s not accidental that Amazon, an over one trillion dollar company was built by compounding capital in this way.

Amazon's own napkin sketch of the model reveals how they were able to keep reinvesting to reduce prices for customers:

Most DAOs are doomed to have indirect capital allocation

Proposal based compounding

The natural way to operate a DAO is to have revenue accrue to the treasury and then allocate it further.

This has been a common approach with most blue chip DAOs following this route.

This allows direct capital compounding, however, unless decision making power and budgets are delegated to high-performing, fast-moving centralized teams, this approach will compound capital a lot more slowly.

It also puts token holder status in potentially uncertain territory (especially large token holders based in the US). See this comment from Ernst & Young:

“We’re seeing examples of this in case law,” Post points out. “It implies governance token holders should always be aware of their DAO’s activities. If they’re not, and the DAO votes to do something illegal, they may be liable, whether they voted in favor or not. We’ve already seen DAOs move out of the US for this reason.”

RPGF

It wouldn't be an Auditless issue if I didn't mention the merits of RPGF.

RPGF aims to achieve intelligent capital compounding with more limited liability.

Since grants are retroactive, impact based and follow clear criteria, it's much harder to compromise this mechanism or argue that token holders have strong accountability on what projects get rewarded.

In particular, conflicts of interest get policed:

Perhaps the clever aspect of RPGF is that it overcomes the shortcomings of indirect capital allocation by creating a strong incentive to commence work even prior to funding.

Distributed earnings

An even more regulation-minimized way to operate a DAO is to distribute earnings to token holders directly. This would be somewhat analogous to Universal Basic Income.

The best way to prevent governance capture is to make sure there is nothing to capture in the first place.

If these token holders are not making capital allocation decisions on behalf of the entire entity, their liability surface is minimized significantly.

On the flip side, that revenue doesn't ever touch the protocol treasury and may never be used to improve the protocol. For larger holders, the revenue from staking could become a significant revenue source, however, and may encourage them to keep contributing going forward.

Compounding through a legal entity

Foundations such as the Optimism Foundation have sprung up to take the mantle of capital allocation.

However, they are also under heavy scrutiny as token holders expect them to be:

Resource-light

Unbiased (supporting ecosystem competitors equally)

Transparent

Use a cost/budget based resource allocation where they have to ask for permission rather than forgiveness

Grant-based rather than operational

Non-profit rather than for-profit.

It's not clear how effective they be within these constraints but there are examples of Foundations that are pushing the envelope.

We are working with some of them.

If you need protocol strategy help for your DAO/Foundation, you are welcome to reach out.

We need a better mechanism

The variety of approaches DAOs take to the capital compounding problem suggests that we don't have the right answer yet.

A protocol like Aera combined with the data from a tool like OS Observer could provide an interesting experiment of helping DAOs better allocate capital while maintaining trustlessness.

Hopefully we get to explore this one day.