Friend.tech could survive

The breakthrough app of onchain summer may not be a speculative fad.

I recently heard that friend.tech, a new social monetization app built on Base has gotten over $1M+ in fees and has over 100k users:

I also tried it out and learned a lot about modern onboarding (catch next week's newsletter for a full breakdown of that).

Onboarding has definitely been the story but many of us are wondering about longevity too.

So is it just speculative?

Friend.tech allows you to sell shares (called keys) in your Twitter account:

Each key allows the holder to view a private group chat and ask questions.

These keys are priced according to a bonding curve model which increases rapidly in price with demand.

Creators also get hefty transaction fees (10%).

This has led many to argue that friend.tech is just a speculative fad and will evaporate quickly.

While I do agree that speculation will die down, there is also something novel in the creator monetization model that friend.tech is pioneering.

Monetizing access

There are 3 main categories of how access to creators is monetized:

The original one: one-to-many paid access, pioneered by Patreon and embraced by X.com's subscriptions

The more extreme version of this including more intimate 1:1 features is OnlyFans

Finally, orb.land and friend.tech are examples of what I call “economic access” apps where some amount of creator's attention is being allocated in an economically scarce way.

There are several ways economic access is different which both makes it a unique and complementary channel for creators on other platforms and introduces new social dynamics.

Long volatility

Creators on these platforms are in what traders would call “long vol” exposure.

They make a fee on every trade of their keys so they are incentivized to encourage both upward and downward market debate about the value of their keys.

This also relates to the natural expiration date of an audience. For example, Gary Vaynerchuk is a popular entry point for young entrepreneurs, teaching them about the mindset of entrepreneurship and what to bet on for their careers.

As these entrepreneurs develop, they naturally become more interested in more advanced content and may happily depart from Gary’s audience.

This type of churn is actually positive, meaning that Gary has succeeded in turning a follower into a determined entrepreneur.

These types of dynamics should become more prevalent with economically scarce access platforms. Creators could become more specific and declare a “season of life” where it makes sense to naturally own their keys and have it be finite.

A recent piece “Volatility As A Service” from decentralised.co goes much deeper into why volatility matters.

Long exposure

In friend.tech, the key owner can buy any number of their own keys too, allowing them to balance “long vol” exposure and pure “long” exposure.

There's a reflexive aspect of this – by buying your own keys you signal being undervalued.

Scarcity

The scarcity of keys creates a unique relationship between the creator and the key owner.

In particular, the system always guarantees that a key holder has importance to a creator. If the creator “blows up”, the key value goes up and each creator now owns a bigger investment.

The nature of this is very different across friend.tech and orb.land.

Reciprocity

Are you a key holder for a friend?

Do they own your keys?

There's a fascinating dynamic involving reciprocity on the platform.

Since becoming a key holder costs real money, there is real pressure to reciprocate, made even more difficult if the “price of friendship” between two people is inconsistent.

Positive externalities and signaling

While being a Patreon or OF subscriber to a creator is not something to brag about (commodity); being a friend.tech key holder is.

Both economic, trend and polarization factors will play a role here.

Friend.tech is both parts public wallet and social graph at the same time. If the platform has legs, an entire category of tools will emerge at the intersection of financial analysis and social analytics.

Orb.land also has externalities but they play out differently. Since the questions and responses are public, each Orb page can be seen as advertising space and used accordingly.

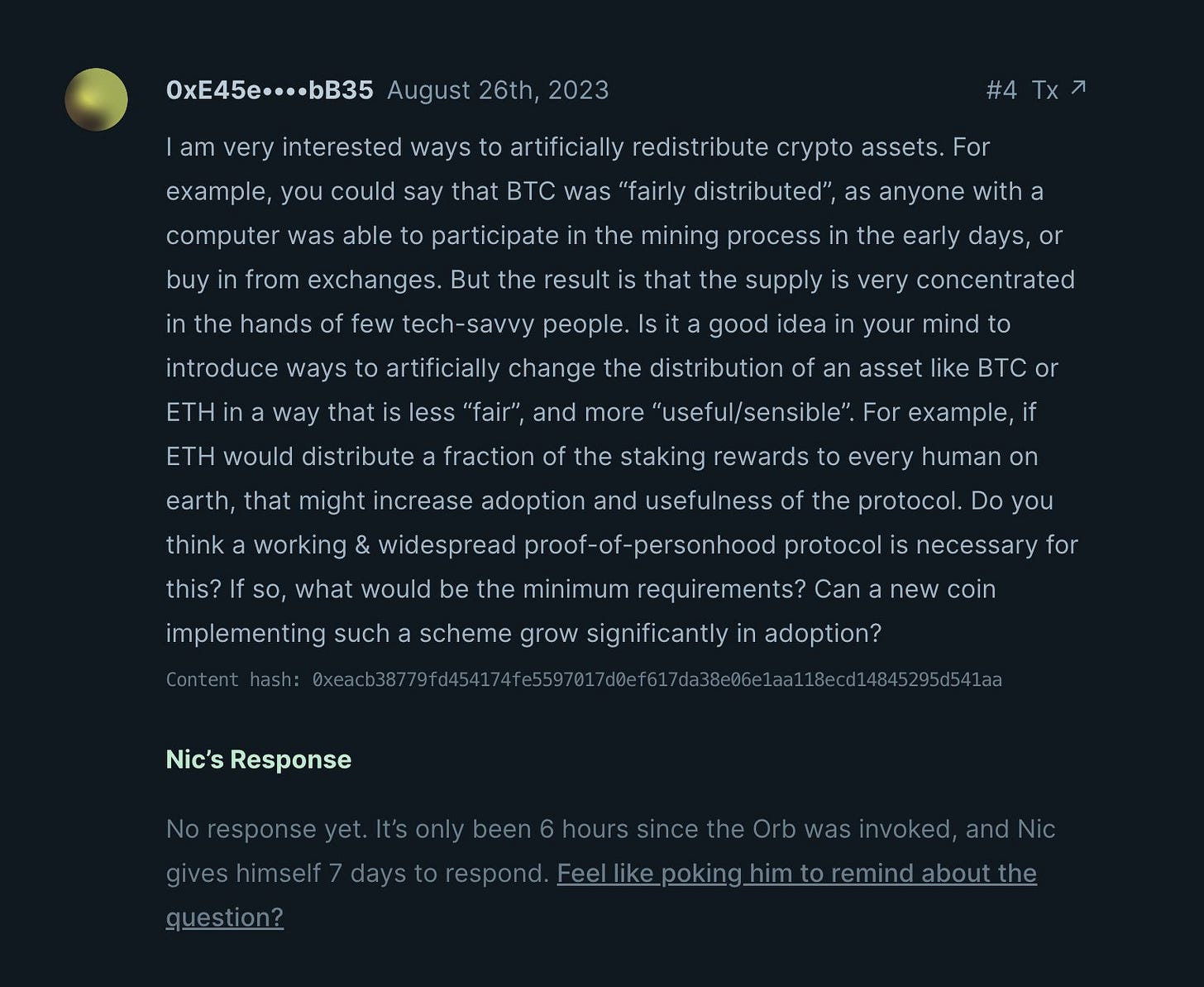

For example, consider this recent “mystery question” from Nic Carter's Orb:

In the future, questions like this could be posed by the marketing departments of a Proof of Personhood provider, blurring the line between legitimate use and advertising.

In summary, friend.tech is a distinct app launching in a pre-existing (albeit very nascent) category.

It offers enough new mechanics and game theory to obfuscate analysis of longevity.

I'm optimistic it could survive but it's probably 2-3 iterations away from a model that correctly balances social utility and financial utility.

Super interesting. Have been some big failures trying something similar but this sounds more viable (see https://cryptocelebrities.org/ and https://en.wikipedia.org/wiki/Football_Index)

Can't wait to see where this goes!