Use Net Revenue Retention to measure product market fit in crypto

Crypto's long lost metric for product market fit

Active Users is a vanity metric for crypto companies.

Revenue without active usage is possible – just make your users money while they sleep.

But making users money doesn't mean you have product market fit.

If your APY is 2% and another product is delivering stable yield at 4%, you may struggle to retain those customers.

In other cases a product with an APY of 1% will have a better user experience and retain users that way.

It’s possible to have the best of both worlds – have a passive product but still measure product-market fit.

To do so, we will use a metric called Net Revenue Retention.

First – we’ll discuss why a metric is needed.

Why is it important to measure product market fit

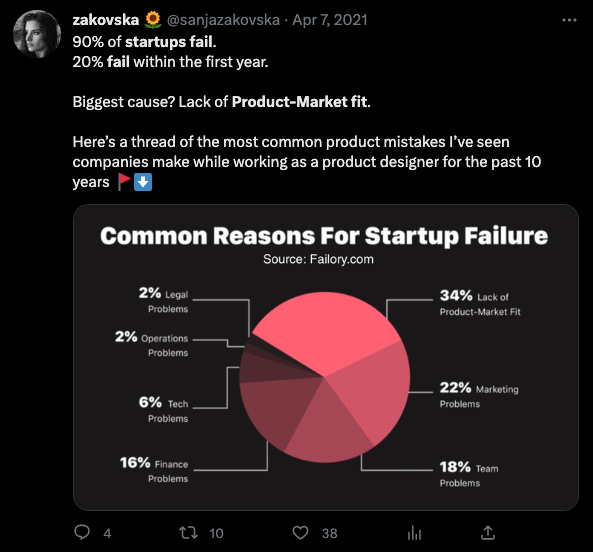

~34% of start-ups fail because they don't find product market fit. It is often reported as the single most common cause of failure.

But it’s notoriously difficult to optimize for.

Most advice on getting to product market fit focuses on describing “how it feels when you have it”.

Lenny wrote an excellent newsletter on this exact topic.

One of my favorite articles How Superhuman Built an Engine to Find Product Market Fit by Rahul Vohra goes a step further.

Rahul argues that by measuring product market fit, we can find ways to increase it and eventually reach the threshold point.

This is exactly why NRR will be so useful for us.

Why we need a different metric

Jeff Morris Jr. argued that crypto works differently in an article called Crypto Market Fit.

He argued for a need to measure product market fit differently.

This idea actually isn't new to crypto.

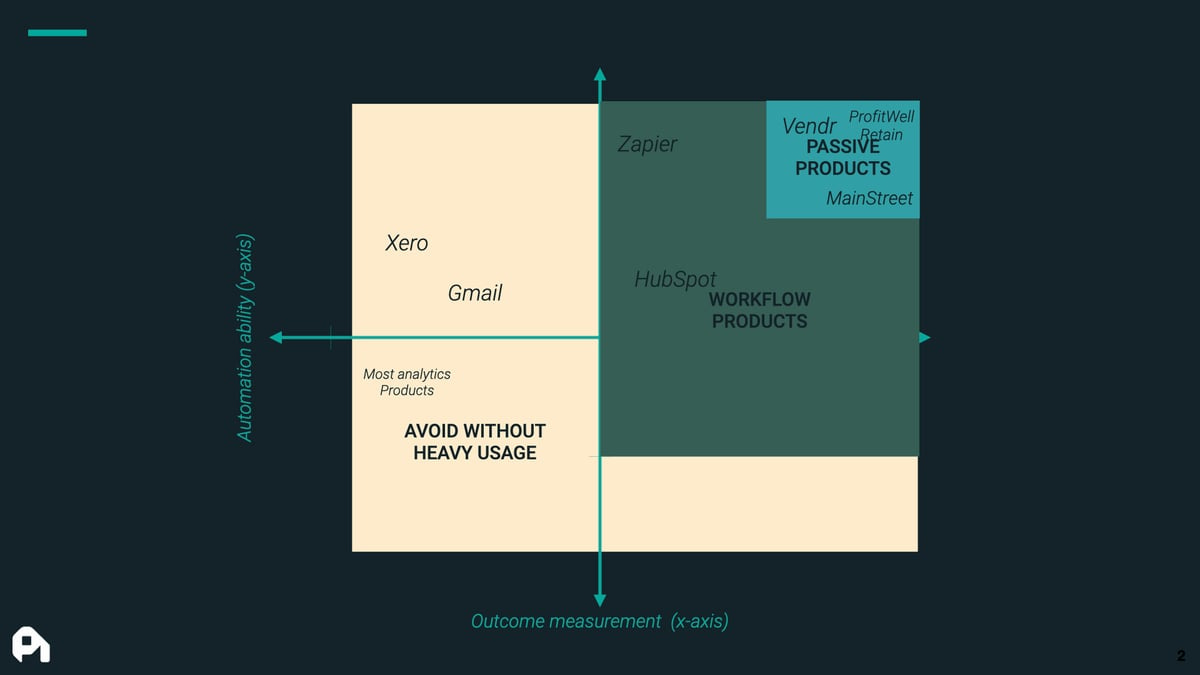

Patrick Campbell from Paddle (previously ProfitWell) described a more general framework in “anti-active usage products”.

He describes “passive products” as products that:

Are fully automated

Have clear outcome measurement

Yield products in crypto follow this exact model.

Measuring user activity for these products doesn't make sense as delivering value in a passive way and not requiring ongoing maintenance is actually the selling point.

Net Revenue Retention

Net Revenue Retention (NRR) is a concept defined in SaaS subscription software where it refers to your ability to increase the monetization of existing customers over time.

Here’s how we can adapt it to passive crypto investment products:

You have a yield product generating $20,000 in fees.

Next month, you generate positive yield for users so the same capital generates $1,000 more in fees per month.

You also manage to upsell users into other yield products, for an extra $2,000 per month.

Finally, some users withdraw capital, reducing fees by $5,000

Your net monthly revenue is $20,000 + 1k + 2k - 5k = $18,000

So your NRR is $18,000 / $20,000 = 90%.

Note that NRR does not include new customer acquisition so you can have NRR < 100% even if monthly revenues from users are growing.

This is what makes NRR a perfect metric for product market fit – it captures the concept of a “leaky bucket” where you may be acquiring users but you are not making them happy as they are reducing their allocation with you over time.

It also allows you to incentivize efforts that focus on providing value to existing customers:

Improving the yields of your products

Adding new useful products.

It does not reward marketing tricks like airdrops for new user acquisition.

How to measure NRR for your protocol

What makes user attribution difficult in crypto is the possibility that one user could hold multiple wallets.

As far as yield products are concerned, there are 4 types of user actions that matter:

Depositing into vaults or minting new shares

Withdrawing from vaults or redeeming shares

Claiming rewards

Transferring shares

And here's a simple classification one could use:

Deposits from a wallet that already holds shares increases NRR. Deposits from a new wallet could be attributed to new NRR at some reduced percentage (e.g., 5% if we believe that 5% of users like to set up new wallets for each investment)

Withdrawals decrease NRR as they always come from existing users. Note that if a protocol does not support transfers of shares, sometimes users can be withdrawing & depositing to transfer funds. In that case it's important that the chance of this happening is reflected in the deposit NRR assumptions

Claiming rewards does not affect NRR, but reinvesting rewards increases NRR just like any deposit

Finally, transferring shares is potentially the trickiest calculation. One could make an assumption that some fixed percentage, e.g., 50% of transfers are between two of a user’s wallets rather than liquidating transfers. This number would be lower for highly traded vault shares (e.g., staked tokens).

While exact NRR may be hard to calculate, the trend of NRR in a positive or negative direction will be clear and thus something we can optimize for.

The threshold

The typical target for NRR is 100%+ which means that customers are being “net-retained”.

Given the ambiguity of user-wallet mapping, it may be difficult to settle on a number but aiming to go above 100% should be helpful in any context.

In summary, NRR provides a clear way to measure product market fit for passive crypto products.

While measuring it accurately is more difficult than for a SaaS start-up running on Stripe, doing it regularly could unlock sustainable growth for your protocol.

Need help building a crypto product?

→ Twitter: Follow me for more frequent & casual insights on the crypto industry.

→ Need an advisor?: I help Seed stage crypto Founders launch revenue-generating products with proven systems. Respond to this e-mail with “Revenue” to start a conversation or click on “Need an advisor” to jump on a free discovery call.